- Japan

- /

- Trade Distributors

- /

- TSE:8125

3 Leading Dividend Stocks Yielding Up To 4%

Reviewed by Simply Wall St

In a week marked by stock market volatility and inflation concerns, investors are seeking stability amidst the uncertainty. While U.S. equities experienced declines and inflation fears persisted, dividend stocks continue to attract attention for their potential to provide steady income streams in turbulent times. As we explore three leading dividend stocks yielding up to 4%, it's important to consider how these investments can offer resilience and consistent returns amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.39% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.99% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

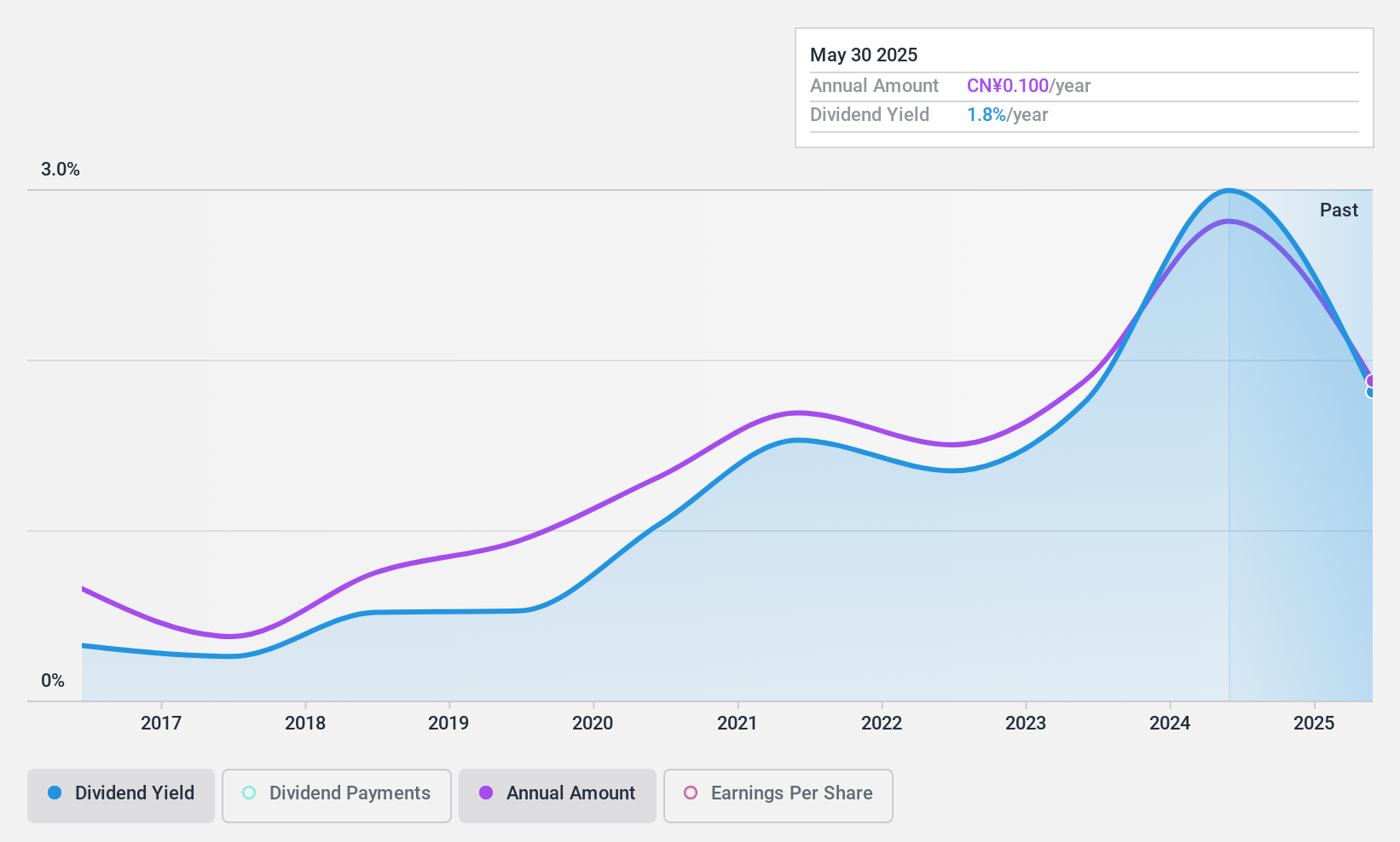

Shanghai Chuangli Group (SHSE:603012)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Chuangli Group Co., Ltd. is engaged in the research, development, production, sale, and servicing of coal mining machinery and equipment both in China and internationally, with a market cap of CN¥3.15 billion.

Operations: Shanghai Chuangli Group Co., Ltd. generates revenue through its operations in the coal mining machinery and equipment sector, serving both domestic and international markets.

Dividend Yield: 2.9%

Shanghai Chuangli Group's dividend yield of 2.87% ranks in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 314.3%, indicating dividends are not well covered by free cash flows. Despite a low payout ratio of 32.7%, suggesting earnings coverage, dividend reliability is undermined by volatility over the past decade. Recent earnings show decreased revenue and net income, potentially impacting future payouts.

- Click here to discover the nuances of Shanghai Chuangli Group with our detailed analytical dividend report.

- Our expertly prepared valuation report Shanghai Chuangli Group implies its share price may be too high.

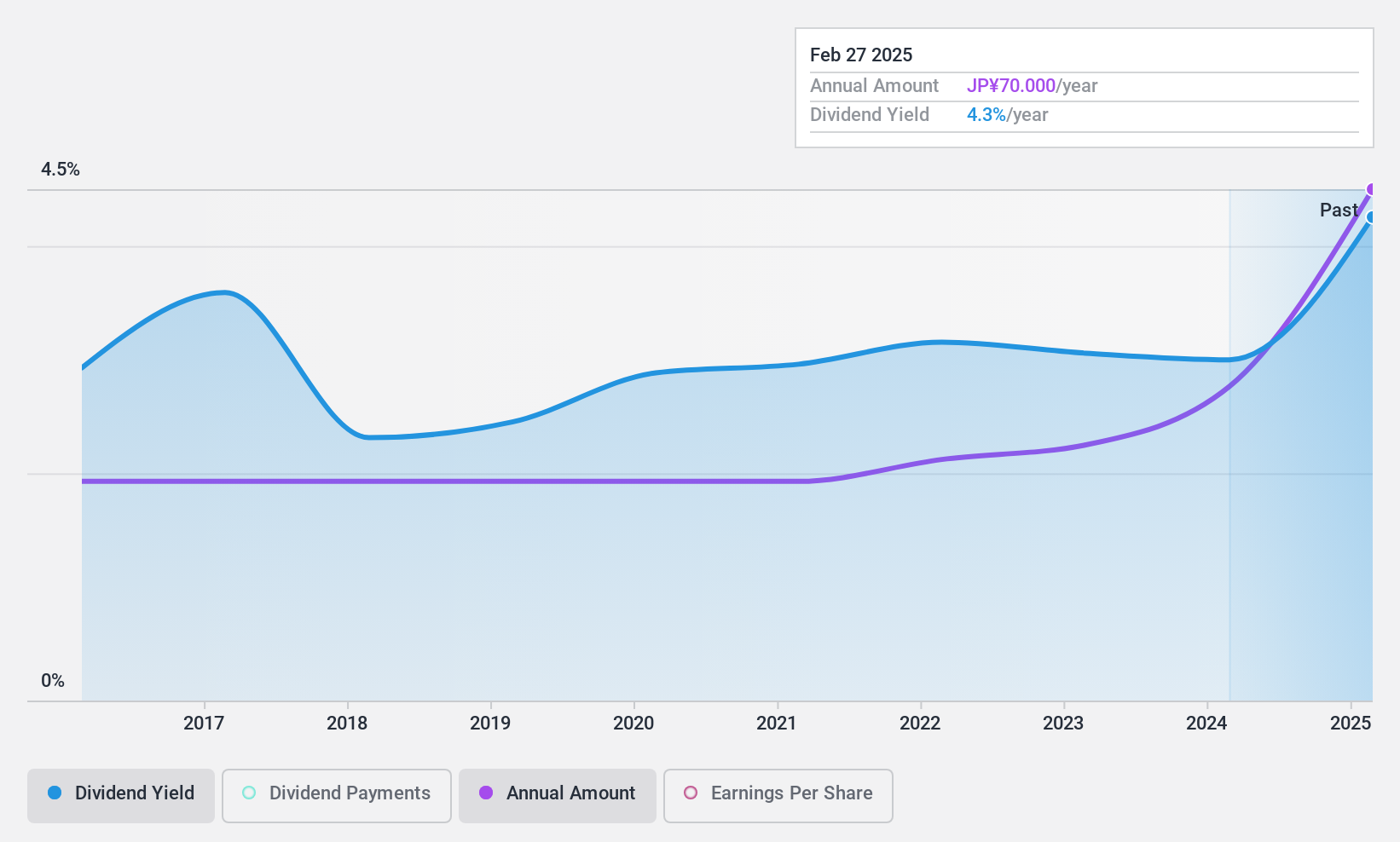

WakitaLTD (TSE:8125)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Wakita & Co., LTD. operates in the construction equipment, trading, and real estate sectors in Japan with a market cap of ¥81.92 billion.

Operations: Wakita & Co., LTD.'s revenue is derived from its operations in construction equipment, trading, and real estate sectors within Japan.

Dividend Yield: 4%

Wakita Ltd. offers a compelling dividend profile with a yield of 4.01%, placing it in the top 25% of payers in Japan. The company's dividends have grown steadily over the past decade, supported by a sustainable payout ratio of 75% and strong cash flow coverage at 28.5%. Trading significantly below its estimated fair value, Wakita presents an attractive opportunity for dividend investors seeking stability and growth potential without excessive volatility or risk to payouts.

- Navigate through the intricacies of WakitaLTD with our comprehensive dividend report here.

- The analysis detailed in our WakitaLTD valuation report hints at an inflated share price compared to its estimated value.

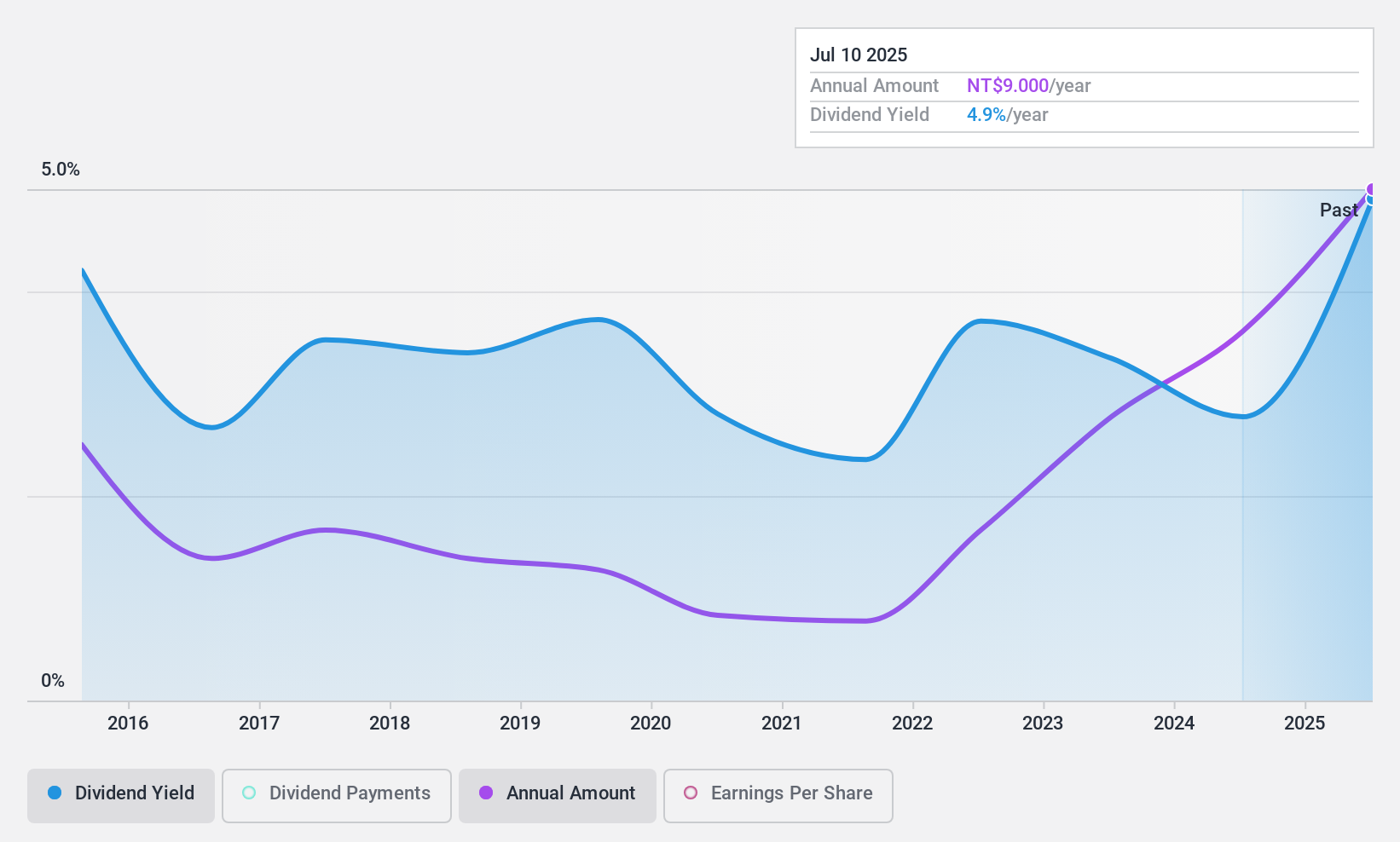

Depo Auto Parts Industrial (TWSE:6605)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Depo Auto Parts Industrial Co., Ltd. manufactures and sells automotive and related lighting products, with a market cap of NT$34.82 billion.

Operations: Depo Auto Parts Industrial Co., Ltd. generates revenue primarily from the research and development, manufacturing, and sales of various automotive lamps, amounting to NT$19.87 billion.

Dividend Yield: 2.9%

Depo Auto Parts Industrial's dividend payments are well covered by earnings and cash flows, with payout ratios of 36.3% and 27.3%, respectively. However, the dividend yield of 2.94% is below the market's top tier in Taiwan, and the company's dividend history has been volatile over the past decade. Recent earnings show growth, but a recent workplace incident led to a partial suspension of operations as investigations continue.

- Delve into the full analysis dividend report here for a deeper understanding of Depo Auto Parts Industrial.

- The analysis detailed in our Depo Auto Parts Industrial valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Explore the 2007 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WakitaLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8125

WakitaLTD

Engages in the construction equipment, trading, and real estate businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.