- Taiwan

- /

- Electrical

- /

- TPEX:5013

The New Best Wire IndustrialLtd (GTSM:5013) Share Price Is Up 75% And Shareholders Are Holding On

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market But New Best Wire Industrial Co.,Ltd (GTSM:5013) has fallen short of that second goal, with a share price rise of 75% over five years, which is below the market return. Zooming in, the stock is up just 4.8% in the last year.

View our latest analysis for New Best Wire IndustrialLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, New Best Wire IndustrialLtd actually saw its EPS drop 1.5% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 1.9% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 3.3% per year is probably viewed as evidence that New Best Wire IndustrialLtd is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

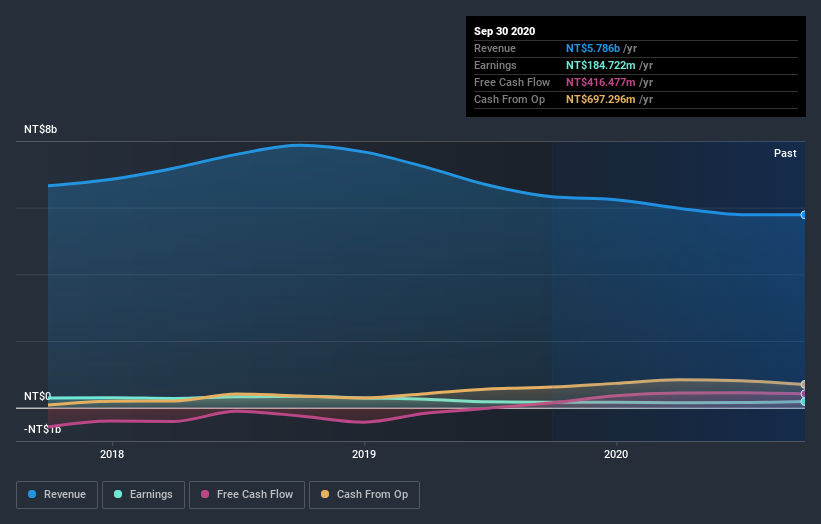

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for New Best Wire IndustrialLtd the TSR over the last 5 years was 93%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

New Best Wire IndustrialLtd shareholders gained a total return of 6.9% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 14% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with New Best Wire IndustrialLtd (including 1 which can't be ignored) .

Of course New Best Wire IndustrialLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade New Best Wire IndustrialLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade New Best Wire IndustrialLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Best Wire IndustrialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5013

New Best Wire IndustrialLtd

New Best Wire Industrial Co., Ltd. provides manufacturing and sales of wire products and stainless-steel pipes.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives