- Taiwan

- /

- Consumer Durables

- /

- TPEX:8342

Is The Market Rewarding I Jang Industrial Co.,Ltd. (GTSM:8342) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

It is hard to get excited after looking at I Jang IndustrialLtd's (GTSM:8342) recent performance, when its stock has declined 2.8% over the past three months. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study I Jang IndustrialLtd's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for I Jang IndustrialLtd

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for I Jang IndustrialLtd is:

19% = NT$140m ÷ NT$743m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.19 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

I Jang IndustrialLtd's Earnings Growth And 19% ROE

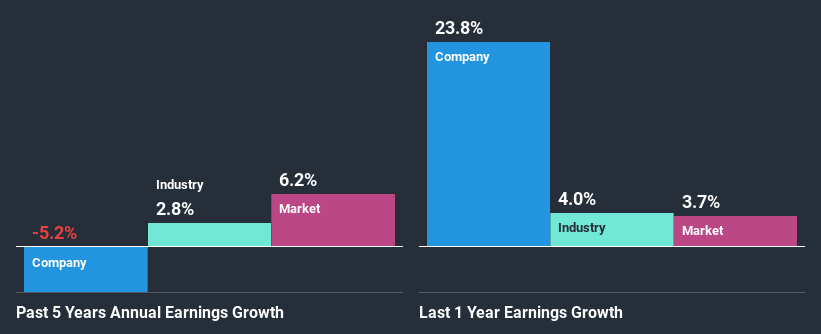

To begin with, I Jang IndustrialLtd seems to have a respectable ROE. Especially when compared to the industry average of 13% the company's ROE looks pretty impressive. Needless to say, we are quite surprised to see that I Jang IndustrialLtd's net income shrunk at a rate of 5.2% over the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. These include low earnings retention or poor allocation of capital.

So, as a next step, we compared I Jang IndustrialLtd's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 2.8% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is I Jang IndustrialLtd fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is I Jang IndustrialLtd Making Efficient Use Of Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Summary

In total, we're a bit ambivalent about I Jang IndustrialLtd's performance. Despite the high ROE, the company has a disappointing earnings growth number, due to its poor rate of reinvestment into its business. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of I Jang IndustrialLtd's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade I Jang IndustrialLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8342

I Jang IndustrialLtd

Manufactures and sells commercial storage equipment, and custom-made and household products worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success