Discovering Hidden Opportunities in These 3 Undiscovered Gems

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap indexes have faced notable challenges amid cautious Federal Reserve commentary and political uncertainty, with the S&P 600 small-cap index experiencing significant pressure. As investors navigate these turbulent waters, identifying stocks that demonstrate resilience through strong fundamentals and growth potential becomes crucial for uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to individuals, professionals, farmers, associations, and companies in France, with a market cap of €508.35 million.

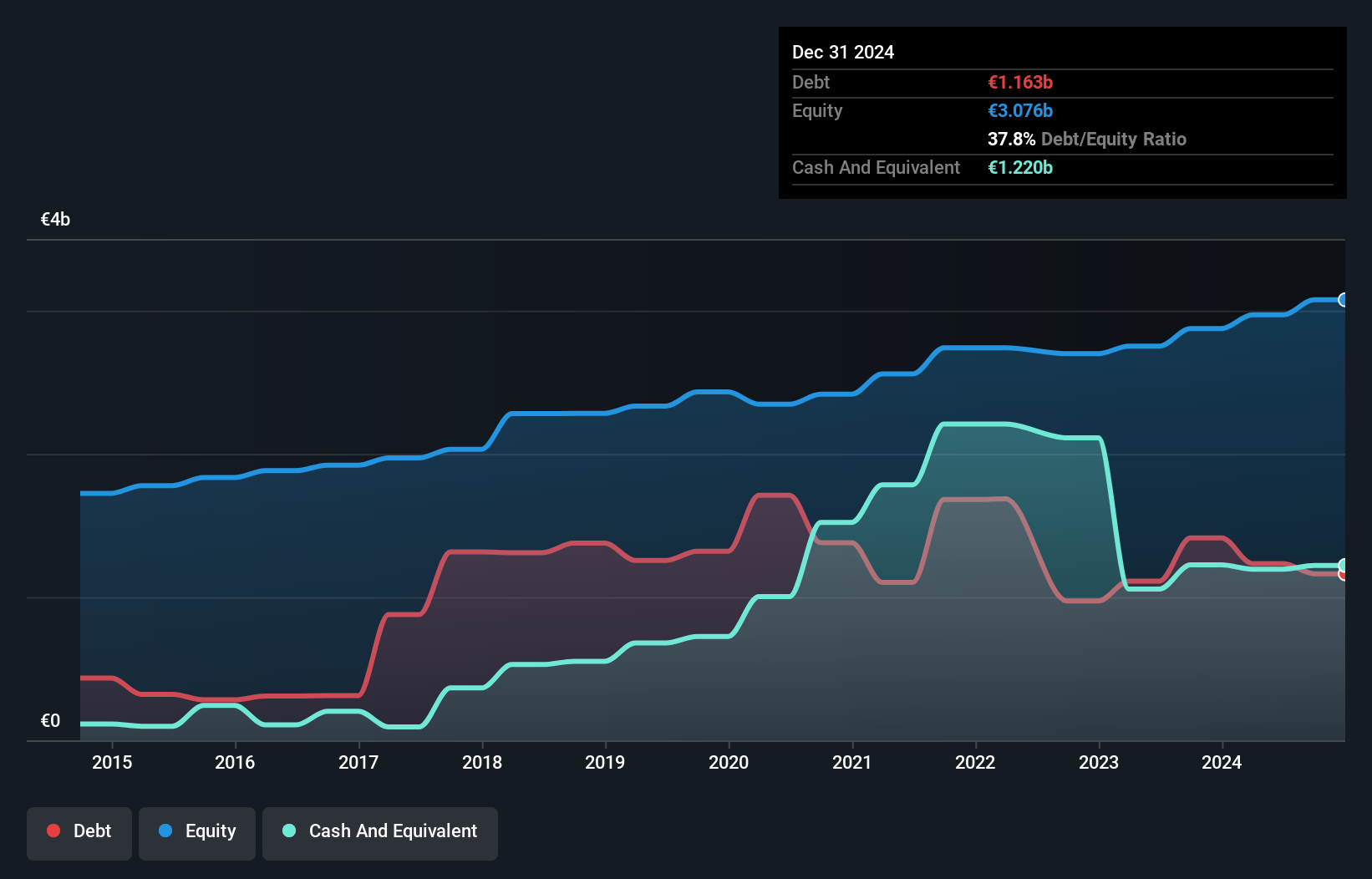

Operations: The cooperative generates revenue primarily from its retail banking segment, amounting to €350.44 million.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine, a noteworthy player in the financial sector, boasts total assets of €25.5 billion and equity of €3 billion. With deposits totaling €20.7 billion against loans of €21 billion, it operates with primarily low-risk funding sources, accounting for 92% of its liabilities. The bank's allowance for bad loans is sufficient at 111%, reflecting an appropriate level given its 1.1% non-performing loan ratio. Despite trading at a significant discount to estimated fair value by 41%, recent earnings growth trails the industry average slightly but has maintained a steady annual increase over five years.

Qualitau (TASE:QLTU)

Simply Wall St Value Rating: ★★★★★★

Overview: Qualitau Ltd develops, manufactures, and sells test equipment and services for the semiconductor industry targeting European and Far-Eastern markets, with a market cap of ₪924.81 million.

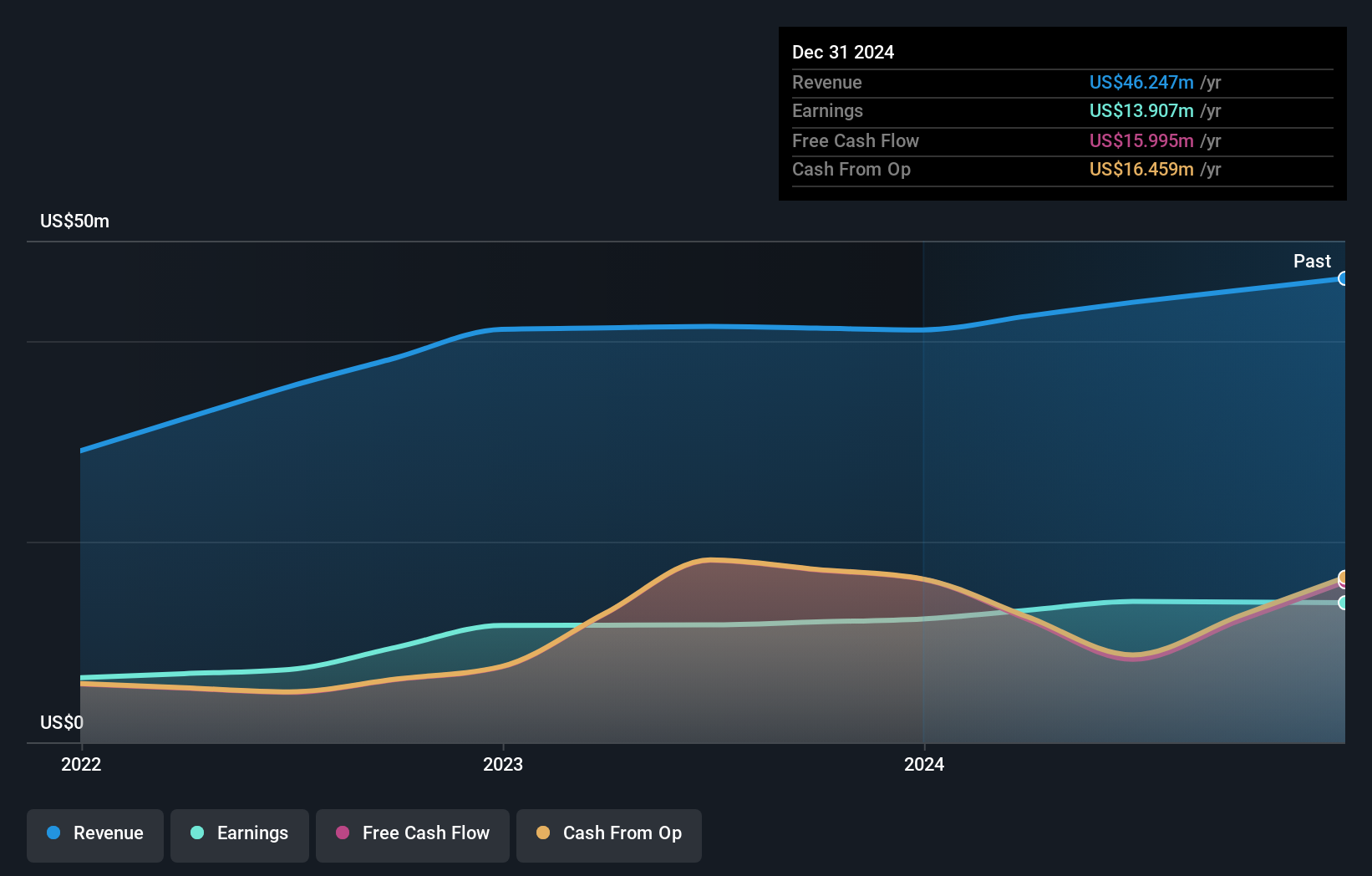

Operations: Qualitau generates revenue primarily from its electronic components and parts segment, totaling $43.87 million. The company's financial performance is influenced by its operations in the semiconductor industry across European and Far-Eastern markets.

Qualitau stands out with its attractive valuation, boasting a price-to-earnings ratio of 18.8x compared to the semiconductor industry's 32.6x average. Despite recent share price volatility, this company has shown impressive earnings growth of 20.1% over the past year, surpassing the industry’s 5.8%. With no debt on its balance sheet, Qualitau's financial health appears robust and free cash flow is positive at US$12.26 million as of March 2024. The high level of non-cash earnings suggests strong underlying operations, making it a compelling prospect in the semiconductor sector despite market fluctuations.

- Take a closer look at Qualitau's potential here in our health report.

Examine Qualitau's past performance report to understand how it has performed in the past.

Great Giant Fibre Garment (TPEX:4441)

Simply Wall St Value Rating: ★★★★★★

Overview: Great Giant Fibre Garment Co., Ltd. is a Taiwanese company engaged in the manufacturing and sale of garments and textiles, with a market capitalization of NT$14.83 billion.

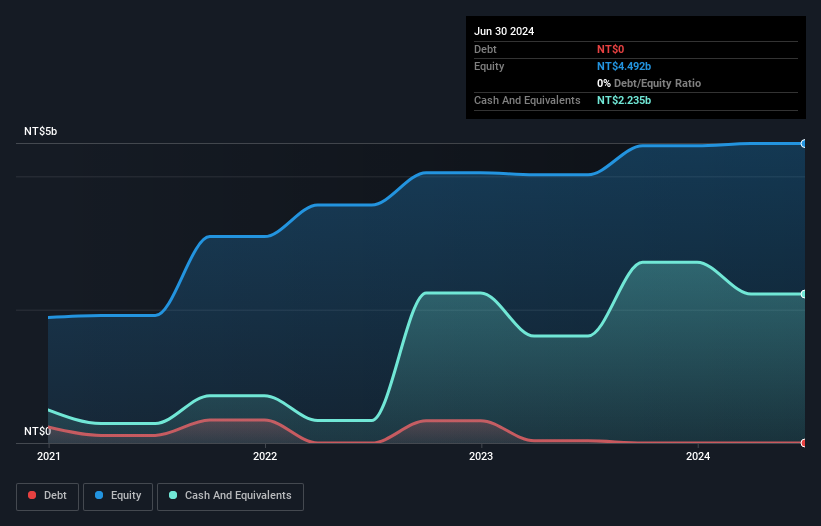

Operations: Great Giant Fibre Garment generates revenue primarily from its clothing business sales and manufacturing, amounting to NT$5.74 billion.

Great Giant Fibre Garment, a smaller player, shows promising financial health with no debt over the past five years and high-quality earnings. The company’s price-to-earnings ratio of 16.7x is below the TW market average of 20.8x, suggesting potential undervaluation. Despite its earnings growth rate of 13.4% not surpassing the Luxury industry average of 13.9%, it still indicates solid performance within its sector. Additionally, with positive free cash flow and profitability ensuring a stable cash runway, Great Giant Fibre Garment seems well-positioned to navigate future market challenges while offering an intriguing prospect for investors seeking undiscovered opportunities in this space.

- Get an in-depth perspective on Great Giant Fibre Garment's performance by reading our health report here.

Learn about Great Giant Fibre Garment's historical performance.

Make It Happen

- Unlock our comprehensive list of 4633 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4441

Great Giant Fibre Garment

Manufactures and sells garments and textiles in Taiwan.

Flawless balance sheet with acceptable track record.