- Taiwan

- /

- Real Estate

- /

- TWSE:6177

3 Global Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape of easing trade tensions and mixed economic signals, investors are witnessing a positive momentum in major indices like the S&P 500 and Nasdaq Composite. Amidst these developments, dividend stocks emerge as attractive options for those seeking steady income streams, particularly in times of economic uncertainty where consistent payouts can provide financial stability.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1561 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Taisun Enterprise (TWSE:1218)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taisun Enterprise Co., Ltd. operates in Taiwan, focusing on the processing, manufacturing, wholesaling, and retailing of oil, food and beverages, and flour products with a market cap of NT$10.12 billion.

Operations: Taisun Enterprise Co., Ltd.'s revenue is primarily derived from its Consumer Business Segment at NT$6.39 billion, followed by the Bulk/Staple Business Division at NT$3.13 billion, and the Foreign Business Division contributing NT$698.38 million.

Dividend Yield: 6%

Taisun Enterprise's dividend payments are covered by both earnings and cash flows, with a payout ratio of 88.4% and a cash payout ratio of 57%. However, the dividends have been unstable over the past four years, showing volatility and declining payments. Despite trading significantly below its estimated fair value, recent legal issues and regulatory actions could impact investor sentiment. The company has returned to profitability this year with net income of TWD 742.41 million but faces challenges in maintaining reliable dividend growth.

- Click here to discover the nuances of Taisun Enterprise with our detailed analytical dividend report.

- The analysis detailed in our Taisun Enterprise valuation report hints at an deflated share price compared to its estimated value.

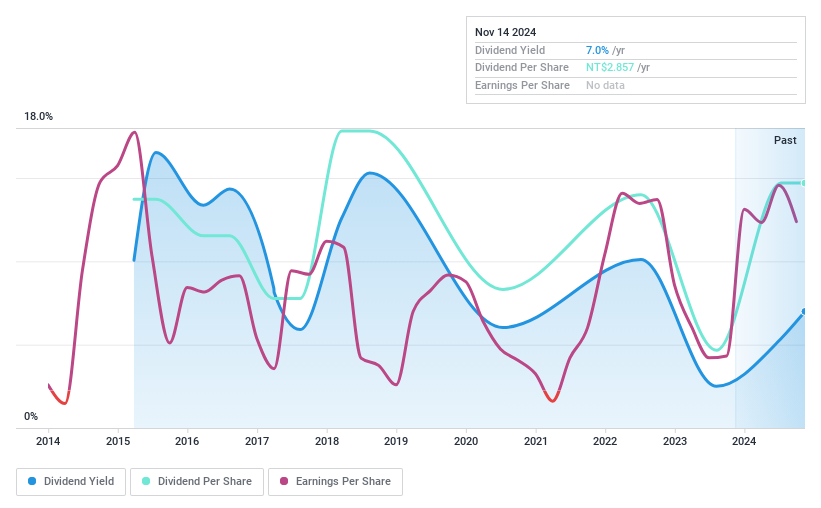

Da-Cin ConstructionLtd (TWSE:2535)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Da-Cin Construction Co., Ltd. operates in civil engineering and building construction across Taiwan, Singapore, Malaysia, and Vietnam with a market capitalization of NT$15.07 billion.

Operations: Da-Cin Construction Co., Ltd.'s revenue is primarily derived from its Engineering Department, contributing NT$14.51 billion, and its Construction Sector, which adds NT$713.85 million.

Dividend Yield: 6.3%

Da-Cin Construction's dividend yield of 6.28% ranks in the top 25% of the TW market, but its sustainability is questionable due to lack of free cash flow coverage and volatility over the past decade. Despite a reasonable payout ratio of 72%, dividends have been unreliable, though they have grown recently. Earnings increased by TWD 165.92 million last year, supporting dividend payments; however, high non-cash earnings could affect future reliability.

- Take a closer look at Da-Cin ConstructionLtd's potential here in our dividend report.

- Our valuation report here indicates Da-Cin ConstructionLtd may be undervalued.

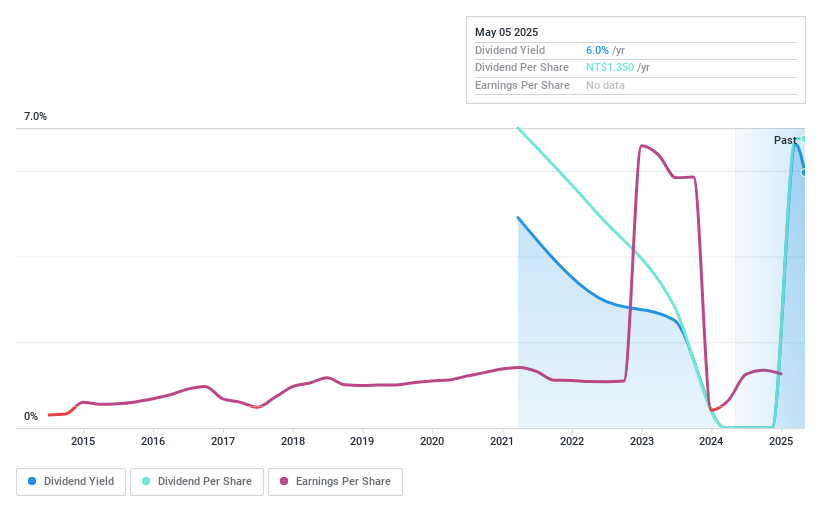

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Da-Li Development Co., Ltd. and its subsidiaries engage in the construction business in Taiwan and the United States, with a market cap of NT$21.01 billion.

Operations: Da-Li Development Co., Ltd. generates its revenue primarily from its Construction Segment with NT$4.46 billion and Construction Department with NT$11.40 billion.

Dividend Yield: 5.6%

Da-Li Development's dividend yield of 5.56% is among the top 25% in the TW market, yet its sustainability is challenged by lack of free cash flow coverage and historical volatility. Despite a reasonable payout ratio of 63.5%, dividends remain unreliable and not fully covered by earnings or cash flows. Recent earnings growth supports payouts, but debt coverage issues persist. The company's selection for a significant urban renewal project may influence future financial stability and dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Da-Li DevelopmentLtd.

- Our valuation report unveils the possibility Da-Li DevelopmentLtd's shares may be trading at a premium.

Seize The Opportunity

- Click here to access our complete index of 1561 Top Global Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Da-Li DevelopmentLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6177

Da-Li DevelopmentLtd

Together its subsidiaries, operates construction business in Taiwan and the United States.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives