Is There More To The Story Than Highlight Tech's (GTSM:6208) Earnings Growth?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Highlight Tech's (GTSM:6208) statutory profits are a good guide to its underlying earnings.

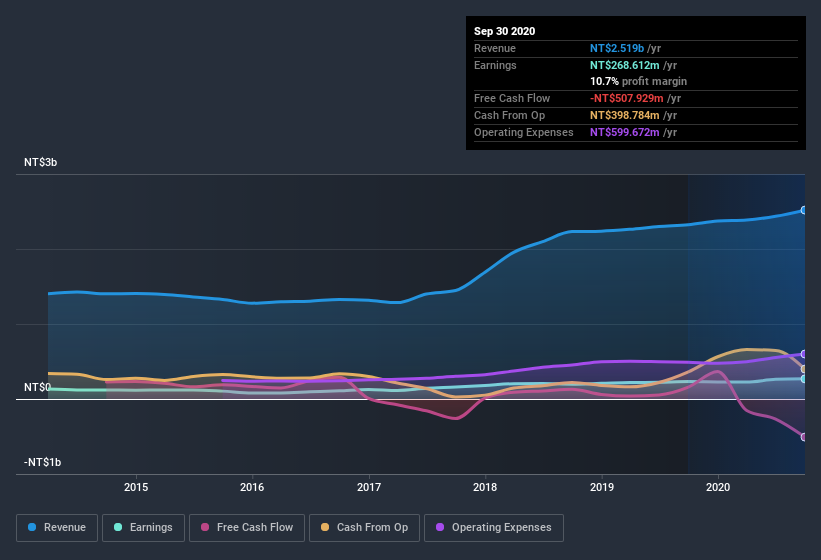

It's good to see that over the last twelve months Highlight Tech made a profit of NT$268.6m on revenue of NT$2.52b. In the chart below, you can see that its profit and revenue have both grown over the last three years.

Check out our latest analysis for Highlight Tech

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll look at what Highlight Tech's cashflow and unusual items tell us about the quality of its earnings, as well as touching on how its recent share issues are impacting shareholders. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Highlight Tech.

Zooming In On Highlight Tech's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Highlight Tech has an accrual ratio of 0.29 for the year to September 2020. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. Over the last year it actually had negative free cash flow of NT$508m, in contrast to the aforementioned profit of NT$268.6m. We saw that FCF was NT$160m a year ago though, so Highlight Tech has at least been able to generate positive FCF in the past. Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Highlight Tech expanded the number of shares on issue by 5.1% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Highlight Tech's historical EPS growth by clicking on this link.

A Look At The Impact Of Highlight Tech's Dilution on Its Earnings Per Share (EPS).

As you can see above, Highlight Tech has been growing its net income over the last few years, with an annualized gain of 68% over three years. And in the last year the company managed to bump profit up by 16%. But in comparison, EPS only increased by 13% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Highlight Tech shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Highlight Tech's profit was boosted by unusual items worth NT$45m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. If Highlight Tech doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Highlight Tech's Profit Performance

Highlight Tech didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. The dilution means the results are weaker when viewed from a per-share perspective. Considering all this we'd argue Highlight Tech's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Highlight Tech, you'd also look into what risks it is currently facing. Be aware that Highlight Tech is showing 4 warning signs in our investment analysis and 1 of those is a bit concerning...

Our examination of Highlight Tech has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Highlight Tech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Highlight Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6208

Highlight Tech

Designs, manufactures, sells, retails, wholesales, repairs, and maintains electronic components in Taiwan and China.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026