Nishoku Technology Inc. (TWSE:3679) Stock Catapults 31% Though Its Price And Business Still Lag The Market

Despite an already strong run, Nishoku Technology Inc. (TWSE:3679) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

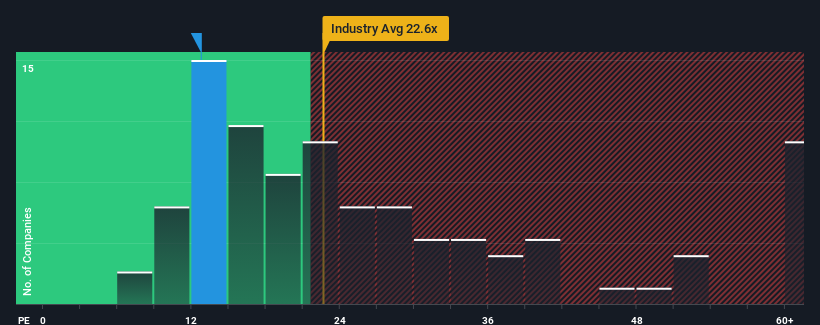

In spite of the firm bounce in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 24x, you may still consider Nishoku Technology as an attractive investment with its 12.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Nishoku Technology recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Nishoku Technology

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nishoku Technology's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 19% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Nishoku Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Nishoku Technology's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Nishoku Technology revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Nishoku Technology (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Nishoku Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nishoku Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3679

Nishoku Technology

Designs and manufactures plastic injection molds in Taiwan, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives