Undiscovered Gems with Promising Potential for November 2024

Reviewed by Simply Wall St

As global markets approach record highs with broad-based gains, small-cap indexes have notably outperformed their larger counterparts, reflecting a renewed investor interest in these often-overlooked segments. Amid this backdrop of positive sentiment driven by strong labor market data and stabilizing economic indicators, identifying stocks with solid fundamentals and growth potential can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Guangdong Yangshan United Precision Manufacturing (SZSE:001268)

Simply Wall St Value Rating: ★★★★★★

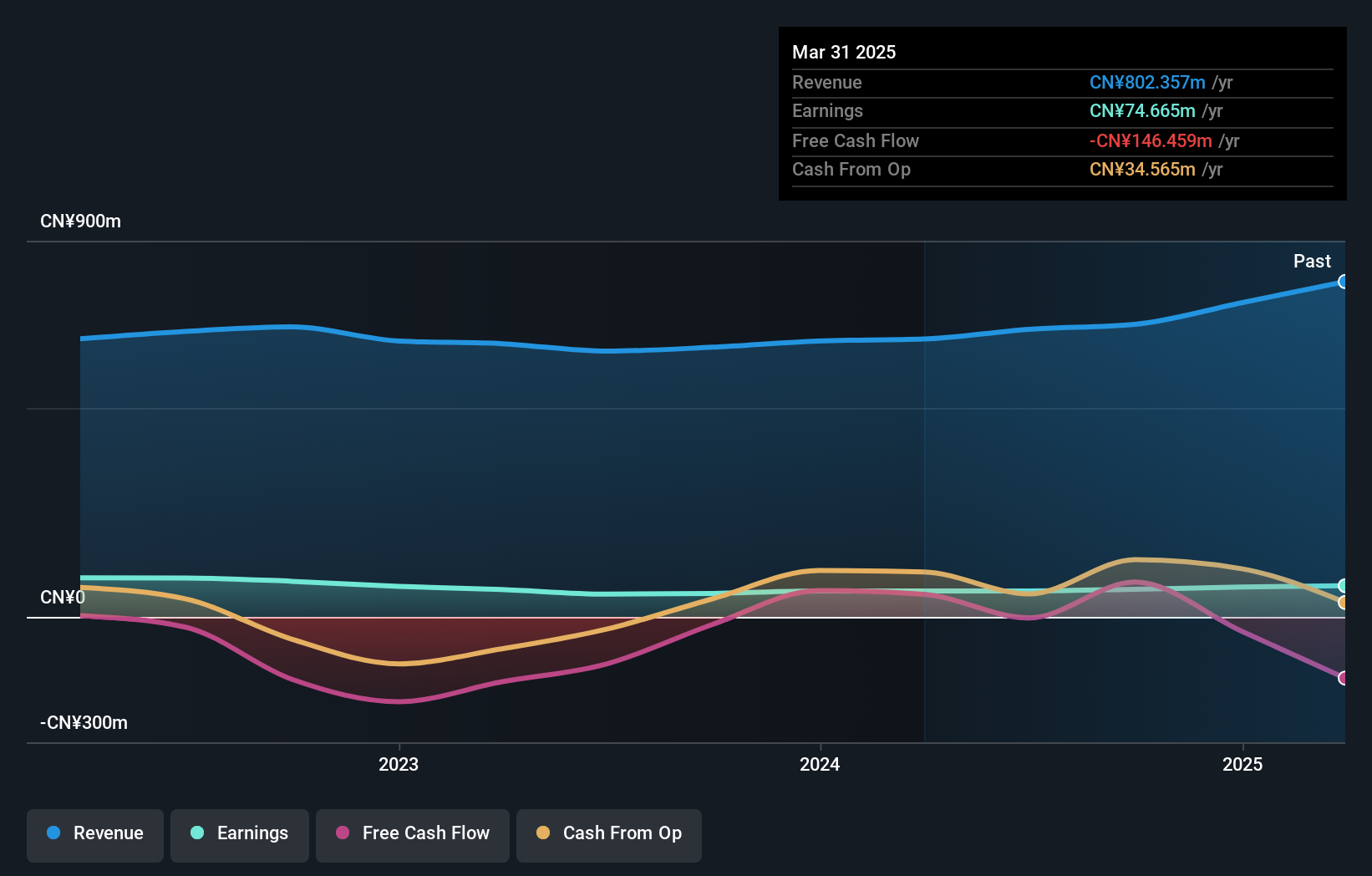

Overview: Guangdong Yangshan United Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry and has a market cap of CN¥2.06 billion.

Operations: Guangdong Yangshan United Precision Manufacturing generates revenue through its precision manufacturing operations. The company has a market capitalization of CN¥2.06 billion, indicating its scale in the industry.

Guangdong Yangshan United Precision Manufacturing, a promising small player in the machinery sector, has caught attention with its impressive 17.4% earnings growth over the past year, outpacing the industry average of -0.4%. The company's debt-to-equity ratio has significantly improved from 22.3% to 6.5% over five years, indicating better financial health. Trading at a substantial discount of 82.5% below estimated fair value adds to its appeal as an undervalued asset. Recent activities include repurchasing shares worth CNY 15.5 million and reporting nine-month sales of CNY 541 million, up from CNY 501 million last year, reflecting robust operational performance despite past challenges.

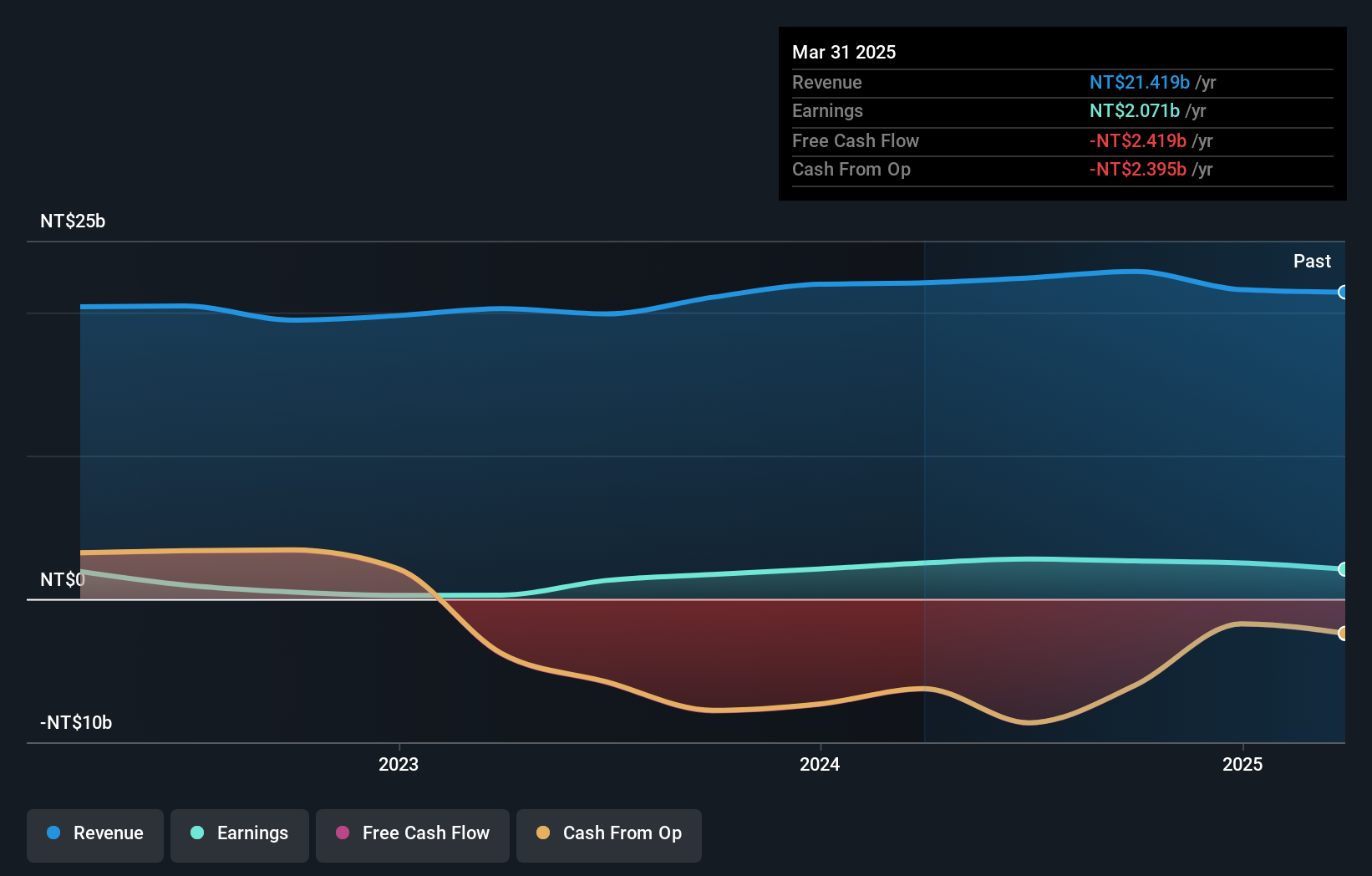

Central Reinsurance (TWSE:2851)

Simply Wall St Value Rating: ★★★★★☆

Overview: Central Reinsurance Corporation offers a range of property and life reinsurance services both in Taiwan and internationally, with a market cap of NT$21.13 billion.

Operations: The company generates revenue primarily from reinsurance services, totaling NT$22.85 billion.

Central Reinsurance, a player in the insurance sector, showcases a robust financial profile with no debt and high-quality earnings. Over the past five years, its earnings have grown at an annual rate of 9.9%, indicating steady progress. Despite this growth, its recent performance did not outpace the broader insurance industry’s 79.3% surge last year. The company is trading at a significant discount of 51% below estimated fair value, suggesting potential undervaluation in the market. Recent changes in leadership and committee appointments reflect active governance adjustments to enhance operational oversight and strategic direction moving forward.

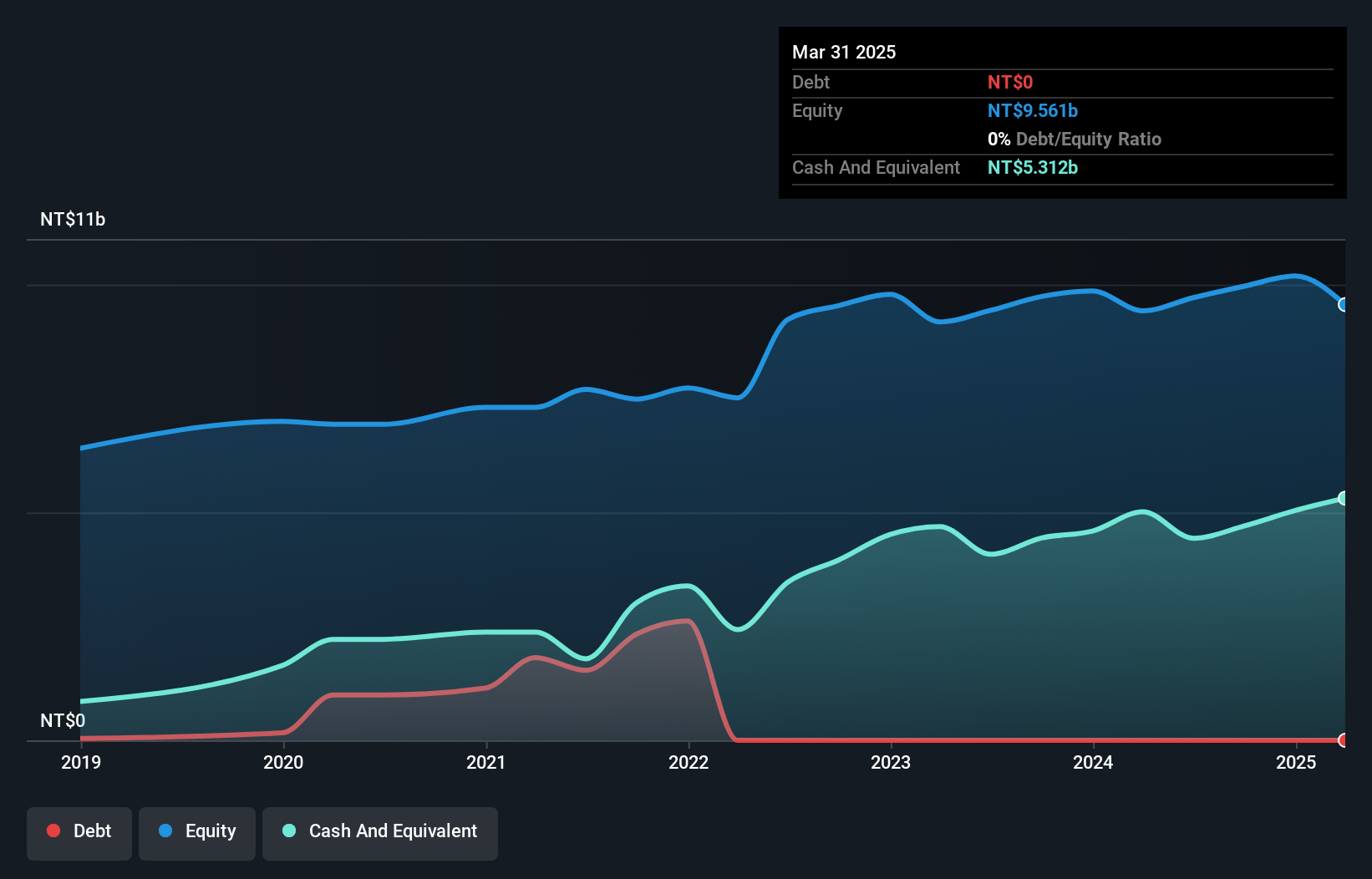

Apex Dynamics (TWSE:4583)

Simply Wall St Value Rating: ★★★★★★

Overview: Apex Dynamics, Inc. specializes in the production and sale of robots for plastics injection molding machines across Taiwan, Asia, the Americas, Europe, and other international markets with a market capitalization of NT$58.77 billion.

Operations: Apex Dynamics generates revenue primarily from its Precision Machinery Department, contributing NT$2.34 billion, and a smaller portion from the Hospitality Service Segment at NT$571.76 million.

Apex Dynamics, a small player in the machinery sector, has shown steady earnings growth of 10.5% annually over the past five years, though its recent yearly growth of 3% lags behind the industry’s 14.6%. The company is debt-free now, a notable improvement from five years ago when it had a debt-to-equity ratio of 9.6%. Despite high volatility in share prices recently, Apex's profitability remains strong with free cash flow consistently positive. In Q3 2024, sales increased to TWD 758.75 million from TWD 646.27 million last year; however, net income decreased to TWD 251.63 million from TWD 303.49 million previously reported for the same period.

- Delve into the full analysis health report here for a deeper understanding of Apex Dynamics.

Evaluate Apex Dynamics' historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 4638 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001268

Guangdong Yangshan United Precision Manufacturing

Guangdong Yangshan United Precision Manufacturing Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives