- Taiwan

- /

- Electrical

- /

- TWSE:3308

Bestec Power Electronics Co., Ltd. (TWSE:3308) Stocks Pounded By 33% But Not Lagging Industry On Growth Or Pricing

The Bestec Power Electronics Co., Ltd. (TWSE:3308) share price has fared very poorly over the last month, falling by a substantial 33%. Looking at the bigger picture, even after this poor month the stock is up 37% in the last year.

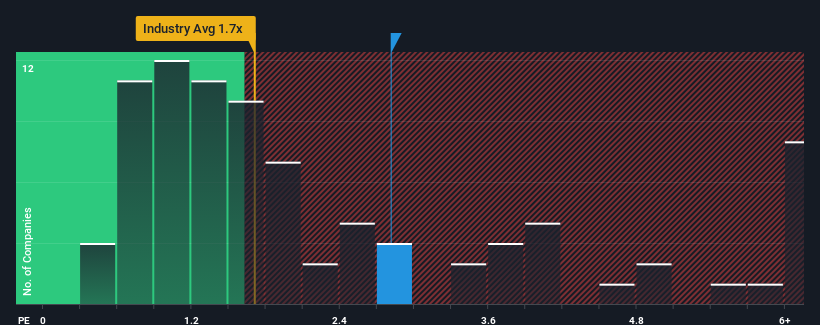

In spite of the heavy fall in price, given close to half the companies operating in Taiwan's Electrical industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider Bestec Power Electronics as a stock to potentially avoid with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Bestec Power Electronics

How Bestec Power Electronics Has Been Performing

Bestec Power Electronics certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Bestec Power Electronics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Bestec Power Electronics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. The strong recent performance means it was also able to grow revenue by 63% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 15% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Bestec Power Electronics' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Bestec Power Electronics' P/S?

Despite the recent share price weakness, Bestec Power Electronics' P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Bestec Power Electronics can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Bestec Power Electronics (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Bestec Power Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bestec Power Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3308

Bestec Power Electronics

Engages in the design, fabrication, marketing, and sale of switching power supply products worldwide.

Slight with mediocre balance sheet.

Market Insights

Community Narratives