- Taiwan

- /

- Electrical

- /

- TWSE:4545

Min Aik Precision Industrial (TWSE:4545) Is Looking To Continue Growing Its Returns On Capital

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Min Aik Precision Industrial (TWSE:4545) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Min Aik Precision Industrial is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.054 = NT$123m ÷ (NT$3.1b - NT$848m) (Based on the trailing twelve months to March 2024).

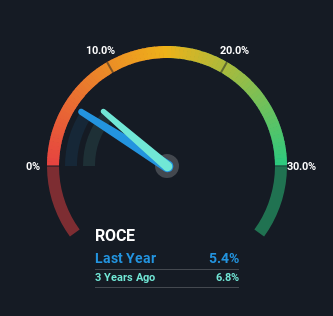

Therefore, Min Aik Precision Industrial has an ROCE of 5.4%. In absolute terms, that's a low return but it's around the Electrical industry average of 6.7%.

See our latest analysis for Min Aik Precision Industrial

Historical performance is a great place to start when researching a stock so above you can see the gauge for Min Aik Precision Industrial's ROCE against it's prior returns. If you'd like to look at how Min Aik Precision Industrial has performed in the past in other metrics, you can view this free graph of Min Aik Precision Industrial's past earnings, revenue and cash flow.

The Trend Of ROCE

Shareholders will be relieved that Min Aik Precision Industrial has broken into profitability. The company was generating losses five years ago, but has managed to turn it around and as we saw earlier is now earning 5.4%, which is always encouraging. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. That being said, while an increase in efficiency is no doubt appealing, it'd be helpful to know if the company does have any investment plans going forward. Because in the end, a business can only get so efficient.

The Bottom Line

To bring it all together, Min Aik Precision Industrial has done well to increase the returns it's generating from its capital employed. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for Min Aik Precision Industrial (of which 1 is concerning!) that you should know about.

While Min Aik Precision Industrial isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4545

Min Aik Precision Industrial

Engages in processes and manufactures electroplating of aluminum and copper products, precision stamping components, and electroless nickel plating products.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.