- Taiwan

- /

- Commercial Services

- /

- TPEX:6803

Peninsula Group And 2 Other Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes approaching record highs and a strong labor market boosting sentiment, investors are increasingly focused on strategies to navigate the current economic landscape marked by geopolitical tensions and evolving fiscal policies. In this context, dividend stocks like Peninsula Group offer a compelling opportunity for income generation and portfolio diversification, providing stability amid broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Peninsula Group (TASE:PEN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peninsula Group Ltd offers credit solutions in Israel and has a market cap of ₪453.39 million.

Operations: Peninsula Group Ltd's revenue segments include credit solutions in Israel.

Dividend Yield: 7.9%

Peninsula Group offers a compelling dividend profile with a 7.87% yield, ranking in the top 25% of Israeli market payers. Despite high debt levels, its dividends are stable and reliable, growing over the past decade without volatility. The payout ratio of 74.4% is sustainable, backed by strong cash flow coverage at 22.5%. Recent earnings showed increased quarterly net income to ILS 15.16 million but decreased nine-month figures compared to last year.

- Navigate through the intricacies of Peninsula Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Peninsula Group is priced higher than what may be justified by its financials.

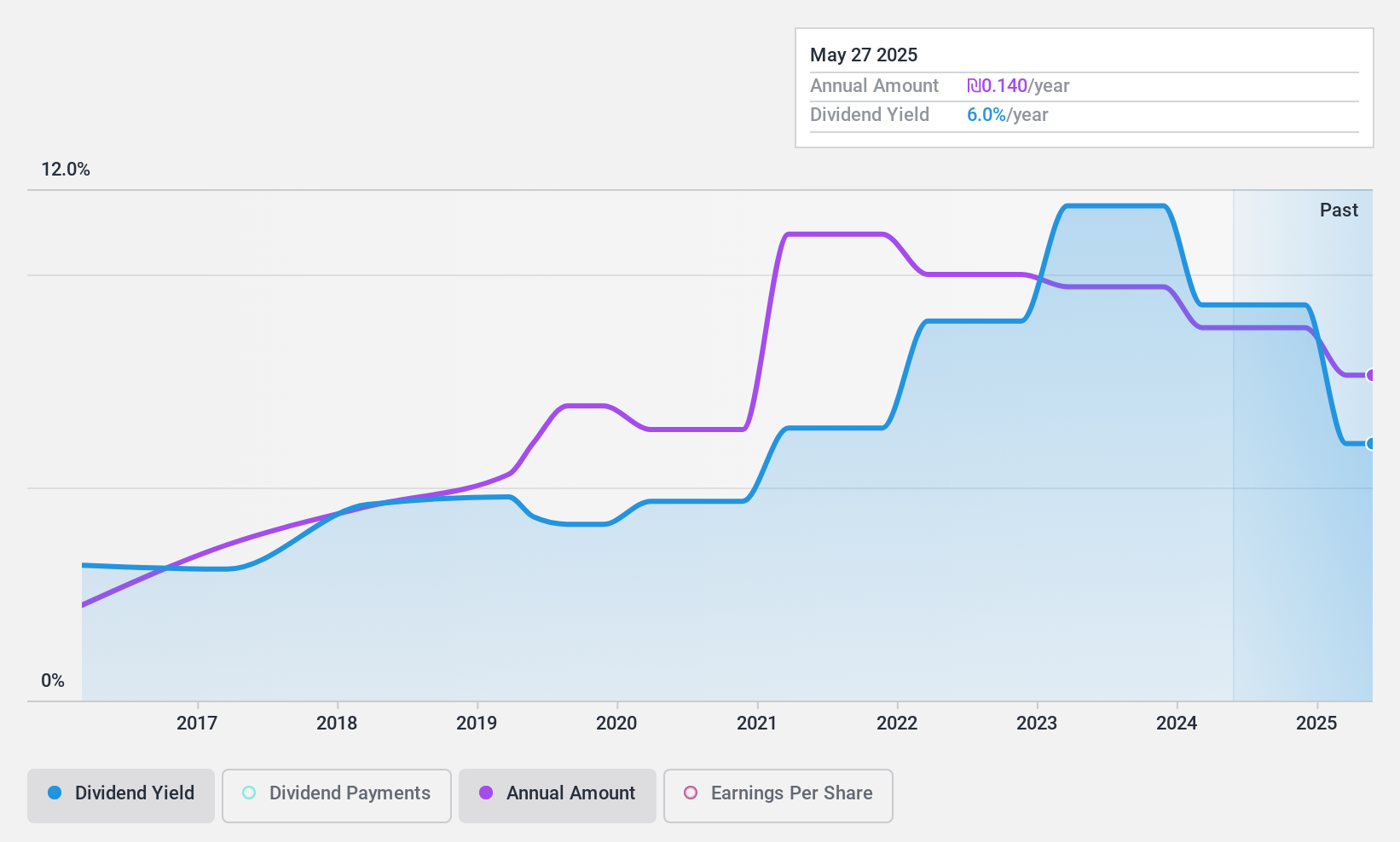

ECOVE Environment (TPEX:6803)

Simply Wall St Dividend Rating: ★★★★★★

Overview: ECOVE Environment Corp. offers waste management services across Taiwan, Macau, China, Southeast Asia, the United States, and India with a market cap of NT$20.05 billion.

Operations: ECOVE Environment Corp.'s revenue primarily comes from Environmental Protection Services, amounting to NT$9.74 billion.

Dividend Yield: 5.3%

ECOVE Environment maintains a strong dividend profile with a yield of 5.26%, placing it in the top 25% of Taiwan's market payers. The dividends have been stable and growing over the past decade, supported by an earnings payout ratio of 87.2% and a cash payout ratio of 54.2%. Recent financials show improved performance, with Q3 net income rising to TWD 353.19 million from TWD 332.02 million year-over-year, indicating robust earnings coverage for its dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of ECOVE Environment.

- Insights from our recent valuation report point to the potential overvaluation of ECOVE Environment shares in the market.

Shibusawa Warehouse (TSE:9304)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Shibusawa Warehouse Co., Ltd. offers logistics and warehousing services both in Japan and internationally, with a market cap of ¥44.93 billion.

Operations: The Shibusawa Warehouse Co., Ltd. generates revenue from its logistics and warehousing services provided domestically and internationally.

Dividend Yield: 3.9%

Shibusawa Warehouse's dividend yield of 3.87% ranks in the top 25% of Japan's market, with stable and growing payments over the last decade. Despite a low earnings payout ratio of 17.8%, indicating strong earnings coverage, its high cash payout ratio (374.8%) suggests dividends are not well covered by free cash flows, raising sustainability concerns. Recent share buybacks totaling ¥319.5 million aim to enhance capital efficiency and shareholder returns, reflecting a commitment to returning profits to investors.

- Delve into the full analysis dividend report here for a deeper understanding of Shibusawa Warehouse.

- Our valuation report here indicates Shibusawa Warehouse may be overvalued.

Summing It All Up

- Discover the full array of 1963 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ECOVE Environment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6803

ECOVE Environment

Provides waste management services to public and private entities in Taiwan, Macau, China, Southeast Asia, the United States, and India.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives