- Taiwan

- /

- Commercial Services

- /

- TPEX:8390

Are Strong Financial Prospects The Force That Is Driving The Momentum In Jiin Yeeh Ding Enterprises Corp.'s GTSM:8390) Stock?

Jiin Yeeh Ding Enterprises' (GTSM:8390) stock is up by a considerable 6.9% over the past month. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Jiin Yeeh Ding Enterprises' ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Jiin Yeeh Ding Enterprises

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Jiin Yeeh Ding Enterprises is:

11% = NT$248m ÷ NT$2.2b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Jiin Yeeh Ding Enterprises' Earnings Growth And 11% ROE

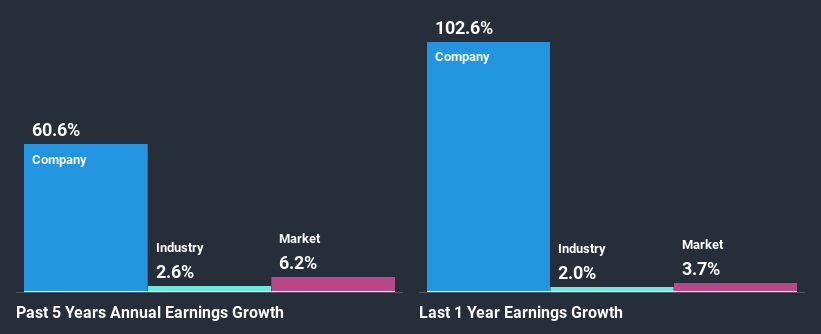

To begin with, Jiin Yeeh Ding Enterprises seems to have a respectable ROE. On comparing with the average industry ROE of 5.6% the company's ROE looks pretty remarkable. This probably laid the ground for Jiin Yeeh Ding Enterprises' significant 61% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

We then compared Jiin Yeeh Ding Enterprises' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 2.6% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Jiin Yeeh Ding Enterprises fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Jiin Yeeh Ding Enterprises Efficiently Re-investing Its Profits?

Jiin Yeeh Ding Enterprises has a significant three-year median payout ratio of 56%, meaning the company only retains 44% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Moreover, Jiin Yeeh Ding Enterprises is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

Overall, we are quite pleased with Jiin Yeeh Ding Enterprises' performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Jiin Yeeh Ding Enterprises' past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade Jiin Yeeh Ding Enterprises, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:8390

Jiin Yeeh Ding Enterprises

A professional electronic waste recycling and treatment company, provides e-waste disposal service for the technology companies in Taiwan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.