As global markets react to the recent U.S. elections and economic policy shifts, major indices like the S&P 500 have reached record highs, driven by expectations of growth-friendly fiscal policies and tax reforms. Amidst this backdrop of optimism and uncertainty, dividend stocks emerge as a compelling option for investors seeking stability and income, offering potential resilience through consistent payouts even in fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Midea Group (SZSE:000333)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Midea Group Co., Ltd. operates in the manufacturing and sale of home appliances, as well as robotic and automation systems, both in China and internationally, with a market cap of CN¥555.11 billion.

Operations: Midea Group Co., Ltd. generates revenue through its home appliances and robotic and automation systems segments, serving both domestic and international markets.

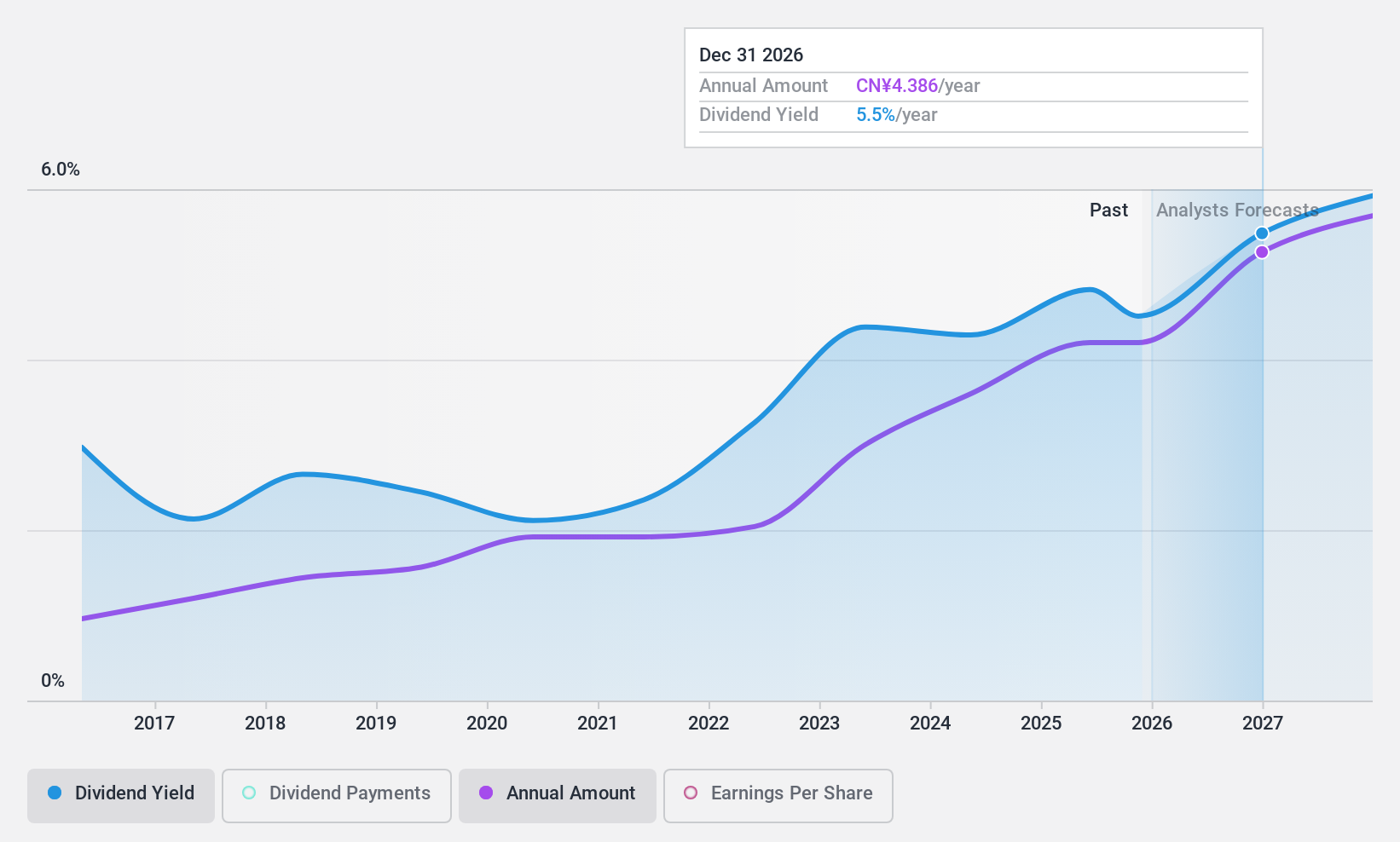

Dividend Yield: 4.1%

Midea Group's dividend yield of 4.09% is notably higher than the CN market average, placing it in the top 25% of dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 55% and 34.5%, respectively, indicating sustainability. Despite a recent follow-on equity offering raising HKD 31 billion, which diluted shares, Midea's stable earnings growth supports its reliable dividend history over the past decade.

- Click to explore a detailed breakdown of our findings in Midea Group's dividend report.

- Our expertly prepared valuation report Midea Group implies its share price may be lower than expected.

Sinmag Equipment (TPEX:1580)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinmag Equipment Corporation manufactures, retails, and wholesales baking and food service equipment with a market cap of NT$7.43 billion.

Operations: Revenue Segments (in millions of NT$): Sinmag Equipment Corporation generates its revenue from the manufacture, retail, and wholesale of baking and food service equipment.

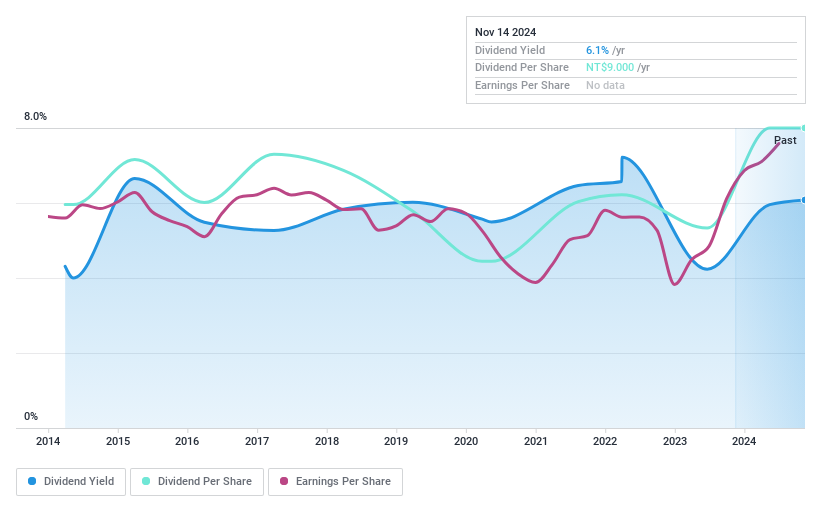

Dividend Yield: 6.1%

Sinmag Equipment offers a dividend yield of 6.08%, placing it in the top 25% of TW market payers, supported by earnings and cash flows with payout ratios of 67.8% and 64.5%. However, its dividend history is marked by volatility, including drops over 20%, indicating unreliability despite recent earnings growth of NT$56 million. The stock trades at a significant discount to estimated fair value but remains impacted by an unstable dividend track record.

- Dive into the specifics of Sinmag Equipment here with our thorough dividend report.

- According our valuation report, there's an indication that Sinmag Equipment's share price might be on the cheaper side.

Nissan Chemical (TSE:4021)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissan Chemical Corporation operates in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals sectors both in Japan and internationally, with a market cap of approximately ¥750.10 billion.

Operations: Nissan Chemical Corporation's revenue segments include Trading at ¥111.27 billion, Performance Materials at ¥92.67 billion, Agricultural Chemicals at ¥86.02 billion, Chemicals at ¥35.54 billion, and Healthcare at ¥6.05 billion.

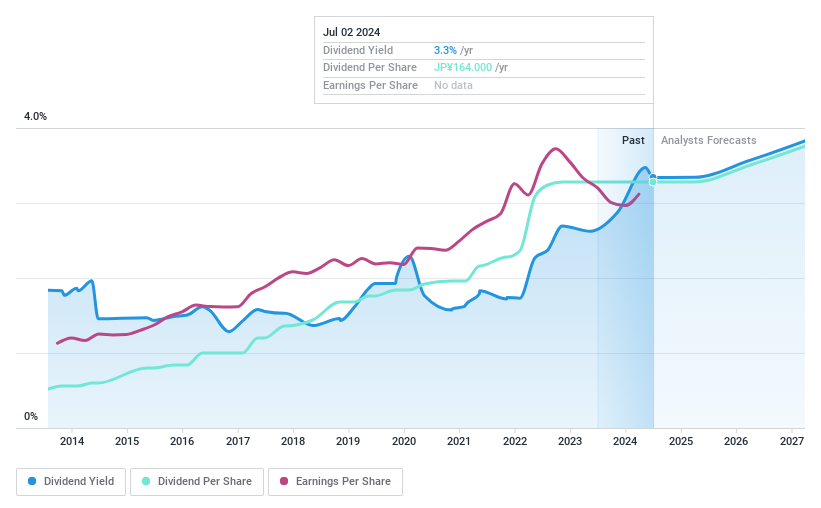

Dividend Yield: 3%

Nissan Chemical's dividend yield of 3.01% is below the top 25% in Japan, yet it boasts a decade of stable and growing dividends. With a payout ratio of 58.2%, dividends are well-covered by earnings, although cash flow coverage at 89.8% suggests less cushion for volatility. Recent board discussions on treasury share cancellation may impact future distributions but currently, the stock trades near its fair value estimate, offering reasonable valuation for investors seeking stability.

- Click here to discover the nuances of Nissan Chemical with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Nissan Chemical's current price could be inflated.

Taking Advantage

- Click this link to deep-dive into the 1940 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:1580

Sinmag Equipment

Engages in the manufacture, retail, and wholesale of baking and food service equipment.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives