- Taiwan

- /

- Commercial Services

- /

- TWSE:8341

We Think Sunny Friend Environmental Technology (TPE:8341) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Sunny Friend Environmental Technology Co., Ltd. (TPE:8341) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Sunny Friend Environmental Technology

What Is Sunny Friend Environmental Technology's Net Debt?

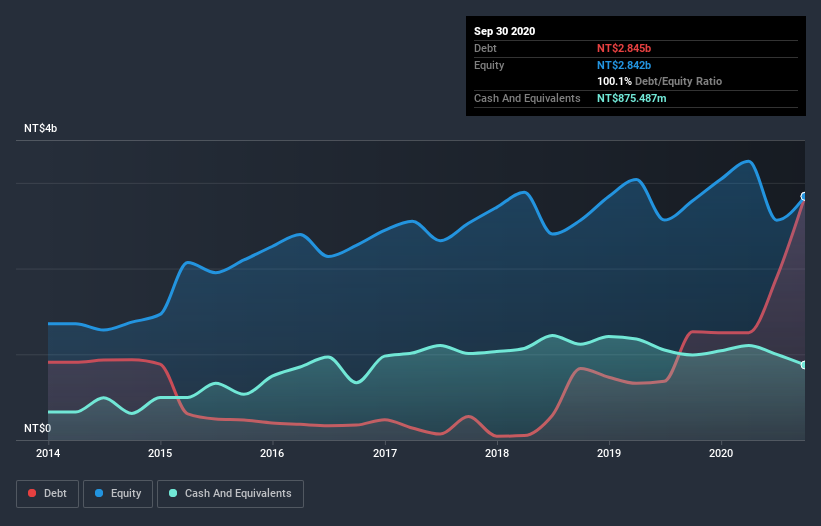

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Sunny Friend Environmental Technology had NT$2.84b of debt, an increase on NT$1.26b, over one year. However, it does have NT$875.5m in cash offsetting this, leading to net debt of about NT$1.97b.

How Strong Is Sunny Friend Environmental Technology's Balance Sheet?

The latest balance sheet data shows that Sunny Friend Environmental Technology had liabilities of NT$742.4m due within a year, and liabilities of NT$3.51b falling due after that. On the other hand, it had cash of NT$875.5m and NT$332.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$3.04b.

Since publicly traded Sunny Friend Environmental Technology shares are worth a total of NT$24.5b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Sunny Friend Environmental Technology has a low net debt to EBITDA ratio of only 1.3. And its EBIT covers its interest expense a whopping 73.6 times over. So we're pretty relaxed about its super-conservative use of debt. The good news is that Sunny Friend Environmental Technology has increased its EBIT by 3.4% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Sunny Friend Environmental Technology's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Sunny Friend Environmental Technology's free cash flow amounted to 24% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

When it comes to the balance sheet, the standout positive for Sunny Friend Environmental Technology was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that Sunny Friend Environmental Technology is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Sunny Friend Environmental Technology is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Sunny Friend Environmental Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:8341

Sunny Friend Environmental Technology

Sunny Friend Environmental Technology Co., Ltd.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives