- Taiwan

- /

- Trade Distributors

- /

- TPEX:8415

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, with notable fluctuations in sectors such as financials and energy, investors are keenly observing how these dynamics may affect corporate earnings. Amidst this backdrop of policy shifts and economic indicators like inflation trends and interest rate expectations, dividend stocks continue to attract attention for their potential to provide steady income streams. In light of these market conditions, identifying strong dividend stocks involves evaluating companies with stable earnings, a history of consistent payouts, and resilience in diverse economic climates.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.68% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.52% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

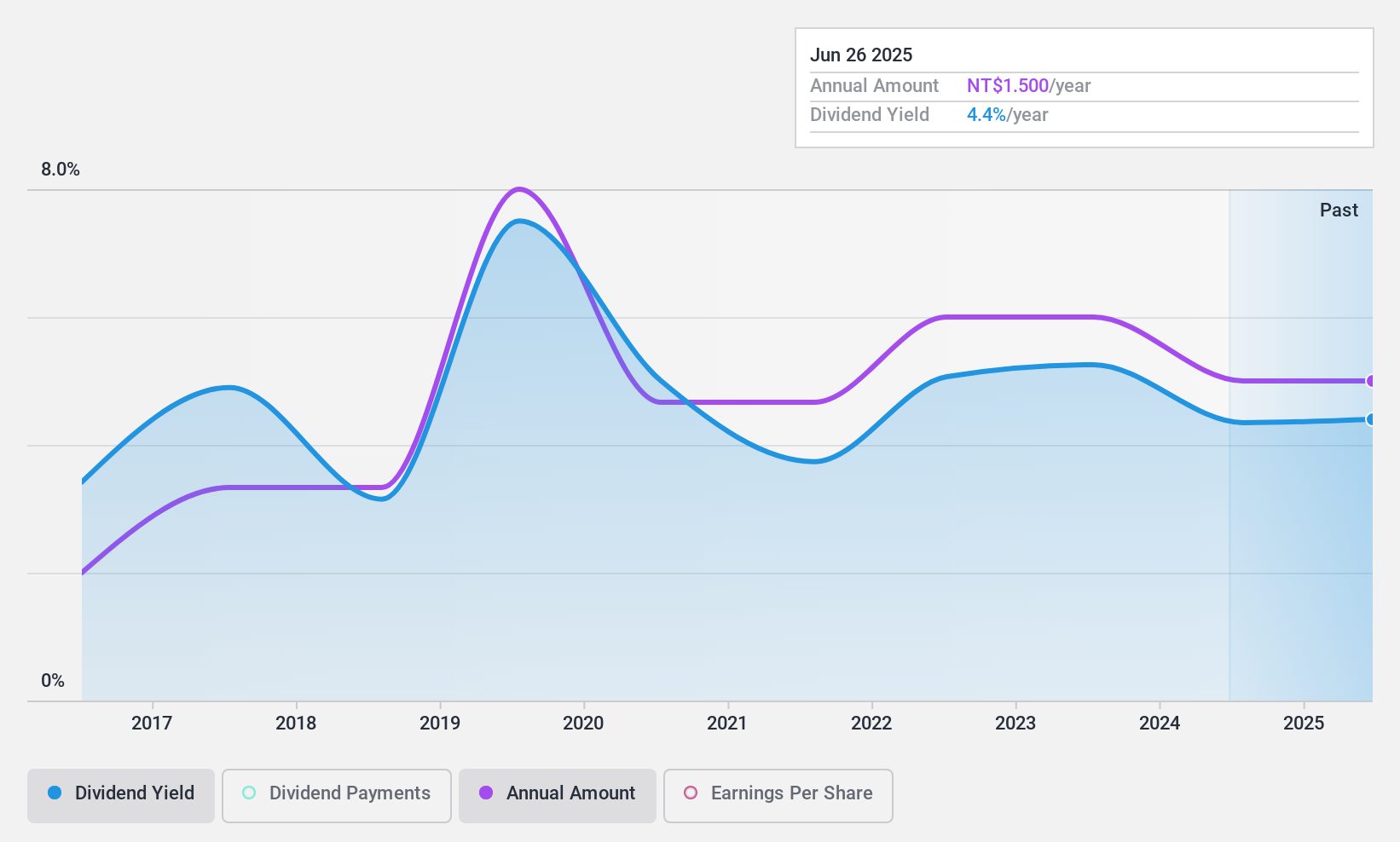

Brighton-Best International (Taiwan) (TPEX:8415)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brighton-Best International (Taiwan) Inc., with a market cap of NT$36.10 billion, is engaged in the distribution and supply of fasteners and related components.

Operations: Brighton-Best International (Taiwan) Inc. generates its revenue primarily through the distribution and supply of fasteners and related components.

Dividend Yield: 4.2%

Brighton-Best International (Taiwan) offers a mixed dividend profile. Despite a reasonable payout ratio of 65.3% and cash payout ratio of 34.7%, indicating dividends are covered by earnings and cash flows, the company's dividend history is unstable with volatility over the past decade. Recent earnings show a decline, with Q3 net income at TWD 872.42 million compared to TWD 1,296.44 million last year, which may impact future dividend reliability despite past increases in payments over ten years.

- Click to explore a detailed breakdown of our findings in Brighton-Best International (Taiwan)'s dividend report.

- Our expertly prepared valuation report Brighton-Best International (Taiwan) implies its share price may be lower than expected.

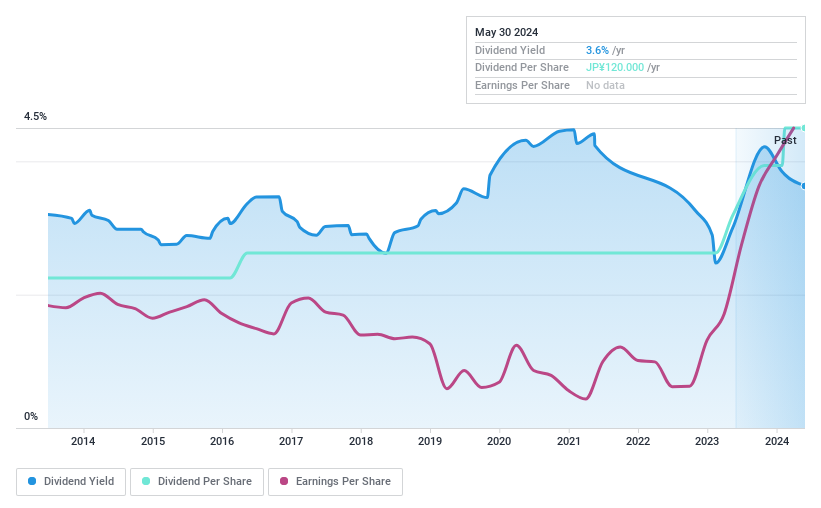

Mars Group Holdings (TSE:6419)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mars Group Holdings Corporation, along with its subsidiaries, operates in the amusement, automatic recognition system, and hotel and restaurant sectors in Japan with a market cap of ¥59.95 billion.

Operations: Mars Group Holdings Corporation generates revenue through its amusement segment (¥37.59 billion), smart solution related business (¥5.34 billion), and hotel/restaurant related business (¥2.48 billion).

Dividend Yield: 6%

Mars Group Holdings offers a compelling dividend profile with a high yield of 6%, ranking in the top 25% of Japan's market. Over the past decade, dividends have grown steadily and remained stable, supported by a low payout ratio of 40.2% and cash payout ratio of 47.3%. Recent guidance indicates strong financial performance with expected net sales of ¥41.8 billion and profit attributable to owners at ¥8.2 billion, further bolstering dividend sustainability.

- Navigate through the intricacies of Mars Group Holdings with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Mars Group Holdings is trading behind its estimated value.

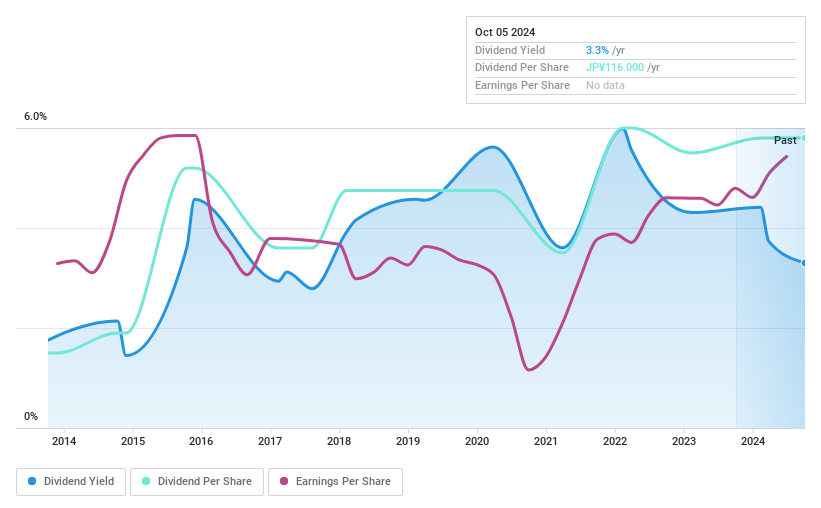

Chiyoda IntegreLtd (TSE:6915)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chiyoda Integre Co., Ltd. manufactures and sells structural and functional parts for various products both in Japan and internationally, with a market cap of ¥35.20 billion.

Operations: Chiyoda Integre Co., Ltd.'s revenue segments include ¥12.75 billion from China, ¥14.34 billion from Japan, and ¥14.54 billion from Southeast Asia.

Dividend Yield: 3.4%

Chiyoda Integre Ltd. has a history of volatile dividend payments over the past decade, despite recent growth. Its dividends are well-covered by earnings and cash flows, with payout ratios of 42.7% and 46.4%, respectively, but yield remains below top-tier levels in Japan. The company is executing a share repurchase program worth ¥400 million to enhance shareholder returns, reflecting flexible capital management amid evolving business conditions. Earnings grew by 14.4% last year, supporting future payouts.

- Get an in-depth perspective on Chiyoda IntegreLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that Chiyoda IntegreLtd's share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 1962 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brighton-Best International (Taiwan) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8415

Brighton-Best International (Taiwan)

Brighton-Best International (Taiwan) Inc.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives