Fewer Investors Than Expected Jumping On Sunonwealth Electric Machine Industry Co., Ltd. (TWSE:2421)

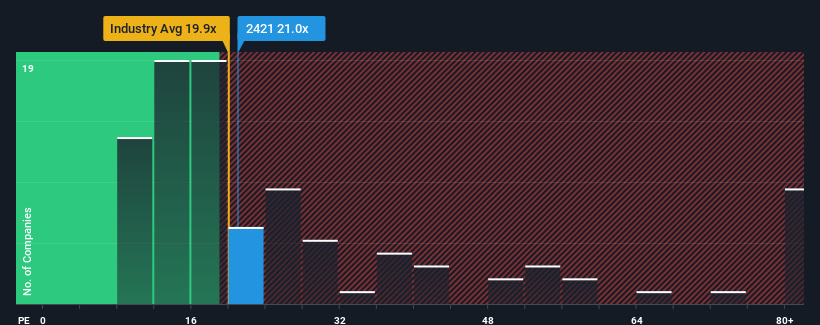

With a median price-to-earnings (or "P/E") ratio of close to 21x in Taiwan, you could be forgiven for feeling indifferent about Sunonwealth Electric Machine Industry Co., Ltd.'s (TWSE:2421) P/E ratio of 21x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Sunonwealth Electric Machine Industry could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Sunonwealth Electric Machine Industry

Is There Some Growth For Sunonwealth Electric Machine Industry?

The only time you'd be comfortable seeing a P/E like Sunonwealth Electric Machine Industry's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.0%. Still, the latest three year period has seen an excellent 121% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 22% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 17% per annum, which is noticeably less attractive.

In light of this, it's curious that Sunonwealth Electric Machine Industry's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Sunonwealth Electric Machine Industry's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Sunonwealth Electric Machine Industry that you should be aware of.

Of course, you might also be able to find a better stock than Sunonwealth Electric Machine Industry. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Sunonwealth Electric Machine Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2421

Sunonwealth Electric Machine Industry

Manufactures and sells precision motors and thermal solutions worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives