Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that New Asia Construction & Development Corp. (TPE:2516) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View 2 warning signs we detected for New Asia Construction & Development

How Much Debt Does New Asia Construction & Development Carry?

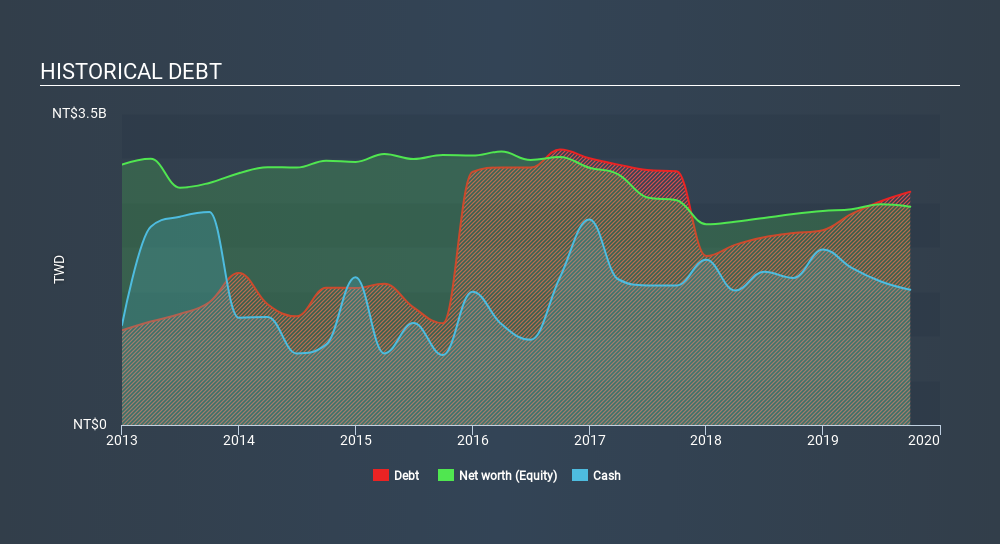

You can click the graphic below for the historical numbers, but it shows that as of September 2019 New Asia Construction & Development had NT$2.62b of debt, an increase on NT$2.2k, over one year. On the flip side, it has NT$1.52b in cash leading to net debt of about NT$1.10b.

How Healthy Is New Asia Construction & Development's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that New Asia Construction & Development had liabilities of NT$5.99b due within 12 months and liabilities of NT$154.5m due beyond that. Offsetting this, it had NT$1.52b in cash and NT$2.84b in receivables that were due within 12 months. So its liabilities total NT$1.79b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's NT$1.36b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since New Asia Construction & Development will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year New Asia Construction & Development wasn't profitable at an EBIT level, but managed to grow its revenue by 2.4%, to NT$7.6b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, New Asia Construction & Development had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at NT$24m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through NT$350m in negative free cash flow over the last year. That means it's on the risky side of things. For riskier companies like New Asia Construction & Development I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:2516

New Asia Construction & Development

Provides public construction services for governments in Taiwan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives