If you're looking at a mature business that's past the growth phase, what are some of the underlying trends that pop up? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. So after we looked into Well Shin Technology (TPE:3501), the trends above didn't look too great.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Well Shin Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.092 = NT$580m ÷ (NT$7.5b - NT$1.2b) (Based on the trailing twelve months to September 2020).

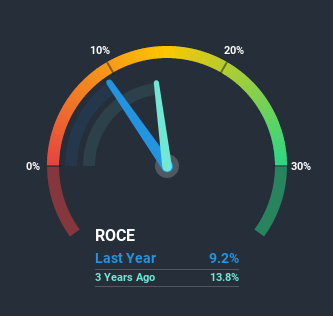

So, Well Shin Technology has an ROCE of 9.2%. In absolute terms, that's a low return, but it's much better than the Electrical industry average of 7.1%.

Check out our latest analysis for Well Shin Technology

In the above chart we have measured Well Shin Technology's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Well Shin Technology.

The Trend Of ROCE

There is reason to be cautious about Well Shin Technology, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 12% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Well Shin Technology becoming one if things continue as they have.

The Bottom Line On Well Shin Technology's ROCE

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Investors must expect better things on the horizon though because the stock has risen 32% in the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

Well Shin Technology does have some risks though, and we've spotted 1 warning sign for Well Shin Technology that you might be interested in.

While Well Shin Technology may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Well Shin Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Well Shin Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:3501

Well Shin Technology

Engages in the manufacture, wholesale, and retail of wire and cable products, electronic components, and electronic materials in Asia, the United States, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives