- Taiwan

- /

- Electrical

- /

- TWSE:6558

Investing in SYNergy ScienTech (TWSE:6558) a year ago would have delivered you a 50% gain

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the SYNergy ScienTech Corp. (TWSE:6558) share price is 50% higher than it was a year ago, much better than the market return of around 27% (not including dividends) in the same period. So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 23% in the last three years.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for SYNergy ScienTech

SYNergy ScienTech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

SYNergy ScienTech actually shrunk its revenue over the last year, with a reduction of 1.3%. Despite the lack of revenue growth, the stock has returned a solid 50% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

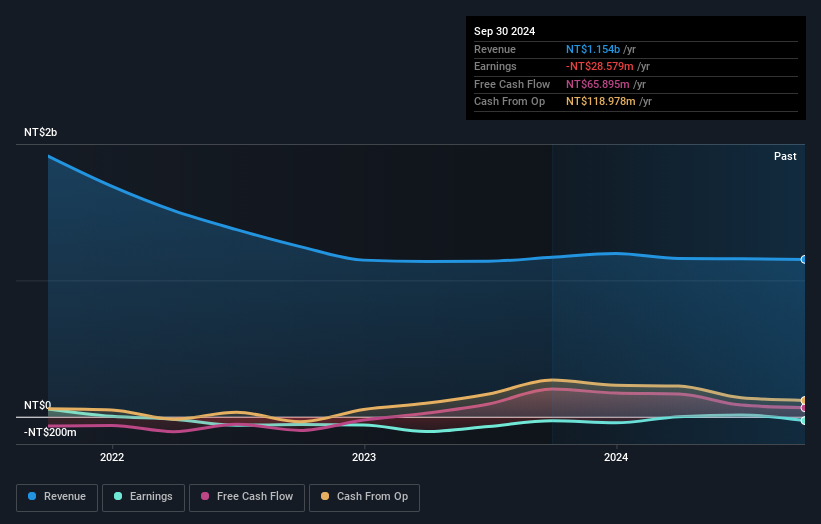

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that SYNergy ScienTech shareholders have received a total shareholder return of 50% over one year. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand SYNergy ScienTech better, we need to consider many other factors. For example, we've discovered 2 warning signs for SYNergy ScienTech that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6558

SYNergy ScienTech

Engages in the research, development, manufacture, and sale of rechargeable lithium-ion and lithium-ion polymer batteries in Taiwan, rest of Asia, the Americas, and Europe.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives