Exploring Syntec Technology And 2 Other Hidden Small Cap Opportunities

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of volatility and resilience, with small-cap stocks showing relative strength compared to their larger counterparts amidst a busy earnings season. As economic indicators send mixed signals and manufacturing activity continues to slump, investors are increasingly on the lookout for small-cap opportunities that can withstand broader market fluctuations. In this context, identifying promising small-cap stocks like Syntec Technology involves looking for companies with strong fundamentals that can navigate the current economic landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Syntec Technology (TPEX:7750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Syntec Technology Co., Ltd. specializes in manufacturing PC-based digital controllers for machine tools, with a market capitalization of NT$33.15 billion.

Operations: Syntec Technology generates revenue primarily from the Machinery & Industrial Equipment segment, amounting to NT$9.58 billion. The company's market capitalization stands at NT$33.15 billion.

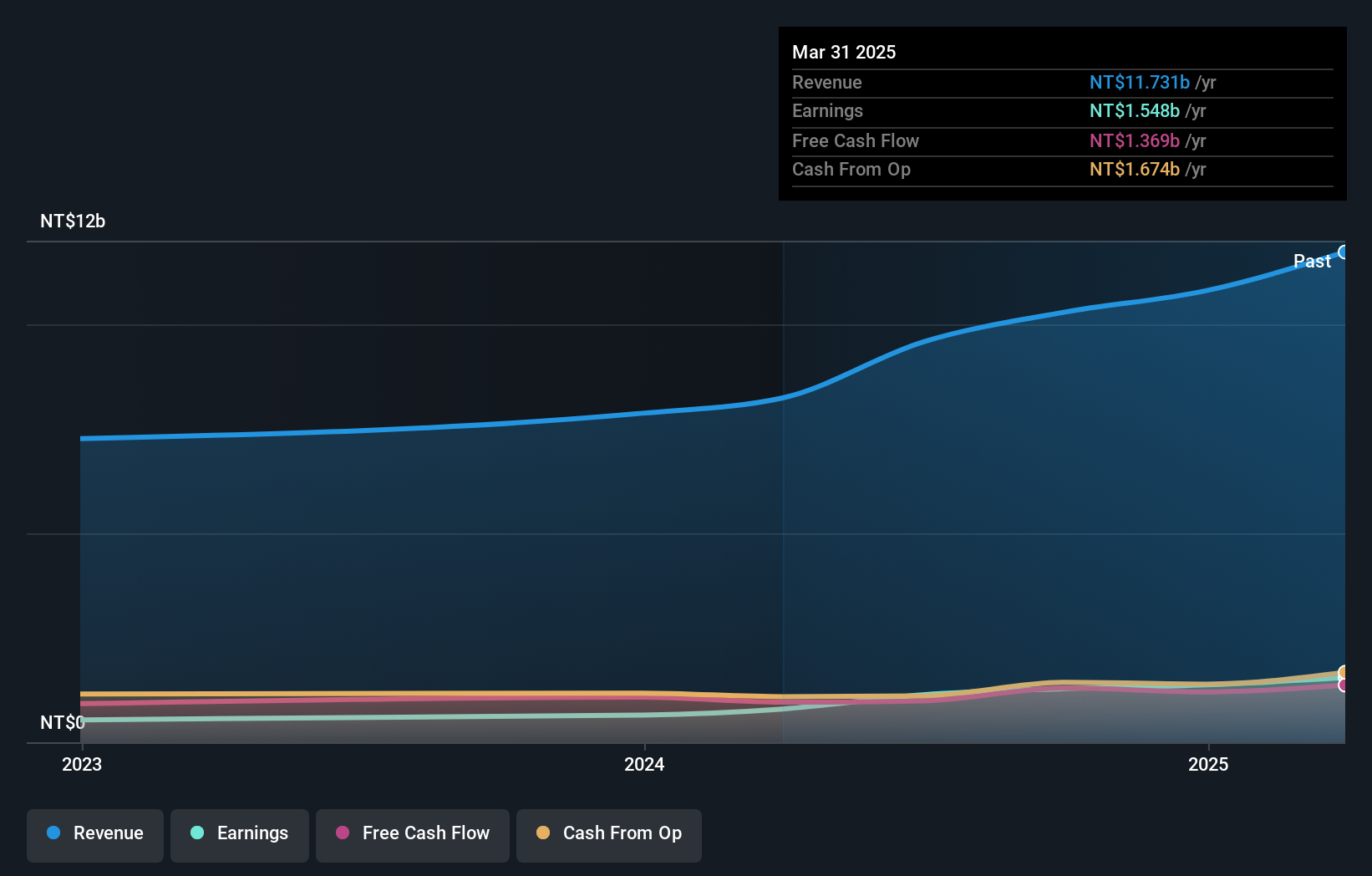

Syntec Technology has demonstrated impressive growth, with earnings surging by 91.4% over the past year, outpacing the Machinery industry's 10.3%. The company appears to maintain a strong financial position, having more cash than its total debt and achieving high-quality earnings. Its interest payments are well covered by EBIT at 86 times coverage, indicating robust operational performance. Recent results show sales reaching TWD 5.63 billion for the half-year ending June 2024, up from TWD 3.93 billion previously, while net income rose to TWD 805 million from TWD 321 million last year. Basic EPS increased significantly to TWD 13.35 from TWD 5.43.

- Take a closer look at Syntec Technology's potential here in our health report.

Explore historical data to track Syntec Technology's performance over time in our Past section.

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. is involved in purchasing and reselling used real estate properties in Japan, with a market capitalization of approximately ¥43.44 billion.

Operations: MUGEN ESTATE generates revenue primarily from its Real Estate Sales Business, contributing ¥54.55 billion, and Leasing and Other Business, adding ¥2.38 billion. The company's net profit margin trends can provide insights into its profitability dynamics over time.

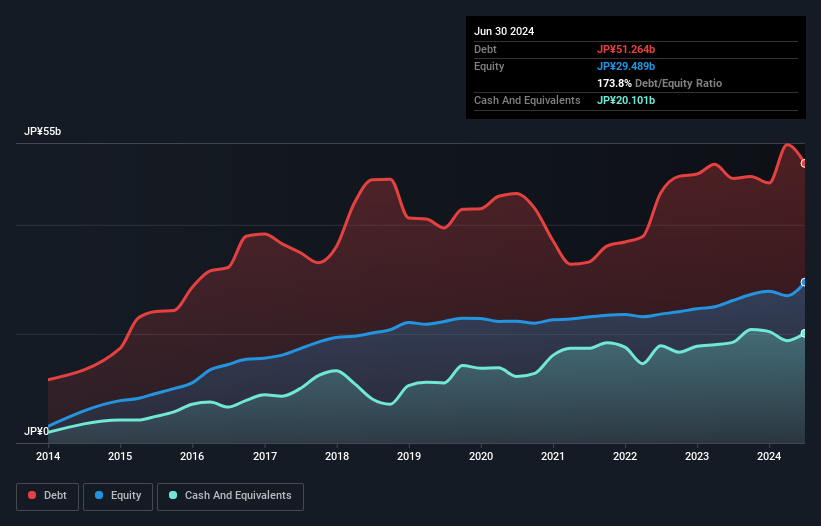

MUGEN ESTATE, a small company in the real estate sector, has been making waves with its strategic expansions and financial performance. Its earnings surged by 65% over the past year, outpacing the industry average of 17.5%. The company's debt-to-equity ratio has slightly improved from 177% to 174% over five years, although it remains high at 106%. Recently added to the S&P Global BMI Index, MUGEN ESTATE is expanding its footprint by opening new sales offices in key regions like Sendai. Additionally, it repurchased shares worth ¥500 million this year, reflecting confidence in its growth strategy.

- Unlock comprehensive insights into our analysis of MUGEN ESTATELtd stock in this health report.

Review our historical performance report to gain insights into MUGEN ESTATELtd's's past performance.

Asia Optical (TWSE:3019)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Optical Co., Inc. is a Taiwanese company that manufactures and sells cameras, optical lenses, and various optical products both domestically and internationally, with a market capitalization of approximately NT$30.02 billion.

Operations: The company's revenue streams are primarily driven by the Optical Components Division, contributing NT$9.93 billion, followed by the Image Sensing Components Business at NT$3.60 billion. The Digital Camera Division and Plastic Photoelectric Component Business Department add NT$2.37 billion and NT$2.62 billion, respectively, to the total revenue.

Asia Optical, a nimble player in the electronics sector, has shown impressive earnings growth of 15% over the past year, outpacing the industry average. The company is debt-free and boasts high-quality past earnings. In recent results for Q2 2024, sales climbed to TWD 5.61 billion from TWD 4.45 billion a year prior, while net income jumped to TWD 446 million from TWD 297 million. Basic earnings per share rose to TWD 1.59 from TWD 1.07 last year, reflecting solid operational performance despite a highly volatile share price in recent months.

- Click here to discover the nuances of Asia Optical with our detailed analytical health report.

Understand Asia Optical's track record by examining our Past report.

Summing It All Up

- Dive into all 4705 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7750

Syntec Technology

Manufactures PC-based digital controllers that specializes in machine tools.

Excellent balance sheet with proven track record.