- Taiwan

- /

- Electrical

- /

- TWSE:1514

3 Global Growth Companies With High Insider Ownership Seeing Up To 34% Revenue Growth

Reviewed by Simply Wall St

Amid a backdrop of easing trade tensions and better-than-expected earnings, global markets have shown resilience, with U.S. stocks climbing and European indices experiencing notable gains. As investors navigate this landscape of cautious optimism, companies demonstrating robust revenue growth coupled with high insider ownership can present compelling opportunities for those seeking to align interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Bethel Automotive Safety Systems (SHSE:603596) | 20.2% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Let's dive into some prime choices out of the screener.

Shanghai Runda Medical Technology (SHSE:603108)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Runda Medical Technology Co., Ltd. operates in the medical technology sector, focusing on providing diagnostic products and services, with a market cap of CN¥10.94 billion.

Operations: Shanghai Runda Medical Technology Co., Ltd. generates its revenue primarily from its diagnostic products and services in the medical technology sector.

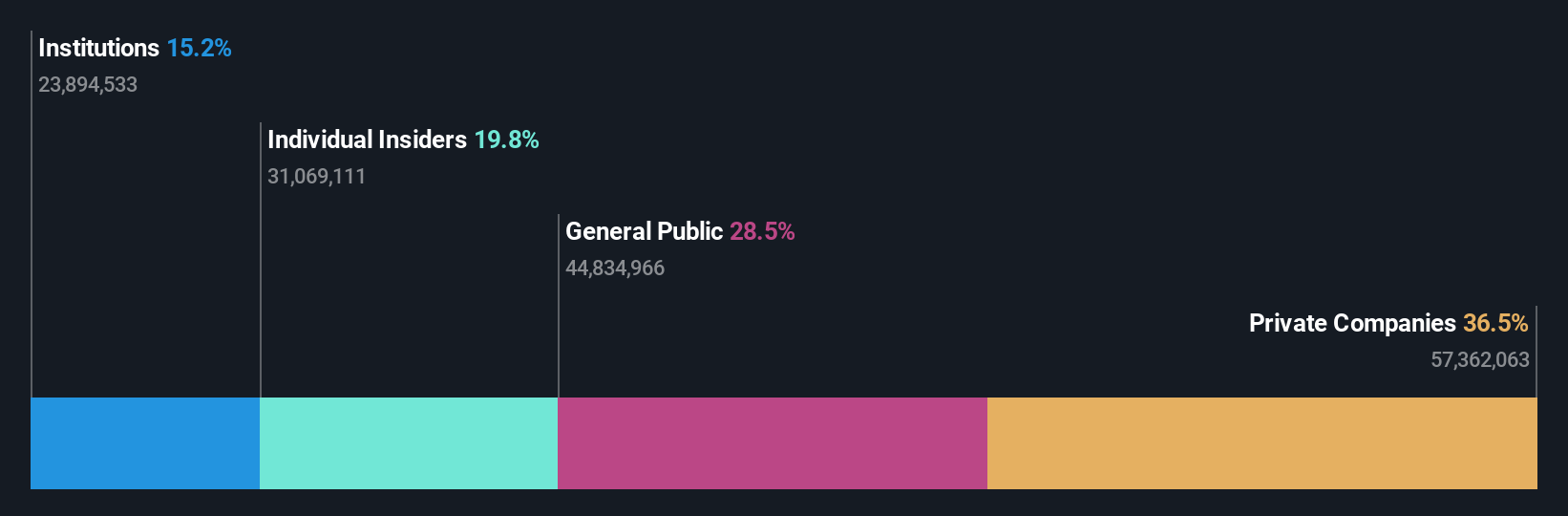

Insider Ownership: 16%

Revenue Growth Forecast: 19.6% p.a.

Shanghai Runda Medical Technology's recent earnings report showed a challenging first quarter with sales of CNY 1.66 billion and a net loss of CNY 69.26 million, contrasting with profits from the previous year. Despite this, the company is forecast to grow earnings by 97.45% annually and is expected to achieve profitability within three years, outpacing market growth rates. However, its financial position is strained as debt isn't well covered by operating cash flow, and share price volatility remains high.

- Click here to discover the nuances of Shanghai Runda Medical Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Shanghai Runda Medical Technology implies its share price may be lower than expected.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. (SHSE:688205) operates in the optoelectronics industry, focusing on the development and production of optical communication devices, with a market cap of CN¥7.22 billion.

Operations: Wuxi Taclink Optoelectronics Technology Co., Ltd. generates its revenue from the development and production of optical communication devices within the optoelectronics sector.

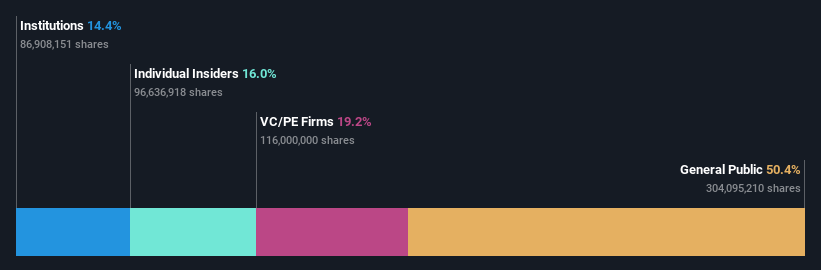

Insider Ownership: 19.8%

Revenue Growth Forecast: 34.6% p.a.

Wuxi Taclink Optoelectronics Technology's recent earnings report revealed a decline in net income to CNY 14.54 million for Q1 2025, despite revenue growth to CNY 198.83 million. The company is forecasted to achieve significant annual earnings growth of 44.7%, outpacing the CN market's average and indicating robust future prospects, although its share price has been highly volatile recently. Insider trading activity over the past three months shows no substantial buying or selling.

- Dive into the specifics of Wuxi Taclink Optoelectronics Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Wuxi Taclink Optoelectronics Technology shares in the market.

Allis ElectricLtd (TWSE:1514)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allis Electric Co., Ltd. develops, produces, and sells transformers, switching devices, and electronic products worldwide with a market cap of NT$26.81 billion.

Operations: The company's revenue is primarily derived from its Electronics Sector (NT$2.43 billion), Switchboard Department (NT$2.38 billion), Construction Division (NT$1.72 billion), Transformer Department (NT$1.07 billion), and Motor Devices Division (NT$1.00 billion).

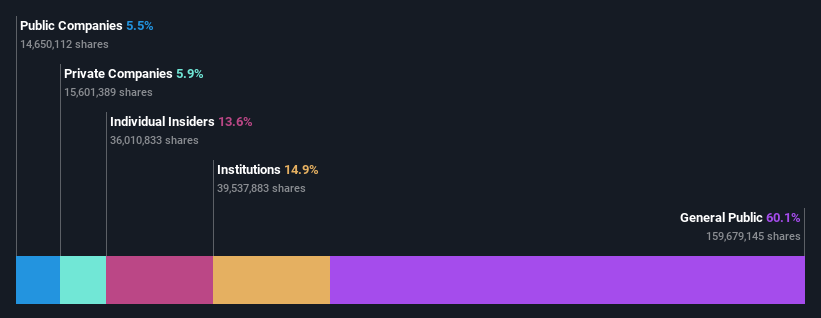

Insider Ownership: 13.6%

Revenue Growth Forecast: 16.5% p.a.

Allis Electric Ltd. has demonstrated steady earnings growth of 24.1% annually over the past five years, with future earnings projected to grow significantly at 21.84% per year, surpassing the TW market average. Despite a decline in sales to TWD 8.88 billion for 2024, net income increased slightly to TWD 801.22 million, reflecting operational resilience. No substantial insider trading activity was reported recently, and changes in company bylaws are under consideration for June 2025.

- Navigate through the intricacies of Allis ElectricLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Allis ElectricLtd's share price might be on the expensive side.

Where To Now?

- Get an in-depth perspective on all 851 Fast Growing Global Companies With High Insider Ownership by using our screener here.

- Looking For Alternative Opportunities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1514

Allis ElectricLtd

Develops, produces, and sells transformers, switching devices, and electronic products worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives