Quaser Machine Tools'(GTSM:4563) Share Price Is Down 57% Over The Past Three Years.

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Quaser Machine Tools, Inc. (GTSM:4563) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 57% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 34% lower in that time. The silver lining is that the stock is up 3.6% in about a week.

Check out our latest analysis for Quaser Machine Tools

Quaser Machine Tools wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Quaser Machine Tools grew revenue at 2.5% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 16% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

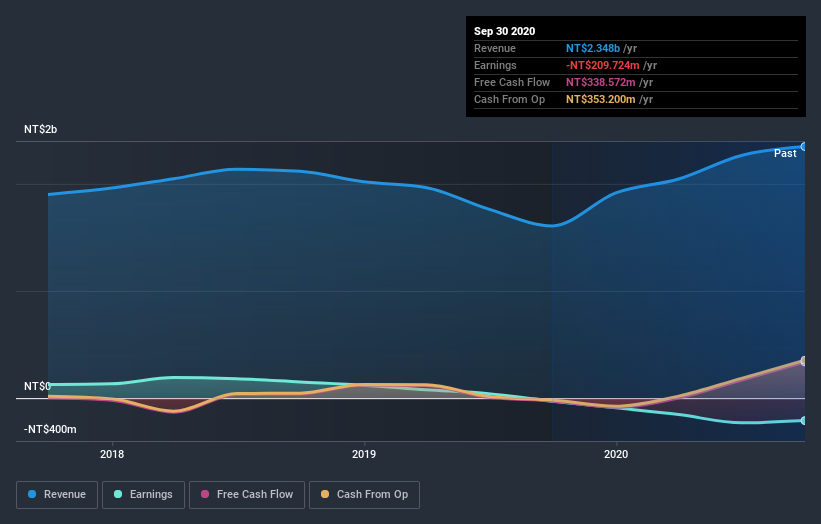

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Quaser Machine Tools' financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Quaser Machine Tools' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Quaser Machine Tools' TSR of was a loss of 52% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Quaser Machine Tools shareholders are down 34% for the year, but the broader market is up 44%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 15% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Quaser Machine Tools (2 are significant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Quaser Machine Tools or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Quaser Machine Tools, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quaser Machine Tools might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4563

Quaser Machine Tools

Engages in the manufacture and sale of computer numerical control (CNC) machine centers, metal-working machines, and related machines in Europe, Asia, the Americas, Africa, and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives