- Taiwan

- /

- Trade Distributors

- /

- TWSE:6192

Lumax International Corp., Ltd.'s (TPE:6192) Has Had A Decent Run On The Stock market: Are Fundamentals In The Driver's Seat?

Most readers would already know that Lumax International's (TPE:6192) stock increased by 2.4% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. In this article, we decided to focus on Lumax International's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Lumax International

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Lumax International is:

13% = NT$635m ÷ NT$5.0b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.13.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Lumax International's Earnings Growth And 13% ROE

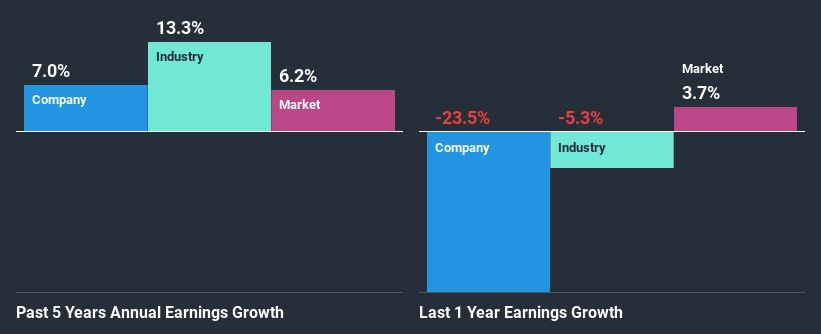

At first glance, Lumax International seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 10%. This probably laid the ground for Lumax International's moderate 7.0% net income growth seen over the past five years.

Next, on comparing with the industry net income growth, we found that Lumax International's reported growth was lower than the industry growth of 13% in the same period, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Lumax International's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Lumax International Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 51% (or a retention ratio of 49%) for Lumax International suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Moreover, Lumax International is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

In total, it does look like Lumax International has some positive aspects to its business. The company has grown its earnings moderately as previously discussed. Still, the high ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be quite low. Up till now, we've only made a short study of the company's growth data. To gain further insights into Lumax International's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade Lumax International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6192

Lumax International

Provides electronic components and program-controlled instruments in Taiwan and China.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives