Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Tera Autotech Corporation (GTSM:6234) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Tera Autotech

What Is Tera Autotech's Debt?

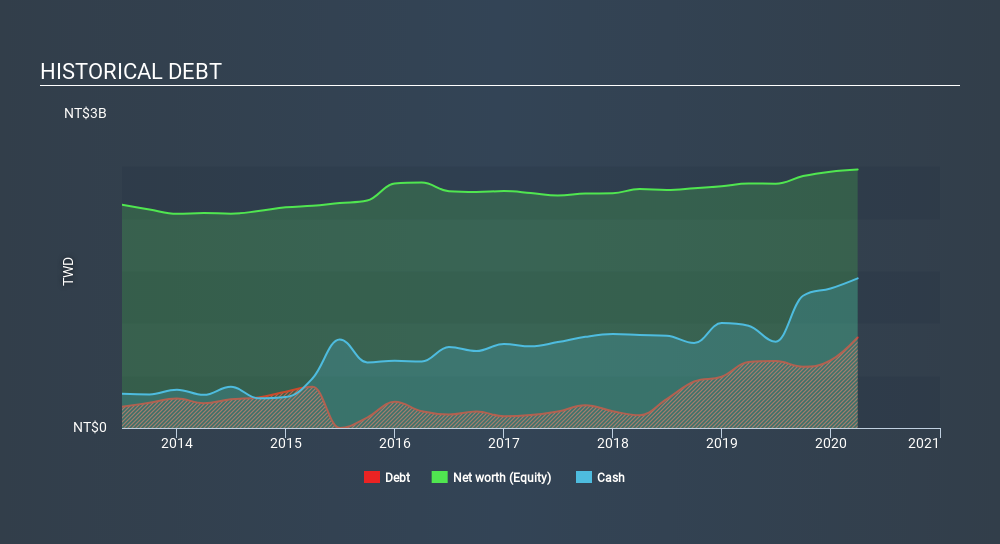

You can click the graphic below for the historical numbers, but it shows that as of March 2020 Tera Autotech had NT$865.0m of debt, an increase on NT$630.0m, over one year. But it also has NT$1.43b in cash to offset that, meaning it has NT$564.9m net cash.

A Look At Tera Autotech's Liabilities

The latest balance sheet data shows that Tera Autotech had liabilities of NT$1.19b due within a year, and liabilities of NT$50.8m falling due after that. On the other hand, it had cash of NT$1.43b and NT$321.1m worth of receivables due within a year. So it actually has NT$514.3m more liquid assets than total liabilities.

This surplus suggests that Tera Autotech is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Tera Autotech boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Tera Autotech grew its EBIT by 166% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Tera Autotech will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Tera Autotech has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Tera Autotech saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Tera Autotech has net cash of NT$564.9m, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 166% over the last year. So is Tera Autotech's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Tera Autotech (1 is significant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TPEX:6234

Tera Autotech

Engages in the research and development, design, manufacture, sale, and import and export of industrial automation equipment in Taiwan and China.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives