- Taiwan

- /

- Commercial Services

- /

- TPEX:8401

Did You Manage To Avoid Bai Sha Technology's (GTSM:8401) 30% Share Price Drop?

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Bai Sha Technology Co., Ltd. (GTSM:8401), since the last five years saw the share price fall 30%.

View our latest analysis for Bai Sha Technology

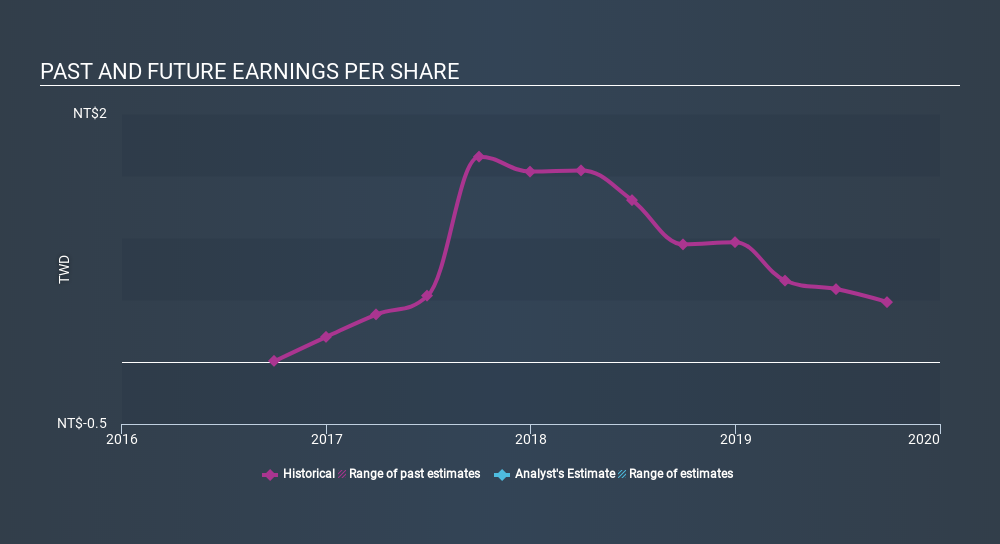

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Bai Sha Technology's share price and EPS declined; the latter at a rate of 21% per year. This fall in the EPS is worse than the 7.0% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Bai Sha Technology the TSR over the last 5 years was -4.4%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Bai Sha Technology shareholders are down 5.1% for the year (even including dividends) , but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Bai Sha Technology you should be aware of, and 1 of them is a bit unpleasant.

But note: Bai Sha Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:8401

Bai Sha Technology

Provides printing products and services in Taiwan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives