Rongcheer Industrial Technology (Suzhou) And 2 Other Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience, with the S&P 500 Index experiencing only a slight decline despite broader market pressures. As investors navigate these complex conditions, identifying promising small-cap stocks becomes crucial for those looking to diversify their portfolios amidst fluctuating indices and economic indicators. In this context, Rongcheer Industrial Technology (Suzhou) and two other lesser-known companies emerge as potential opportunities worth exploring for their unique strengths and growth prospects in an unpredictable market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NPR-Riken | 12.24% | 14.08% | 50.12% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| Uoriki | NA | 3.85% | 9.40% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.11% | 0.82% | 7.95% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Rongcheer Industrial Technology (Suzhou) (SZSE:301360)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rongcheer Industrial Technology (Suzhou) Co., Ltd. is a company engaged in the development and manufacturing of electronic test and measurement instruments, with a market capitalization of CN¥2.87 billion.

Operations: Rongcheer Industrial Technology generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥369.29 million.

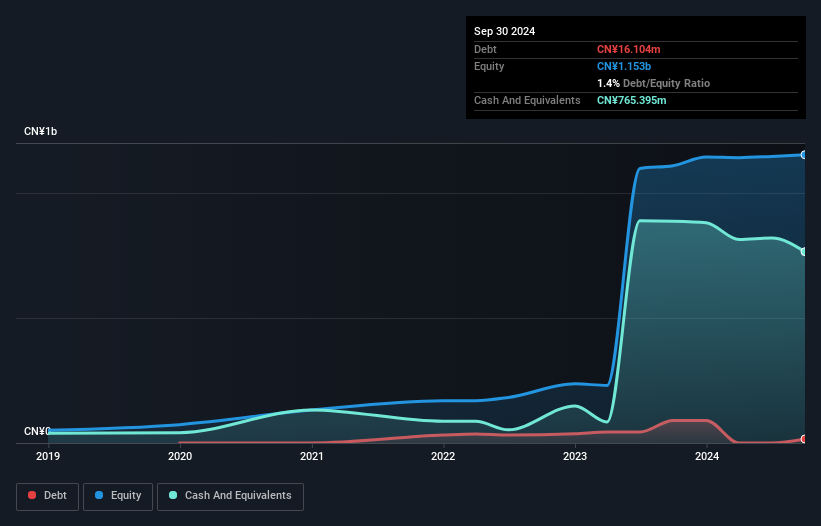

Rongcheer Industrial Technology, a smaller player in the machinery sector, has outpaced its industry with a notable 21% earnings growth over the past year. Despite an increase in its debt to equity ratio from 0% to 1.4% over five years, the company holds more cash than total debt, suggesting financial stability. However, it struggles with negative free cash flow and high non-cash earnings levels. Capital expenditures have been significant, reaching US$39 million recently, which might impact liquidity but could also indicate investment in future growth opportunities within its niche market.

JirFine Intelligent Equipment (SZSE:301603)

Simply Wall St Value Rating: ★★★★☆☆

Overview: JirFine Intelligent Equipment Co., Ltd. focuses on the research and development, production, and sale of CNC machine tools, with a market cap of CN¥5.31 billion.

Operations: JirFine's revenue is primarily driven by the sale of CNC machine tools. The company has experienced a net profit margin of 12.5% in recent periods, reflecting its ability to manage costs and optimize profitability.

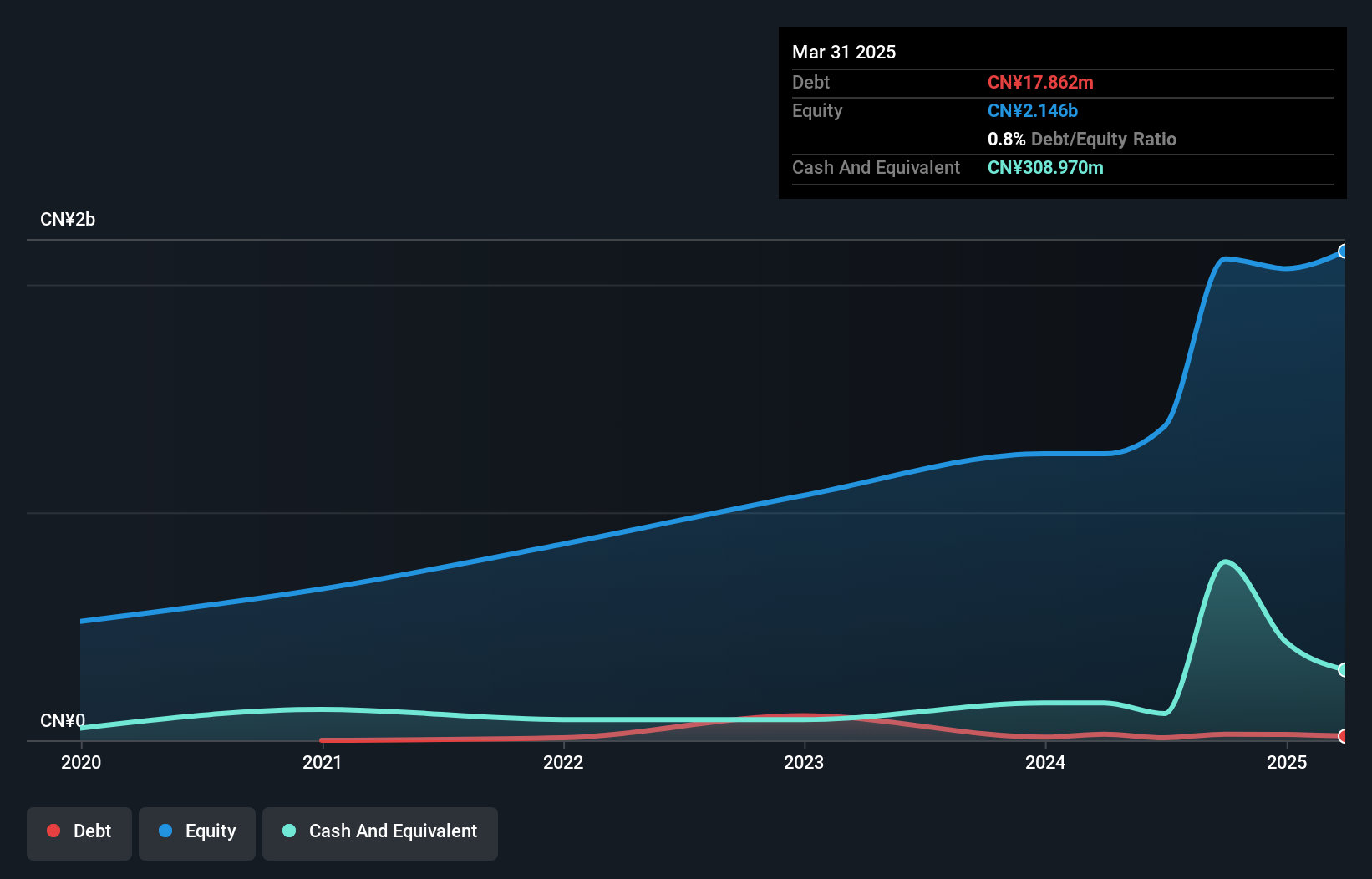

JirFine Intelligent Equipment, a promising player in the machinery sector, recently joined the S&P Global BMI Index. With a Price-to-Earnings ratio of 26.9x, it stands as an attractive value compared to the broader CN market's 36.7x. The company boasts a robust earnings growth of 14% over the past year, outpacing its industry average significantly. Despite not being free cash flow positive currently, JirFine's high level of non-cash earnings and more cash than total debt indicate financial resilience. This blend of factors suggests potential for future performance amidst ongoing industry challenges.

TURVO International (TWSE:2233)

Simply Wall St Value Rating: ★★★★★☆

Overview: TURVO International Co., Ltd. focuses on the development, production, and sale of precision metal parts and components with a market capitalization of NT$14.29 billion.

Operations: TURVO International generates revenue primarily from its China and Taiwan segments, with the China segment contributing NT$2.66 billion and the Taiwan segment adding NT$1.81 billion.

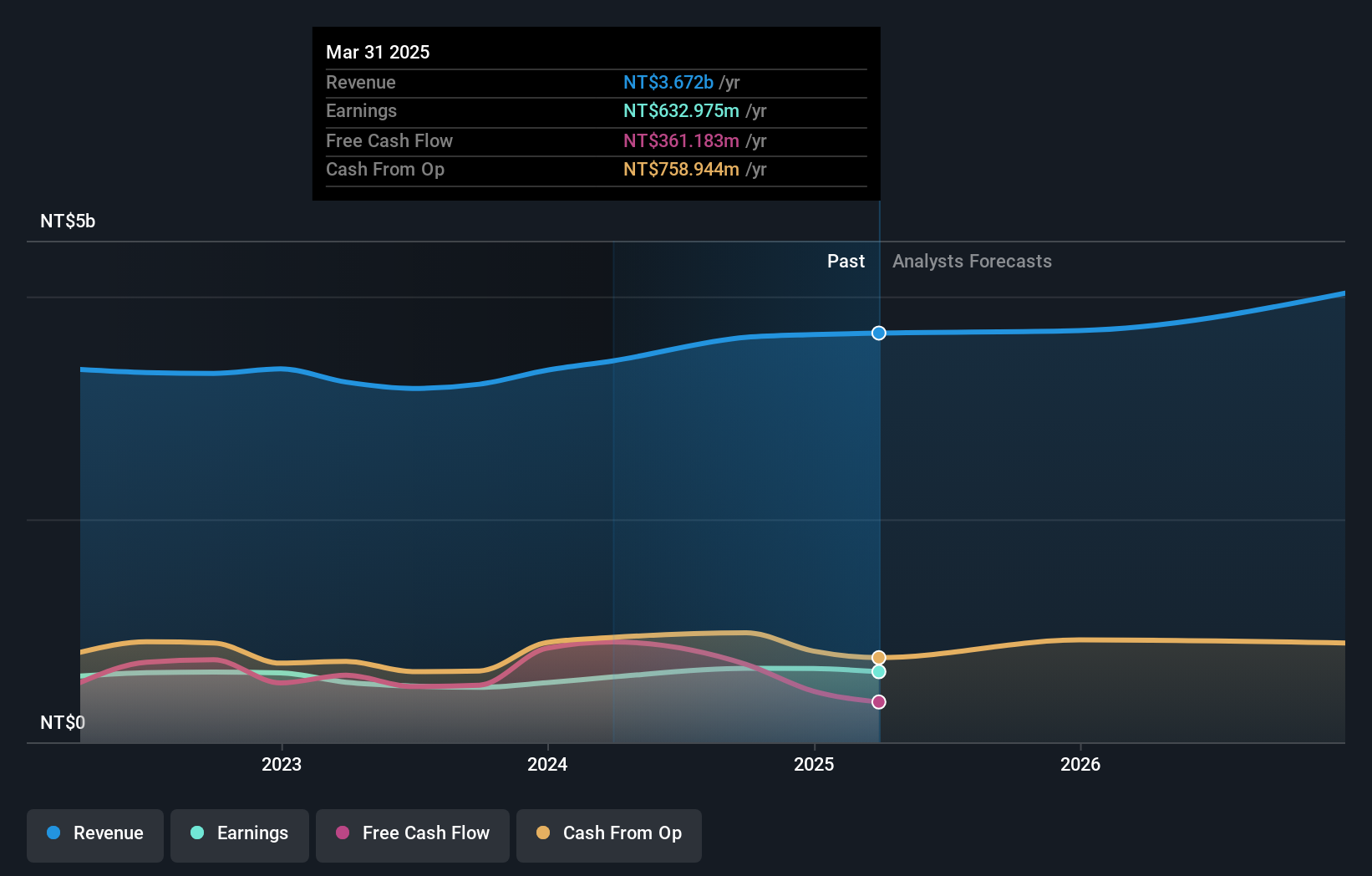

TURVO International, a nimble player in its field, has shown impressive earnings growth of 35% over the past year, outpacing the Machinery industry's 14.6%. The company reported third-quarter sales of TWD 964 million and net income of TWD 187.36 million, up from TWD 897.52 million and TWD 155.37 million respectively a year ago. Its net debt to equity ratio stands at a satisfactory 0.2%, indicating sound financial health. Despite some share price volatility recently, TURVO's high-quality earnings and free cash flow positivity suggest it remains an intriguing prospect for investors seeking value below fair market estimates by around 14%.

- Click to explore a detailed breakdown of our findings in TURVO International's health report.

Understand TURVO International's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 4698 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301603

JirFine Intelligent Equipment

Engages in the research and development, production, and sale of CNC machine tools.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives