- Hong Kong

- /

- Infrastructure

- /

- SEHK:576

3 Reliable Dividend Stocks Offering Up To 6.3% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by political shifts and economic data releases, major U.S. stock indexes have shown mixed results, with growth stocks leading the charge while value-oriented sectors like energy and utilities lag behind. Amidst this backdrop of economic unpredictability, dividend stocks can offer investors a measure of stability through consistent income streams, making them an attractive option in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.08% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1931 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

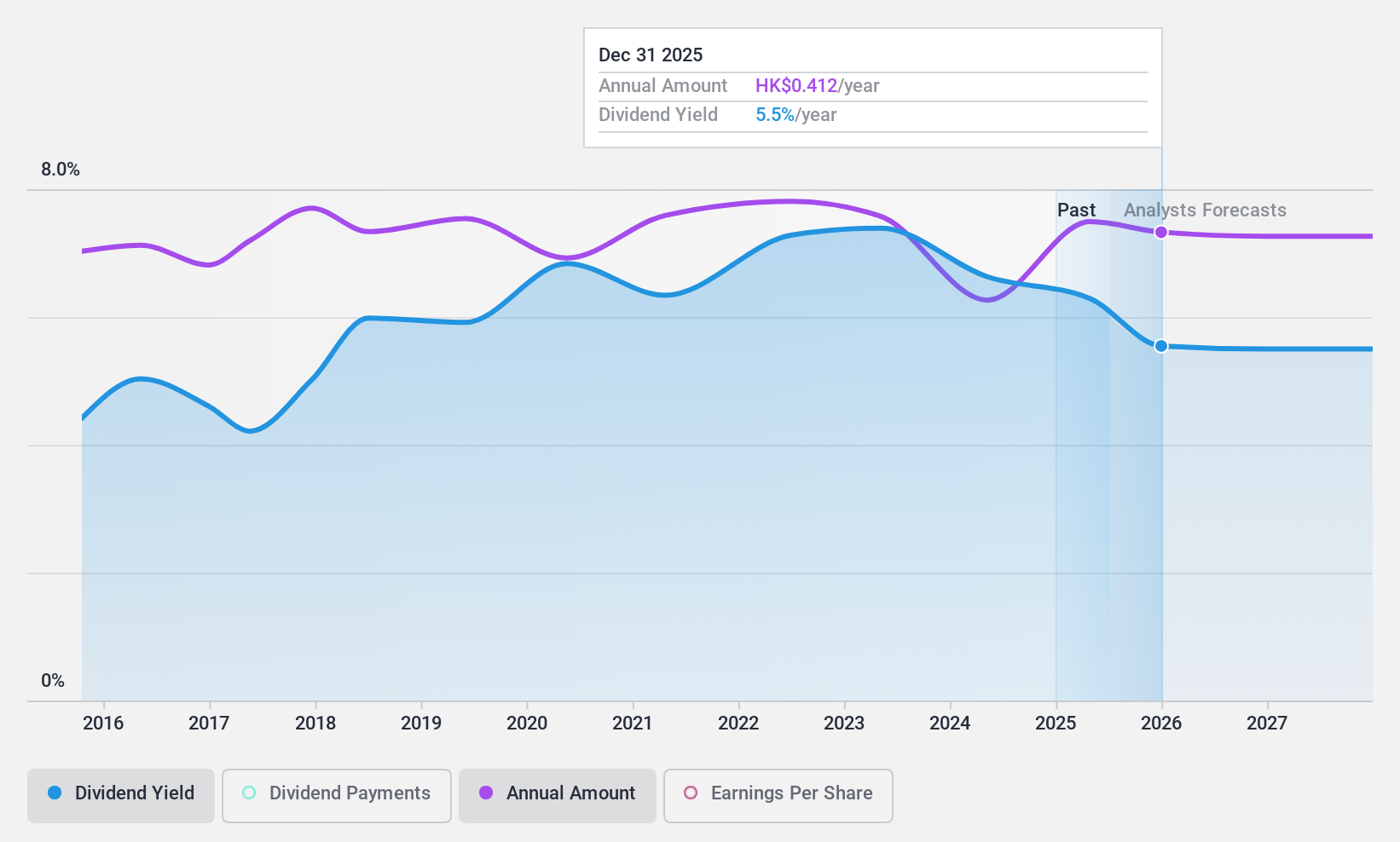

Zhejiang Expressway (SEHK:576)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company that constructs, operates, maintains, and manages roads in the People’s Republic of China, with a market cap of HK$32.19 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue primarily through the construction, operation, maintenance, and management of roads in China.

Dividend Yield: 6.4%

Zhejiang Expressway's dividend payments have been stable and growing over the past decade, though not well-covered by cash flows. The company's payout ratio of 34.7% suggests dividends are sustainable from earnings, despite a high cash payout ratio of 139%. Trading at a price-to-earnings ratio of 5.5x, it offers good value relative to the Hong Kong market average. Recent earnings showed slight revenue decline but increased net income year-on-year, highlighting operational resilience amidst challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Expressway.

- Our expertly prepared valuation report Zhejiang Expressway implies its share price may be lower than expected.

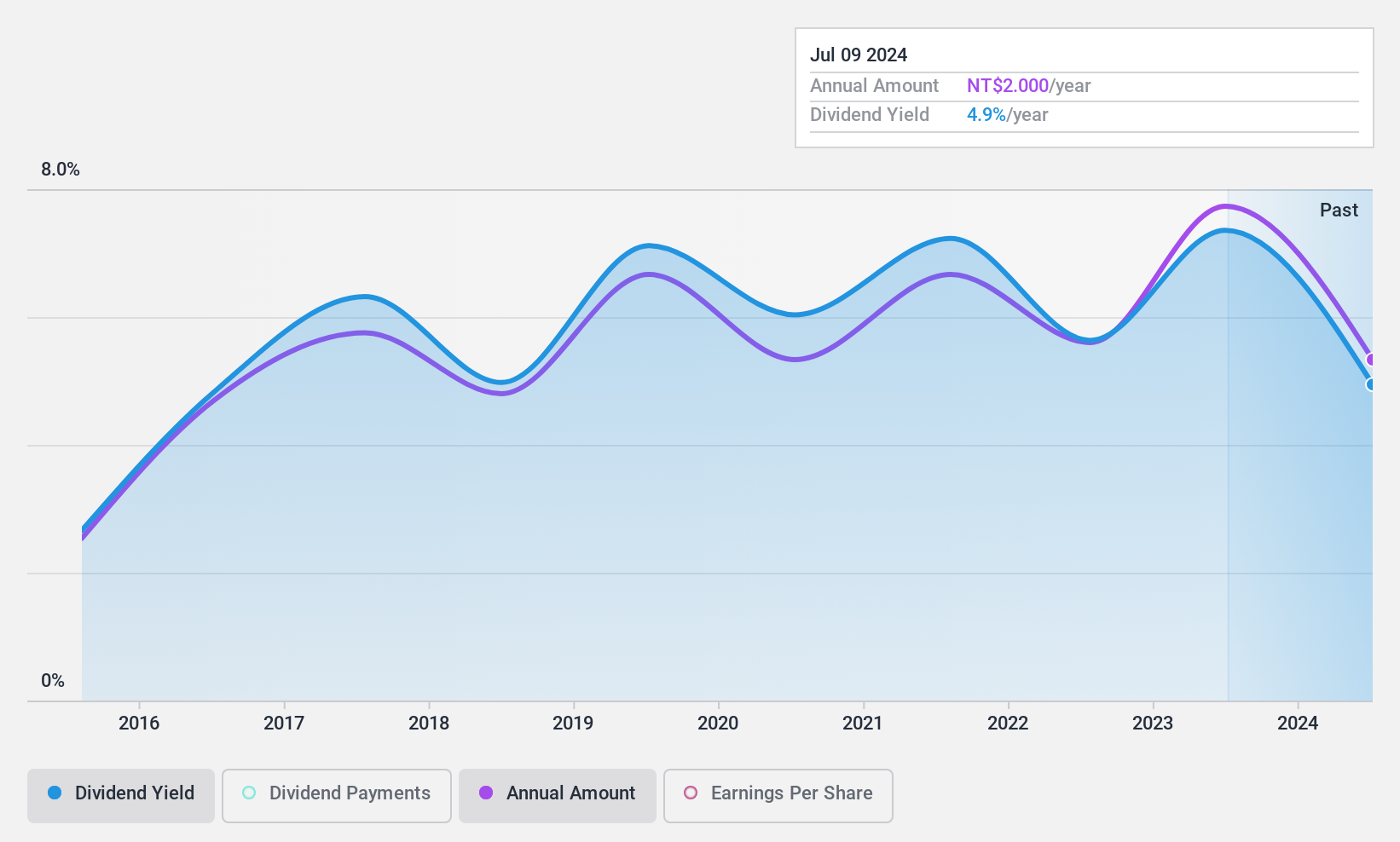

King Chou Marine Technology (TPEX:4417)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: King Chou Marine Technology Co., Ltd. operates globally under the King Net brand, focusing on the manufacturing, processing, exporting, and importing of fishing nets for marine industries with a market cap of NT$3.52 billion.

Operations: King Chou Marine Technology Co., Ltd.'s revenue segments include contributions of NT$2.13 billion from Chin Chou, NT$455.15 million from Kunshan King Chou, and NT$830.91 million from Vietnam King Chou.

Dividend Yield: 4.8%

King Chou Marine Technology's dividend yield is among the top 25% in Taiwan, with a payout ratio of 50.1%, indicating coverage by earnings. However, dividends have been volatile over the past decade despite recent growth. The cash payout ratio stands at 62.3%, suggesting reasonable cash flow support for dividends. Recent Q3 earnings showed increased net income to TWD 105.95 million from TWD 86.41 million year-on-year, reflecting improved profitability amidst fluctuating sales figures.

- Get an in-depth perspective on King Chou Marine Technology's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that King Chou Marine Technology is priced lower than what may be justified by its financials.

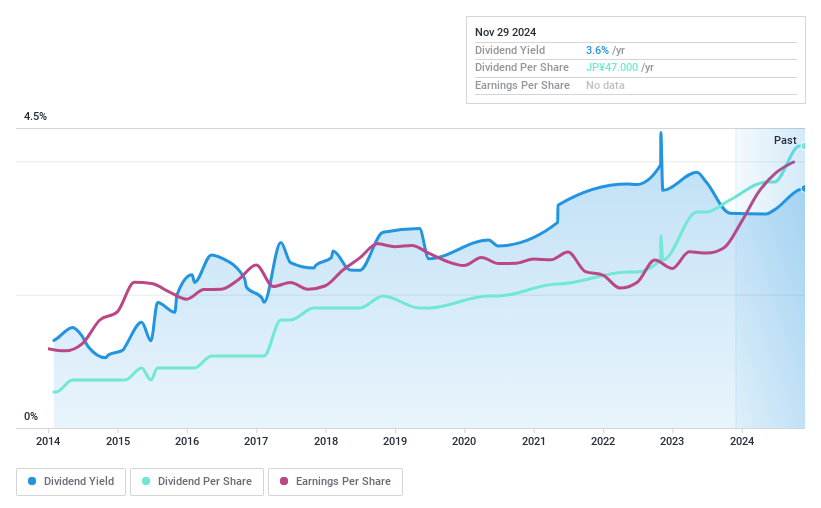

MEISEI INDUSTRIALLtd (TSE:1976)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEISEI INDUSTRIAL Co., Ltd. is a construction works company operating both in Japan and internationally, with a market cap of ¥68.41 billion.

Operations: MEISEI INDUSTRIAL Co., Ltd. generates revenue primarily from its Construction Work segment, amounting to ¥58.38 billion, and its Boiler Business segment, contributing ¥7.35 billion.

Dividend Yield: 3.4%

MEISEI INDUSTRIAL's dividends have been stable and growing over the past decade, supported by a low payout ratio of 38.8%. However, the dividend yield of 3.36% is below Japan's top tier and not covered by free cash flows. Recent earnings growth and a share buyback program aim to enhance shareholder returns, with ¥1,650.35 million spent repurchasing shares to improve capital efficiency amidst strong half-year financial performance.

- Take a closer look at MEISEI INDUSTRIALLtd's potential here in our dividend report.

- Our valuation report unveils the possibility MEISEI INDUSTRIALLtd's shares may be trading at a premium.

Taking Advantage

- Click here to access our complete index of 1931 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Expressway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:576

Zhejiang Expressway

An investment holding company, constructs, operates, maintains, and manages roads in the People’s Republic of China.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives