In a week marked by volatility, U.S. stocks mostly ended lower, with the Nasdaq Composite particularly impacted by competitive concerns in the AI sector and ongoing tariff risks influencing market sentiment. Despite these challenges, certain small-cap stocks remain attractive due to their potential for growth and resilience amid economic fluctuations. Identifying promising stocks often involves looking beyond immediate market turbulence to find companies with strong fundamentals and innovative capabilities that can thrive in diverse conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hennge K.K (TSE:4475)

Simply Wall St Value Rating: ★★★★★★

Overview: Hennge K.K. offers cloud security services globally and has a market capitalization of ¥47.88 billion.

Operations: The primary revenue stream for Hennge K.K. is its Security Software & Services segment, generating ¥8.36 billion.

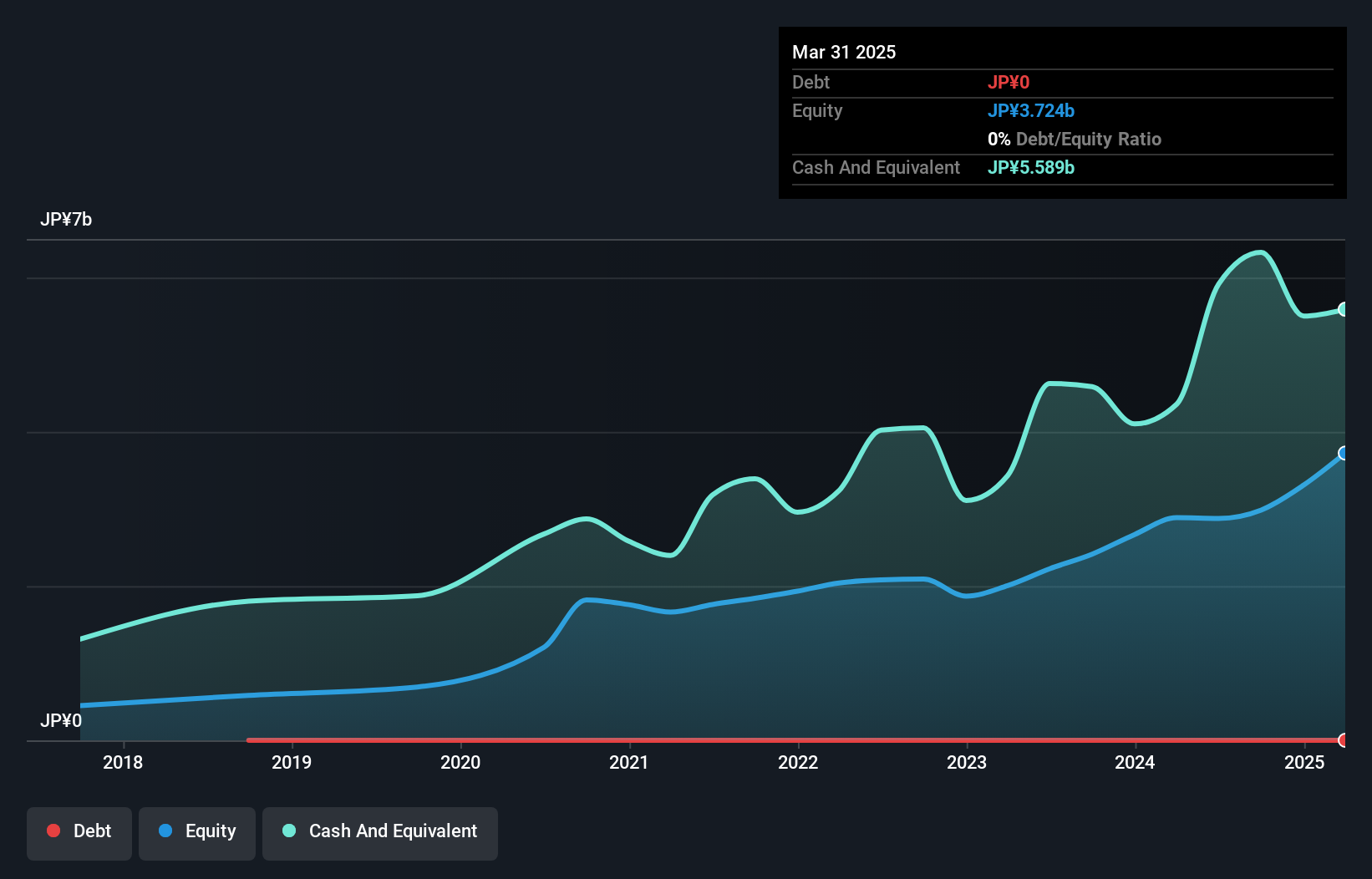

Hennge K.K. stands out with impressive earnings growth of 62.8% over the past year, far surpassing the IT industry's 10.9%. This debt-free company has consistently maintained a stable financial position for five years, enhancing its appeal by trading at 33.4% below estimated fair value. Despite recent share price volatility, Hennge's high-quality earnings and positive free cash flow reflect robust operational health. Looking forward, the firm projects net sales of ¥10,441 million and an operating profit of ¥1,574 million for fiscal year ending September 2025, alongside a dividend increase to ¥4 per share from last year's ¥3 per share.

- Get an in-depth perspective on Hennge K.K's performance by reading our health report here.

Understand Hennge K.K's track record by examining our Past report.

Future (TSE:4722)

Simply Wall St Value Rating: ★★★★★☆

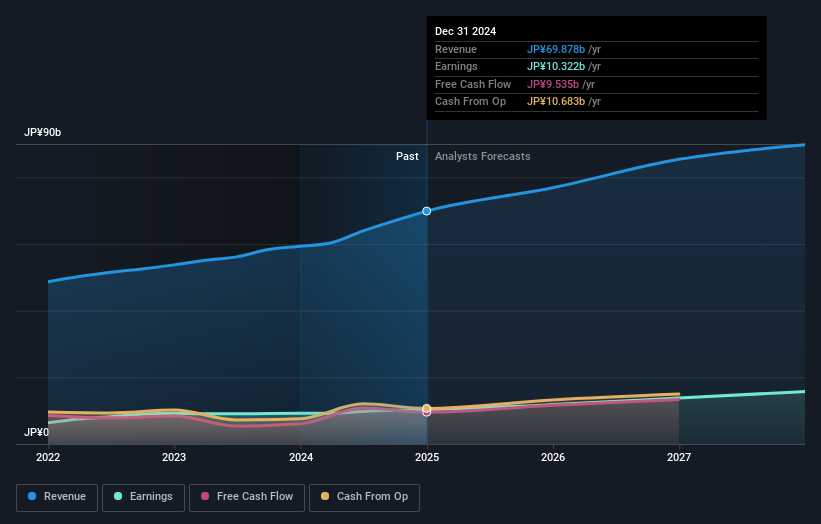

Overview: Future Corporation offers IT consulting and services mainly in Japan, with a market capitalization of approximately ¥173.18 billion.

Operations: The company's revenue is primarily derived from IT consulting and services. The net profit margin has shown variability, reflecting shifts in operational efficiency and cost management.

Future is carving out its niche with high-quality earnings and a solid financial footing. Trading at 36.4% below its estimated fair value, it offers an attractive proposition compared to peers in the industry. The company's debt-to-equity ratio climbed from 0.07% to 32.2% over five years, yet it holds more cash than total debt, indicating sound financial management. With earnings growth of 11.9% last year surpassing the IT industry's average of 10.9%, Future's trajectory seems promising, especially with forecasts suggesting a growth rate of 13.89% annually moving forward into this dynamic sector landscape.

- Click to explore a detailed breakdown of our findings in Future's health report.

Evaluate Future's historical performance by accessing our past performance report.

Shin Zu Shing (TWSE:3376)

Simply Wall St Value Rating: ★★★★☆☆

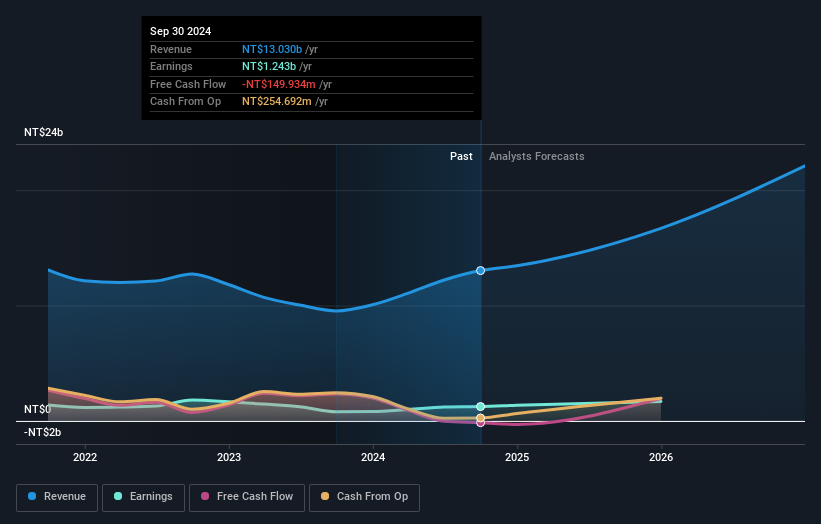

Overview: Shin Zu Shing Co., Ltd. focuses on the research, design, development, production, assembly, testing, manufacturing, and trading of precision springs and related components in Taiwan, Singapore, and China with a market cap of NT$46.39 billion.

Operations: The company generates revenue primarily from pivot products, which account for NT$12.49 billion, followed by MIM products at NT$277.31 million. The focus on these segments highlights their significant contribution to the company's overall financial performance.

Shin Zu Shing, a smaller player in its field, has shown impressive earnings growth of 58.5% over the past year, outpacing the Machinery industry's 14.6%. The company boasts high-quality earnings and enjoys a robust financial position with more cash than total debt. Despite this strength, its share price has been quite volatile recently. A recent adjustment in rental agreements for their business premises reflects strategic operational decisions. With earnings forecasted to grow at 24.49% annually, Shin Zu Shing's future looks promising amidst industry challenges and opportunities for expansion within its niche market segment.

- Navigate through the intricacies of Shin Zu Shing with our comprehensive health report here.

Explore historical data to track Shin Zu Shing's performance over time in our Past section.

Key Takeaways

- Navigate through the entire inventory of 4710 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4722

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion