- Taiwan

- /

- Commercial Services

- /

- TWSE:6139

Undiscovered Gems And 2 Other Hidden Stocks With Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with the S&P 500 and Nasdaq Composite posting strong annual gains despite recent economic uncertainties like a declining Chicago PMI and revised GDP forecasts, investors are increasingly on the lookout for promising opportunities in less-trodden paths. In this environment of cautious optimism, identifying undiscovered gems—stocks that may not yet be on every investor's radar but hold potential due to solid fundamentals or unique market positions—can offer intriguing prospects for those seeking diversification beyond the usual blue-chip names.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Wuxi New Hongtai Electrical TechnologyLtd (SHSE:603016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi New Hongtai Electrical Technology Co., Ltd focuses on the research, development, production, and sale of components for circuit breakers and knife-melt switches in China, with a market capitalization of CN¥6.10 billion.

Operations: Wuxi New Hongtai Electrical Technology Ltd generates revenue primarily from its Transmission and Distribution and Control Equipment Manufacturing segment, amounting to CN¥637.11 million. The company has a market capitalization of CN¥6.10 billion.

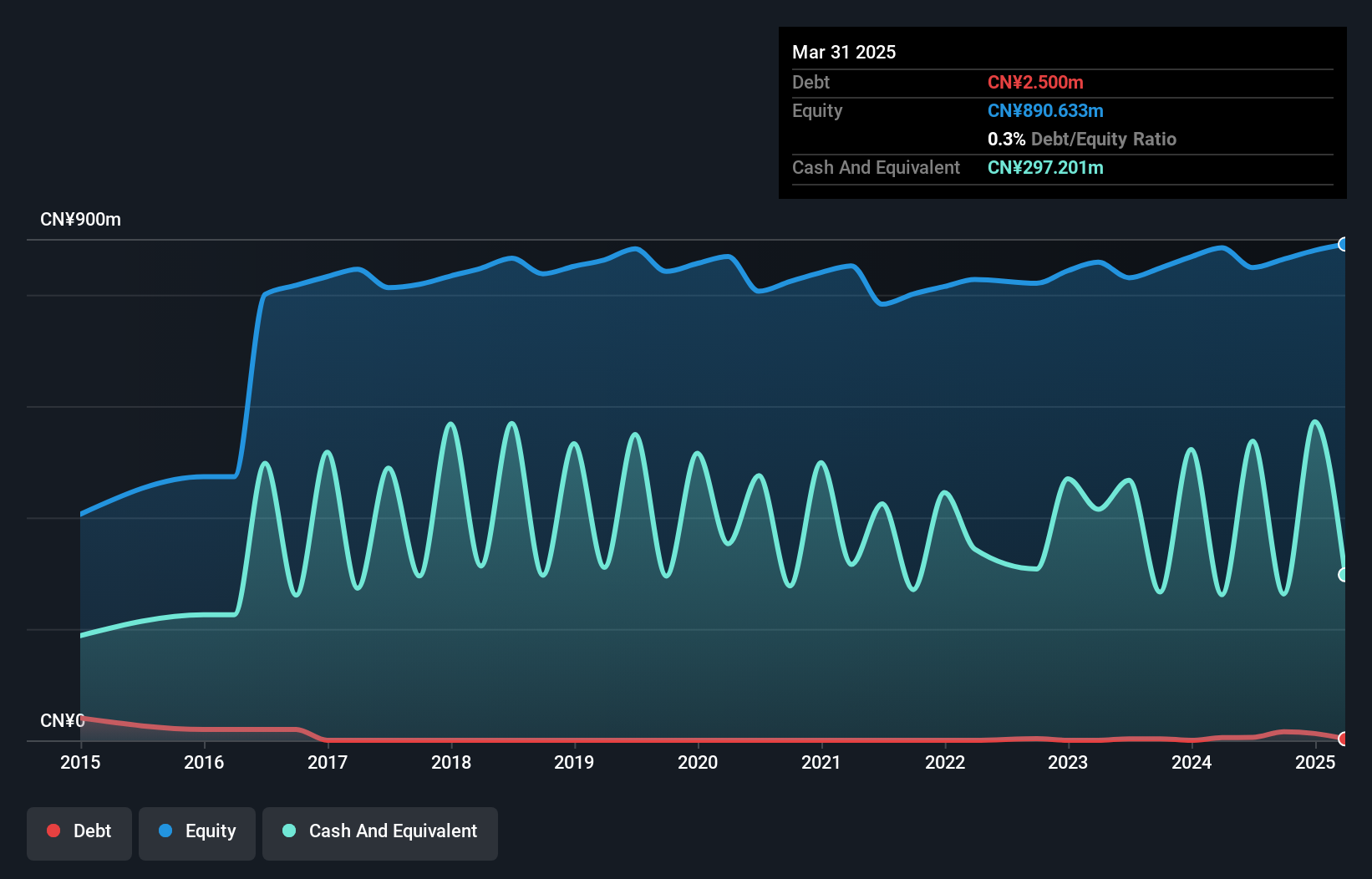

Wuxi New Hongtai Electrical Technology, a relatively small player in the electrical sector, has shown promising earnings growth of 10.8% over the past year, outpacing the industry average of 1.1%. Despite a slight dip in sales to CNY 470.16 million from CNY 478.04 million, net income rose to CNY 52.18 million from CNY 51.12 million, indicating strong operational efficiency with stable basic earnings per share at CNY 0.35. The company's debt-to-equity ratio increased slightly to 0.3%, yet it holds more cash than total debt and trades at a modest discount below its estimated fair value by around 5%.

- Unlock comprehensive insights into our analysis of Wuxi New Hongtai Electrical TechnologyLtd stock in this health report.

Learn about Wuxi New Hongtai Electrical TechnologyLtd's historical performance.

Delta Galil Industries (TASE:DELG)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Galil Industries Ltd. is involved in the design, development, production, marketing, and sale of intimate and activewear products with a market cap of ₪5.39 billion.

Operations: Delta Galil Industries generates revenue primarily from its Private Brands and Brands segments, contributing $766 million and $637.48 million, respectively. The company's net profit margin has shown variability over recent periods.

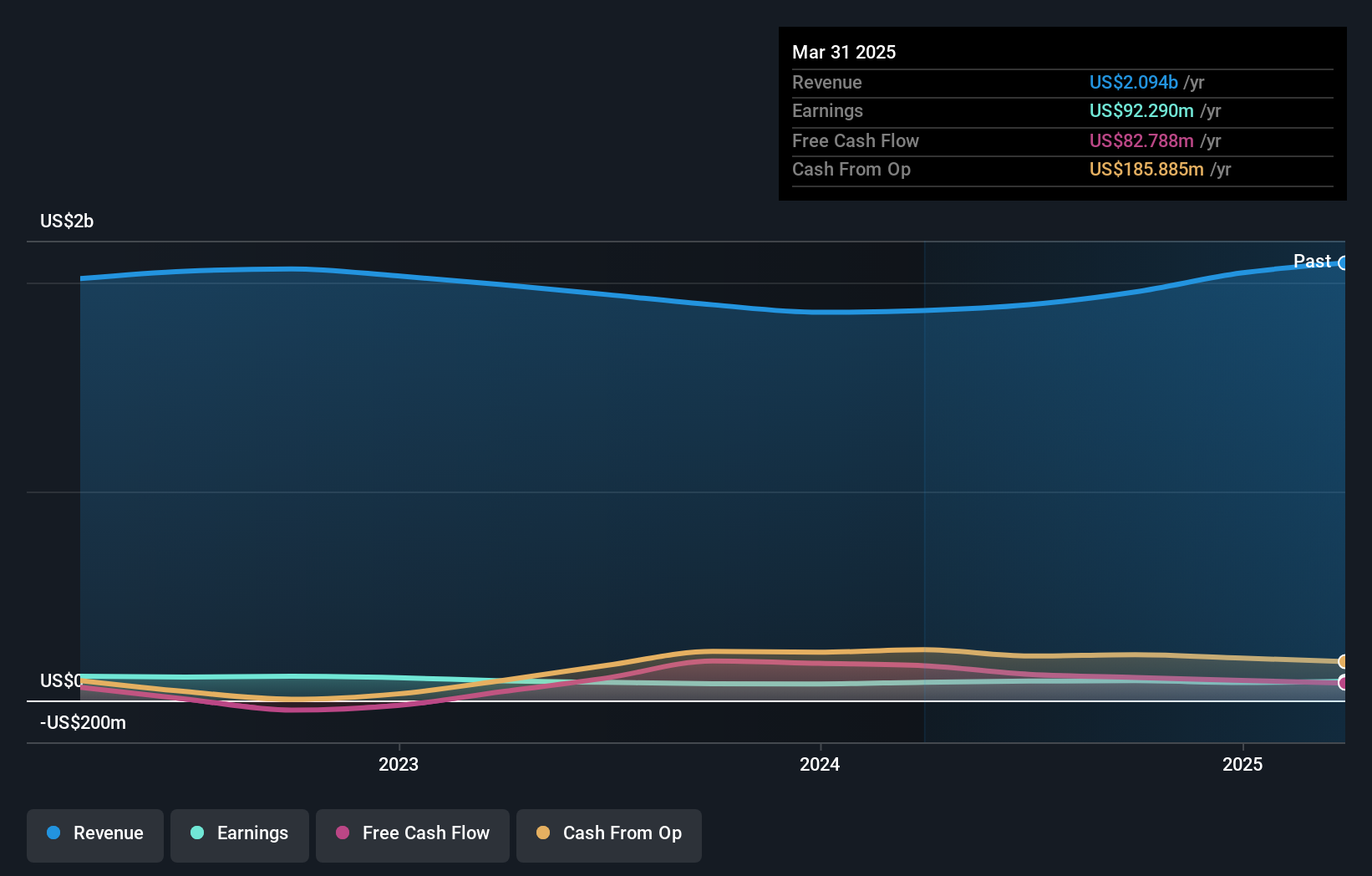

Delta Galil Industries, a notable player in the textile arena, stands out with its robust financial health. Over the past five years, it has significantly lowered its debt to equity ratio from 102.4% to 33%, showcasing prudent financial management. The company's interest payments are well covered by EBIT at 5.4 times, indicating strong operational efficiency. Recent earnings growth of 17.6% surpasses industry averages, reflecting competitive performance within the luxury sector. With net income rising to US$60 million for nine months ending September 2024 and trading at nearly 18% below fair value estimates, Delta Galil presents an intriguing investment opportunity in this niche market segment.

- Dive into the specifics of Delta Galil Industries here with our thorough health report.

Gain insights into Delta Galil Industries' past trends and performance with our Past report.

L&K Engineering (TWSE:6139)

Simply Wall St Value Rating: ★★★★★★

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services across Taiwan, Hong Kong, and internationally, with a market capitalization of NT$53.36 billion.

Operations: The company's revenue primarily comes from its L1 and L2 segments, generating NT$25.53 billion and NT$17.10 billion respectively. The net profit margin for the company shows notable variation across different periods, reflecting changes in cost structures or operational efficiencies.

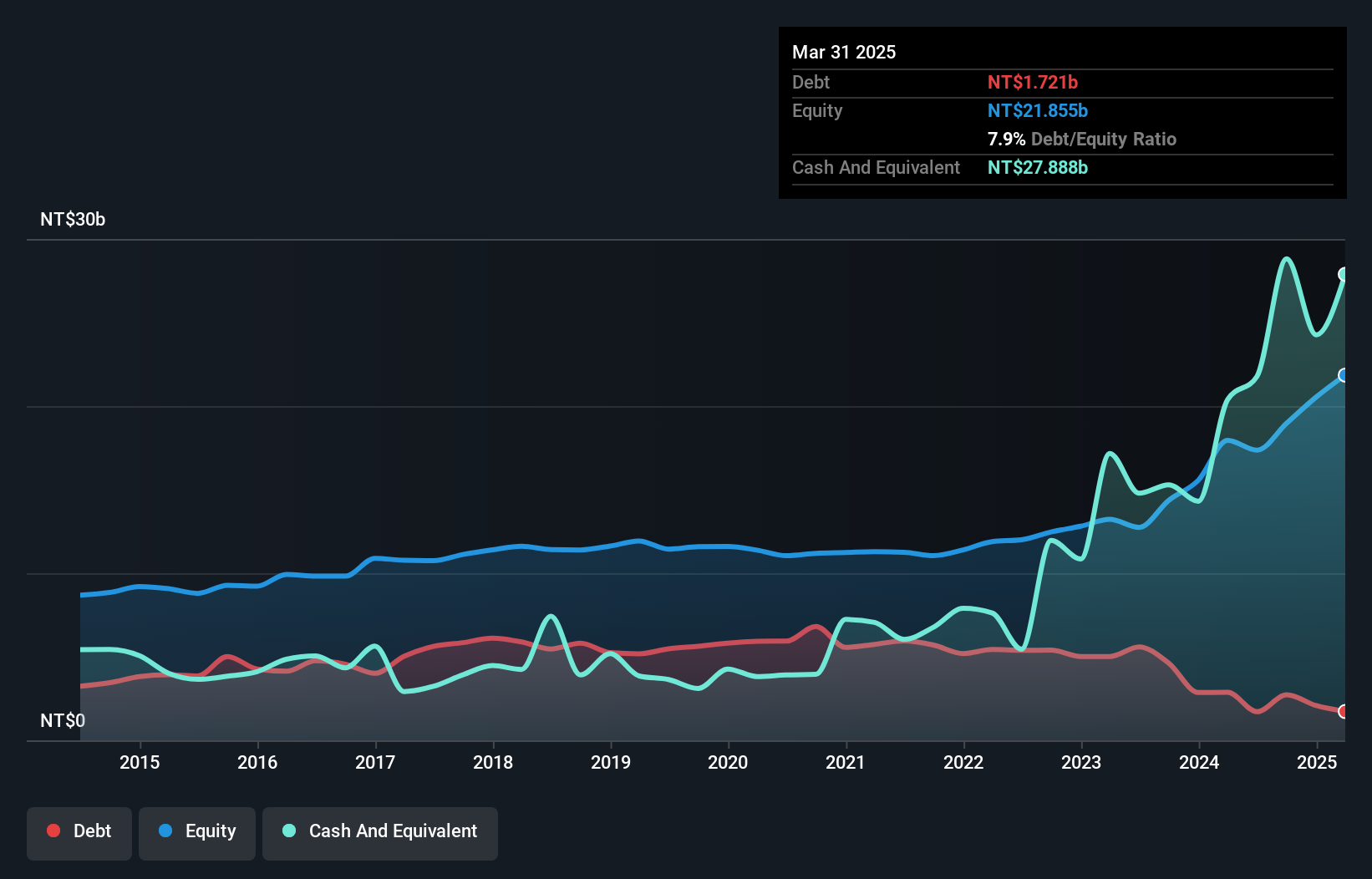

L&K Engineering offers an intriguing profile with its recent earnings report showing third-quarter sales of TWD 16.41 billion, up from TWD 14.57 billion last year, and net income at TWD 1.01 billion compared to TWD 983 million previously. Despite a slight dip in basic earnings per share from continuing operations to TWD 4.33, the nine-month figures reveal significant growth with sales reaching TWD 54.37 billion versus last year's TWD 32.82 billion and net income climbing to TWD 3.01 billion from TWD 1.77 billion prior year, indicating robust performance amidst industry challenges.

- Click to explore a detailed breakdown of our findings in L&K Engineering's health report.

Review our historical performance report to gain insights into L&K Engineering's's past performance.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4662 more companies for you to explore.Click here to unveil our expertly curated list of 4665 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6139

L&K Engineering

Provides turnkey engineering services in Taiwan, Hongkong, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion