Undiscovered Gems In Global And 2 Other Promising Small Caps To Explore

Reviewed by Simply Wall St

As global markets experience a rebound amid easing trade tensions and positive corporate earnings, small-cap stocks have shown resilience with gains for the third consecutive week. Despite challenges such as slowing business activity growth and consumer sentiment declines, the S&P 600 index's performance highlights opportunities for investors seeking potential in lesser-known companies. In this environment, identifying undiscovered gems involves looking for businesses that demonstrate strong fundamentals, adaptability to economic shifts, and potential for growth in niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Thai Steel Cable | NA | 3.33% | 18.04% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| OpenWork | NA | 24.40% | 27.84% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

China National Electric Apparatus Research Institute (SHSE:688128)

Simply Wall St Value Rating: ★★★★★☆

Overview: China National Electric Apparatus Research Institute Co., Ltd. operates in the field of electrical apparatus research and development, with a market cap of CN¥8.80 billion.

Operations: The company generates revenue primarily from its electrical apparatus research and development activities. It has a market cap of CN¥8.80 billion, reflecting its valuation in the industry.

This electrical industry player has been making waves with its impressive earnings growth of 13.5%, outpacing the sector's modest 0.4% rise. Priced attractively, its Price-To-Earnings ratio stands at 21x, significantly lower than the broader Chinese market's 36.8x, suggesting potential undervaluation. The company's robust financial health is underscored by having more cash than total debt and positive free cash flow, though a rising debt-to-equity ratio from 1.2 to 2.8 over five years warrants attention. With high-quality earnings and strong interest coverage, it seems well-positioned for continued performance in its niche market segment.

- Unlock comprehensive insights into our analysis of China National Electric Apparatus Research Institute stock in this health report.

Learn about China National Electric Apparatus Research Institute's historical performance.

Shenyang Xingqi PharmaceuticalLtd (SZSE:300573)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic drugs in the People’s Republic of China with a market cap of CN¥12.62 billion.

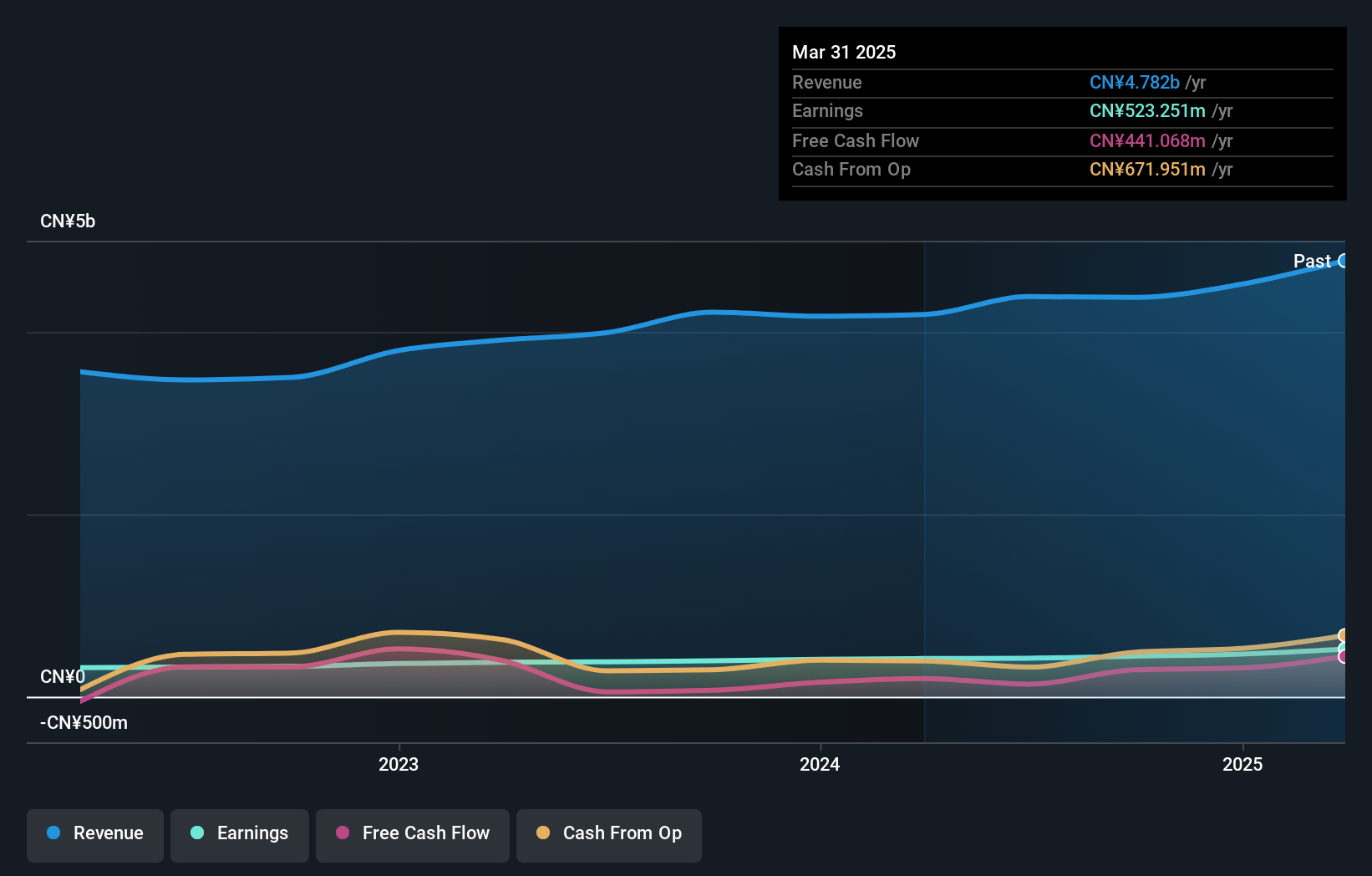

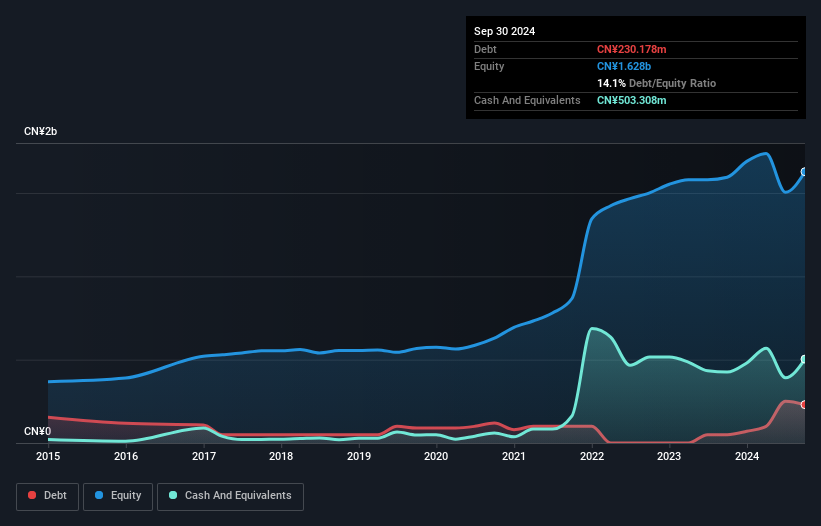

Operations: Shenyang Xingqi Pharmaceutical generates revenue primarily from the sale of ophthalmic drugs in China. The company's net profit margin has shown notable fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

Shenyang Xingqi Pharmaceutical, a promising player in the pharma sector, has shown impressive financial performance. With sales soaring to CNY 536.14 million in Q1 2025 from CNY 349.88 million the previous year, and net income jumping to CNY 145.9 million from CNY 34.75 million, the company is on an upward trajectory. Their debt management is commendable with a reduction in debt-to-equity ratio from 16% to 10.8% over five years and interest payments covered by EBIT at an astounding rate of over 9978 times, indicating robust financial health and potential for continued growth within its industry context.

Apex Dynamics (TWSE:4583)

Simply Wall St Value Rating: ★★★★★★

Overview: Apex Dynamics, Inc. specializes in the production and sale of robots for plastics injection molding machines across Taiwan, Asia, the Americas, Europe, and other international markets with a market cap of NT$48.42 billion.

Operations: Apex Dynamics generates revenue primarily from its Precision Machinery Department, contributing NT$2.38 billion, and Catering Services, adding NT$579.35 million. The company's financial performance is impacted by adjustments and eliminations amounting to -NT$0.32 million.

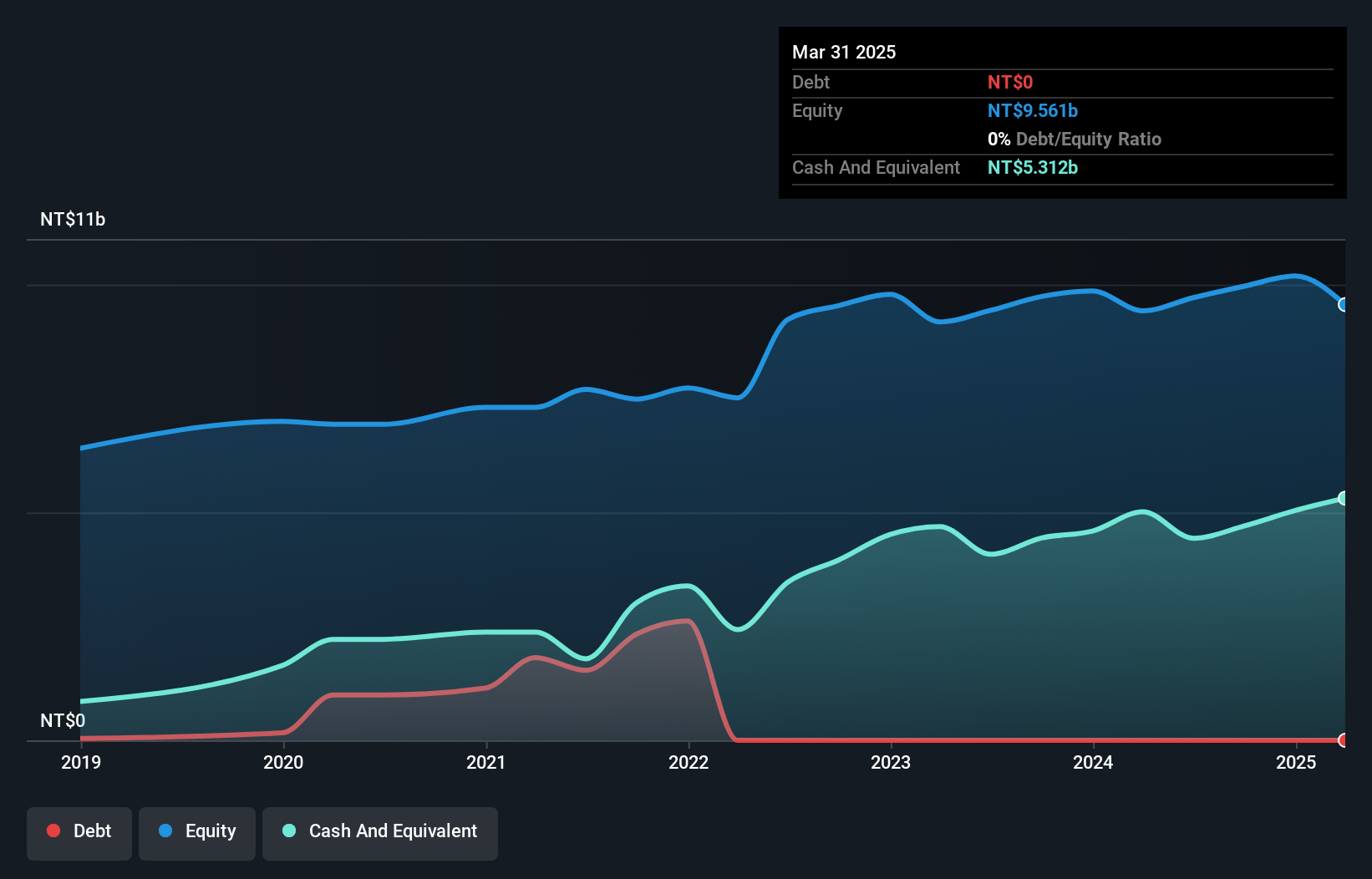

Apex Dynamics showcases a compelling profile, with earnings growth of 29.9% over the past year outpacing the Machinery industry's 22.7%. The company is entirely debt-free, a significant improvement from five years ago when its debt-to-equity ratio stood at 2.4%. This financial health is complemented by high-quality earnings and positive free cash flow, which was TWD 1,354 million as of April 2025. Recent executive changes include appointing Hsiao Kuo-Tung as Chief Internal Auditor in February 2025. Additionally, Apex announced cash dividends totaling TWD 962 million for shareholders, reflecting strong profitability and shareholder value focus.

- Click here and access our complete health analysis report to understand the dynamics of Apex Dynamics.

Examine Apex Dynamics' past performance report to understand how it has performed in the past.

Where To Now?

- Navigate through the entire inventory of 3280 Global Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300573

Shenyang Xingqi PharmaceuticalLtd

Engages in the research and development, production, and sale of ophthalmic drug in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives