- Taiwan

- /

- Electrical

- /

- TWSE:3296

Powertech Industrial (TPE:3296) Shareholders Booked A 12% Gain In The Last Five Years

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Powertech Industrial Co., Ltd. (TPE:3296) share price is up 12% in the last five years, that's less than the market return. The last year has been disappointing, with the stock price down 0.7% in that time.

Check out our latest analysis for Powertech Industrial

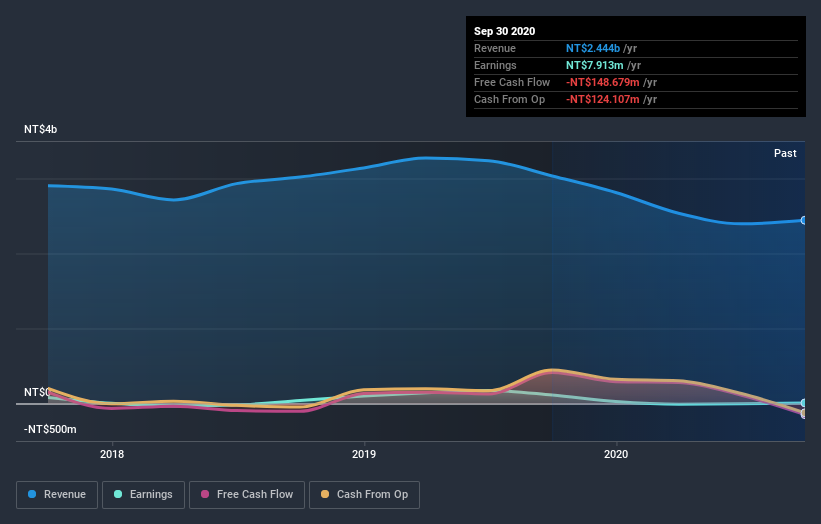

We don't think that Powertech Industrial's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Powertech Industrial's revenue has actually been trending down at about 0.5% per year. The stock is only up 2% for each year during the period. Arguably that's not bad given the soft revenue and loss-making position. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Powertech Industrial stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Powertech Industrial, it has a TSR of 31% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Powertech Industrial provided a TSR of 1.4% over the last twelve months. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 6% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Powertech Industrial you should be aware of, and 2 of them are concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Powertech Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:3296

Powertech Industrial

Powertech Industrial Co., Ltd., together with its subsidiaries, manufacture and sell electronic circuit power protection and smart home wireless remote control devices, wired and wireless communication equipment, and electronic modules and parts.

Mediocre balance sheet low.

Market Insights

Community Narratives