- Taiwan

- /

- Auto Components

- /

- TWSE:1587

Cryomax Cooling System Corp. (TWSE:1587) Stocks Shoot Up 41% But Its P/S Still Looks Reasonable

Cryomax Cooling System Corp. (TWSE:1587) shares have continued their recent momentum with a 41% gain in the last month alone. The annual gain comes to 183% following the latest surge, making investors sit up and take notice.

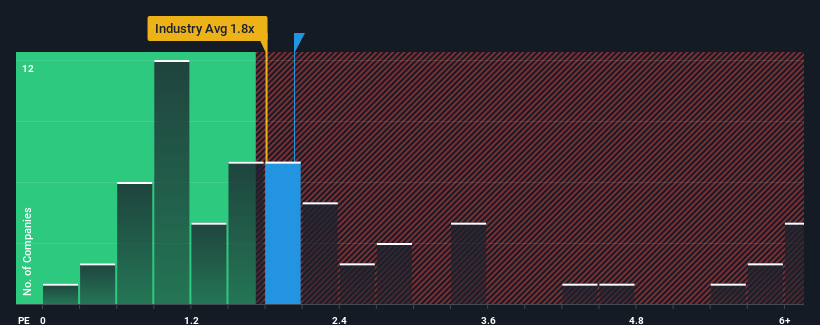

In spite of the firm bounce in price, it's still not a stretch to say that Cryomax Cooling System's price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Taiwan, where the median P/S ratio is around 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Cryomax Cooling System

What Does Cryomax Cooling System's P/S Mean For Shareholders?

For example, consider that Cryomax Cooling System's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cryomax Cooling System's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Cryomax Cooling System?

Cryomax Cooling System's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.0% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Cryomax Cooling System's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Cryomax Cooling System's P/S

Cryomax Cooling System's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears to us that Cryomax Cooling System maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Cryomax Cooling System (of which 2 are potentially serious!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1587

Cryomax Cooling System

Engages in the manufacturing, processing, and trading of metal water storage tanks for various vehicles in Taiwan, the United States, Asia, Europe, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives