Exploring December 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate a complex landscape with major indices like the S&P 500 and Nasdaq Composite hitting record highs, small-cap stocks have shown mixed performance, highlighted by the recent decline in the Russell 2000 Index. This environment of diverging market trends and economic indicators presents a unique opportunity to explore lesser-known stocks that may offer potential value. In this context, identifying promising small-cap companies involves looking for those with strong fundamentals and growth potential that can thrive amid current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 15.90% | 6.43% | -13.73% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Ghitha Holding P.J.S.C (ADX:GHITHA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ghitha Holding P.J.S.C, with a market cap of AED 5.56 billion, is an investment holding company that provides management and investment services across diversified projects and businesses in the United Arab Emirates.

Operations: Ghitha Holding P.J.S.C generates revenue from management and investment services in various projects within the UAE. The company has a market cap of AED 5.56 billion.

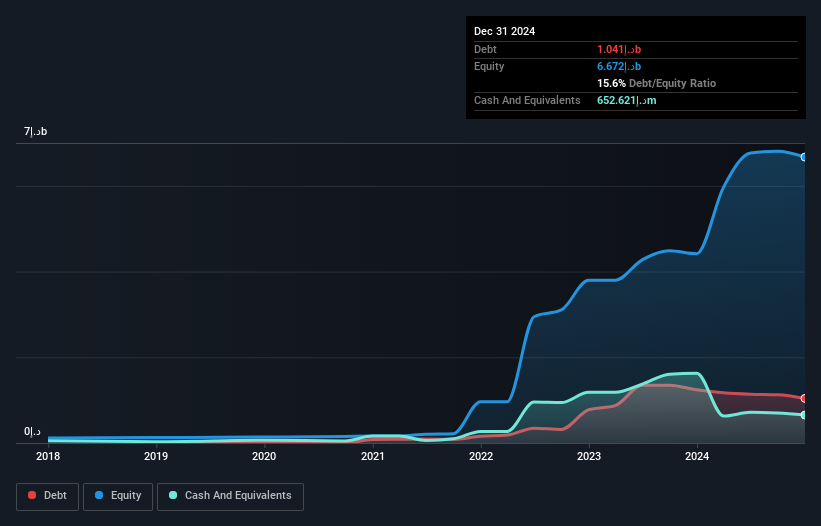

Ghitha Holding P.J.S.C, a relatively small player, has showcased impressive earnings growth of 1039% over the past year, outpacing the Consumer Retailing industry average of 32%. Despite a volatile share price recently, its net debt to equity ratio stands satisfactorily at 6.2%, indicating manageable leverage. The company's EBIT covers interest payments well at 3.8 times. Recent reports show a mixed performance with third-quarter sales slightly down to AED 1,220 million from AED 1,244 million last year and net income dropping to AED 26 million from AED 109 million in the same period last year.

- Dive into the specifics of Ghitha Holding P.J.S.C here with our thorough health report.

Learn about Ghitha Holding P.J.S.C's historical performance.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

Overview: National Cement Company (Public Shareholding) engages in the manufacturing and sale of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.19 billion.

Operations: NCC generates revenue primarily from its cement segment, amounting to AED186.07 million.

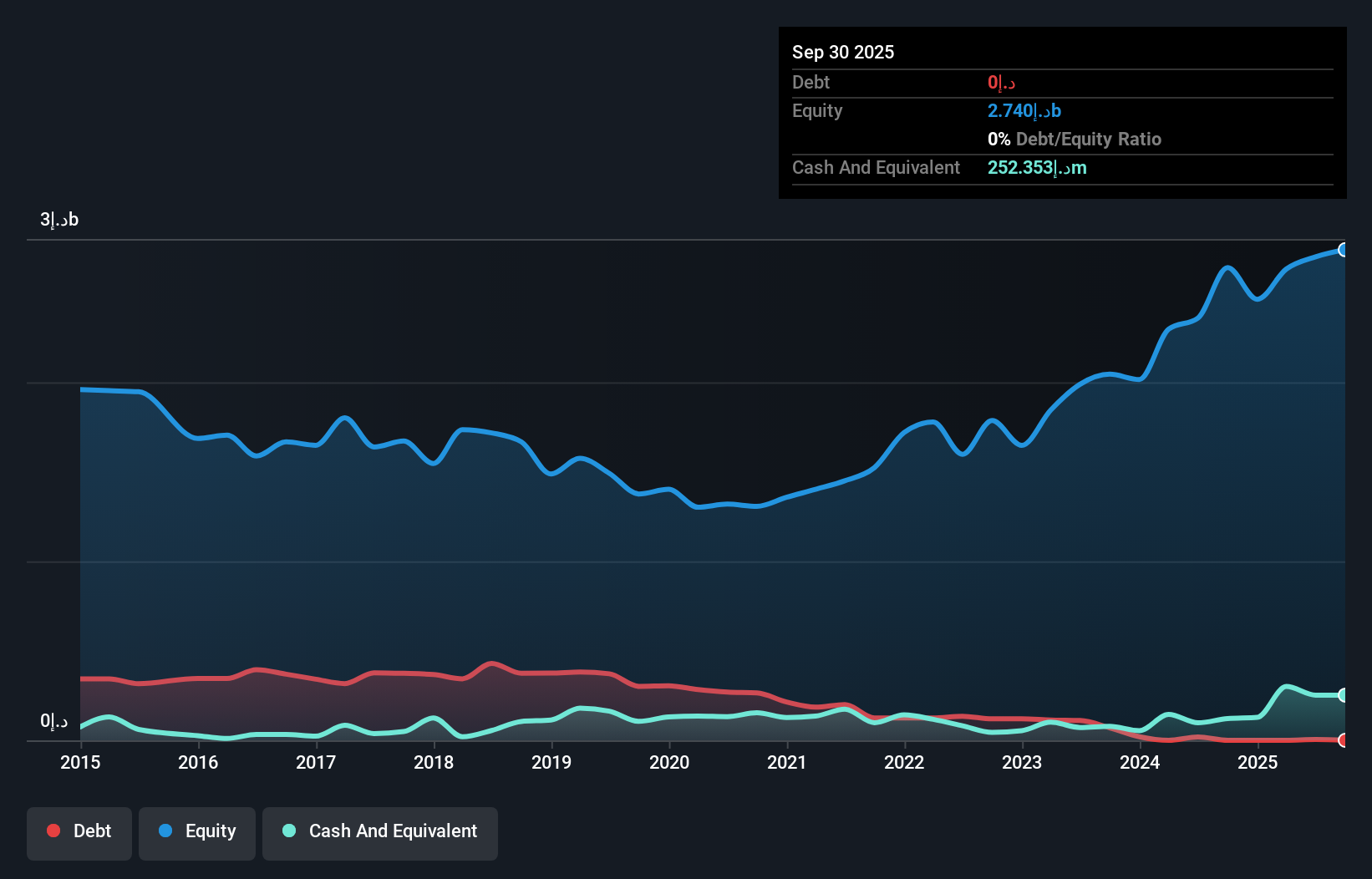

National Cement Company, a smaller player in the industry, shows promising signs despite recent volatility. Over the past year, its earnings skyrocketed by 253.8%, outpacing the Basic Materials sector's 26.5% growth rate. This leap is underscored by high-quality earnings and a debt-free status, contrasting with its previous debt to equity ratio of 21.9% five years ago. Although sales dipped to AED 41.88 million in Q3 from AED 49.01 million last year, net income for nine months soared to AED 135.37 million from AED 50.34 million previously, suggesting operational resilience amidst fluctuating market conditions.

Mega Union Technology (TPEX:6944)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mega Union Technology Inc. specializes in planning and designing water and wastewater recovery systems for industrial applications, with a market cap of NT$25.22 billion.

Operations: Mega Union Technology generates its revenue primarily from the Machinery & Industrial Equipment segment, with reported earnings of NT$9.28 billion. The company's market capitalization stands at NT$25.22 billion.

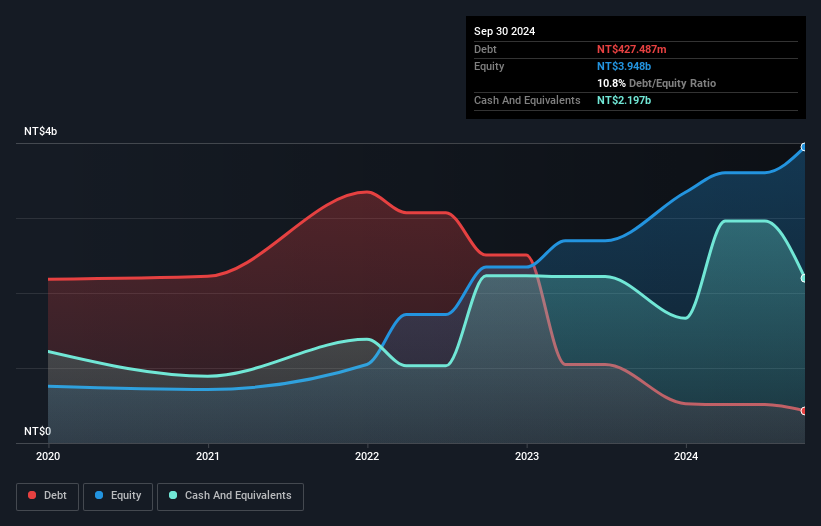

Mega Union Technology stands out with its impressive earnings growth of 102% over the past year, significantly outperforming the Machinery industry's 14.6%. The company boasts high-quality earnings and maintains a favorable cash position, having more cash than total debt. Its Price-To-Earnings ratio of 19.5x is attractively below the TW market average of 21.2x, suggesting potential value for investors. Levered free cash flow turned positive in late 2022 and continued to grow through 2024, likely benefiting from reduced capital expenditures and improved operational efficiency. These factors paint a promising picture for Mega Union's ongoing financial health and industry positioning.

- Click here to discover the nuances of Mega Union Technology with our detailed analytical health report.

Assess Mega Union Technology's past performance with our detailed historical performance reports.

Make It Happen

- Delve into our full catalog of 4622 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6944

Mega Union Technology

Engages in the planning, design, and installation of water and wastewater recycling systems in Taiwan, Singapore, the United States, Mainland China, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives