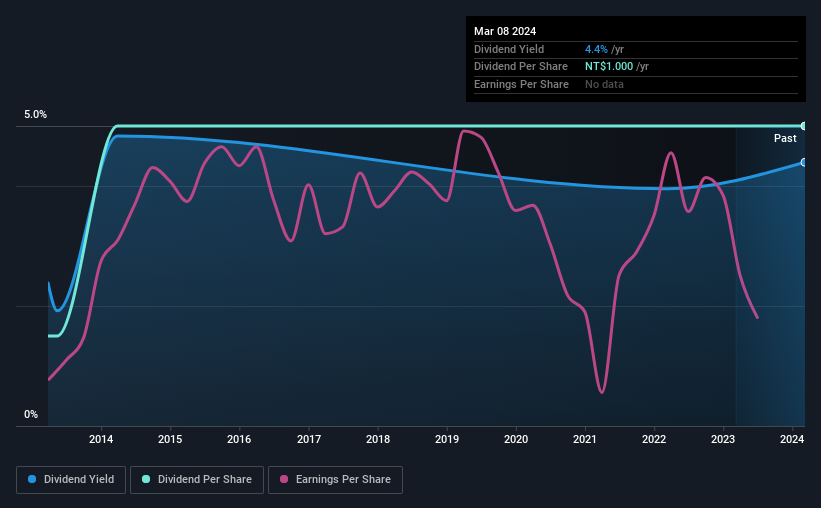

The board of Excel Cell Electronic Co., Ltd. (TWSE:2483) has announced that the dividend on 2nd of May will be reduced by 70% from last year's NT$1.00 to NT$0.30. The yield is still above the industry average at 4.4%.

Check out our latest analysis for Excel Cell Electronic

Excel Cell Electronic's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Excel Cell Electronic was earning enough to cover the dividend, but it wasn't generating any free cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

EPS is set to fall by 15.6% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 15%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Excel Cell Electronic Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2014, the dividend has gone from NT$0.30 total annually to NT$1.00. This implies that the company grew its distributions at a yearly rate of about 13% over that duration. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Excel Cell Electronic's earnings per share has shrunk at 16% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Our Thoughts On Excel Cell Electronic's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While Excel Cell Electronic is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 6 warning signs for Excel Cell Electronic you should be aware of, and 1 of them can't be ignored. Is Excel Cell Electronic not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Excel Cell Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2483

Excel Cell Electronic

Manufactures and supplies electronic components in Taiwan, Asia, Europe, the United States, and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026