- Taiwan

- /

- Electrical

- /

- TWSE:1616

Further Upside For Evertop Wire Cable Corporation (TWSE:1616) Shares Could Introduce Price Risks After 26% Bounce

Evertop Wire Cable Corporation (TWSE:1616) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 189% following the latest surge, making investors sit up and take notice.

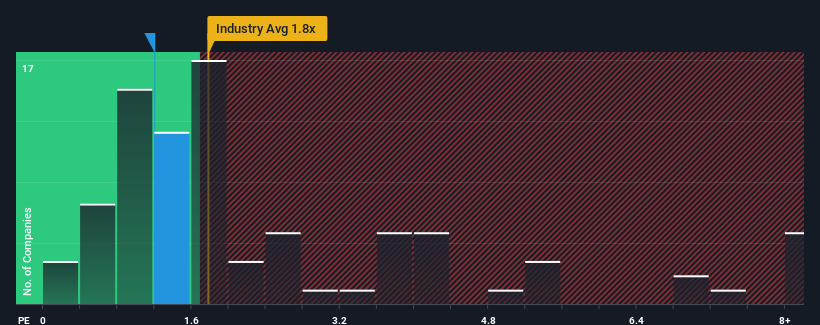

Although its price has surged higher, Evertop Wire Cable may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Electrical industry in Taiwan have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Evertop Wire Cable

How Evertop Wire Cable Has Been Performing

Revenue has risen firmly for Evertop Wire Cable recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Evertop Wire Cable will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Evertop Wire Cable will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Evertop Wire Cable?

The only time you'd be truly comfortable seeing a P/S as low as Evertop Wire Cable's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen an excellent 53% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's about the same on an annualised basis.

With this information, we find it odd that Evertop Wire Cable is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Despite Evertop Wire Cable's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Evertop Wire Cable revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You always need to take note of risks, for example - Evertop Wire Cable has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Evertop Wire Cable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1616

Evertop Wire Cable

Engages in the research and development, manufacture, and sale of wires and cables in Taiwan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives