SpareBank 1 Helgeland And 2 Other Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are closely watching how these factors impact overall market sentiment. With U.S. job growth falling short of estimates and manufacturing showing signs of recovery, dividend stocks remain a popular choice for those seeking steady income amidst volatility. In this environment, a good dividend stock is often characterized by its ability to maintain stable payouts and demonstrate resilience against economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.16% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

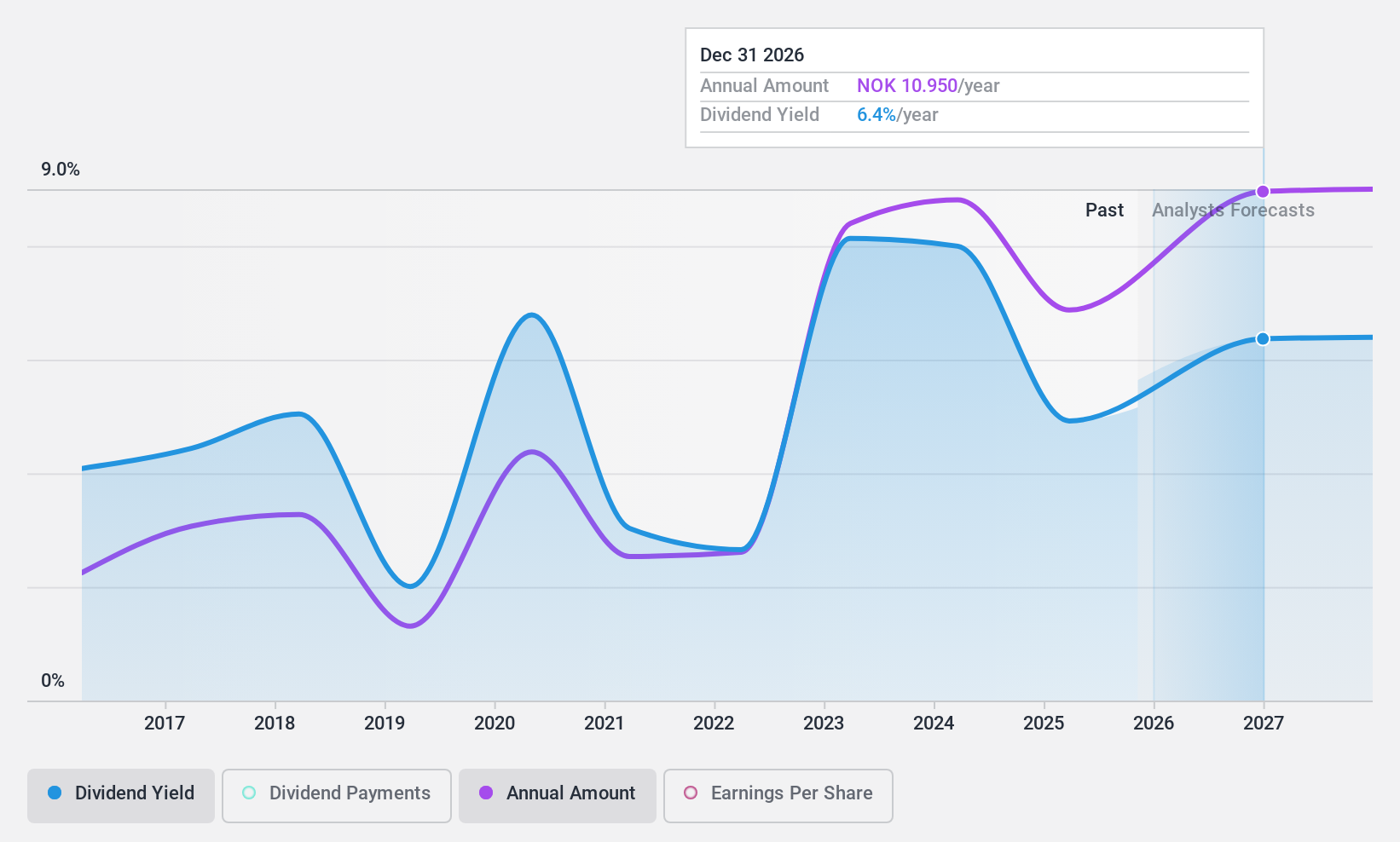

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market cap of NOK4.60 billion.

Operations: SpareBank 1 Helgeland generates revenue through its Retail segment, which accounts for NOK462 million, and its Corporate Market segment, contributing NOK271 million.

Dividend Yield: 6.3%

SpareBank 1 Helgeland's dividend payments are currently covered by earnings with a payout ratio of 70.4%, and future coverage is forecasted at 89.4%. Despite a history of volatility, dividends have increased over the past decade. The stock trades at 31.6% below estimated fair value, offering potential investment appeal. However, its dividend yield of 6.3% lags behind top-tier Norwegian payers, and recent fixed-income offerings may impact financial flexibility in the future.

- Take a closer look at SpareBank 1 Helgeland's potential here in our dividend report.

- Our expertly prepared valuation report SpareBank 1 Helgeland implies its share price may be too high.

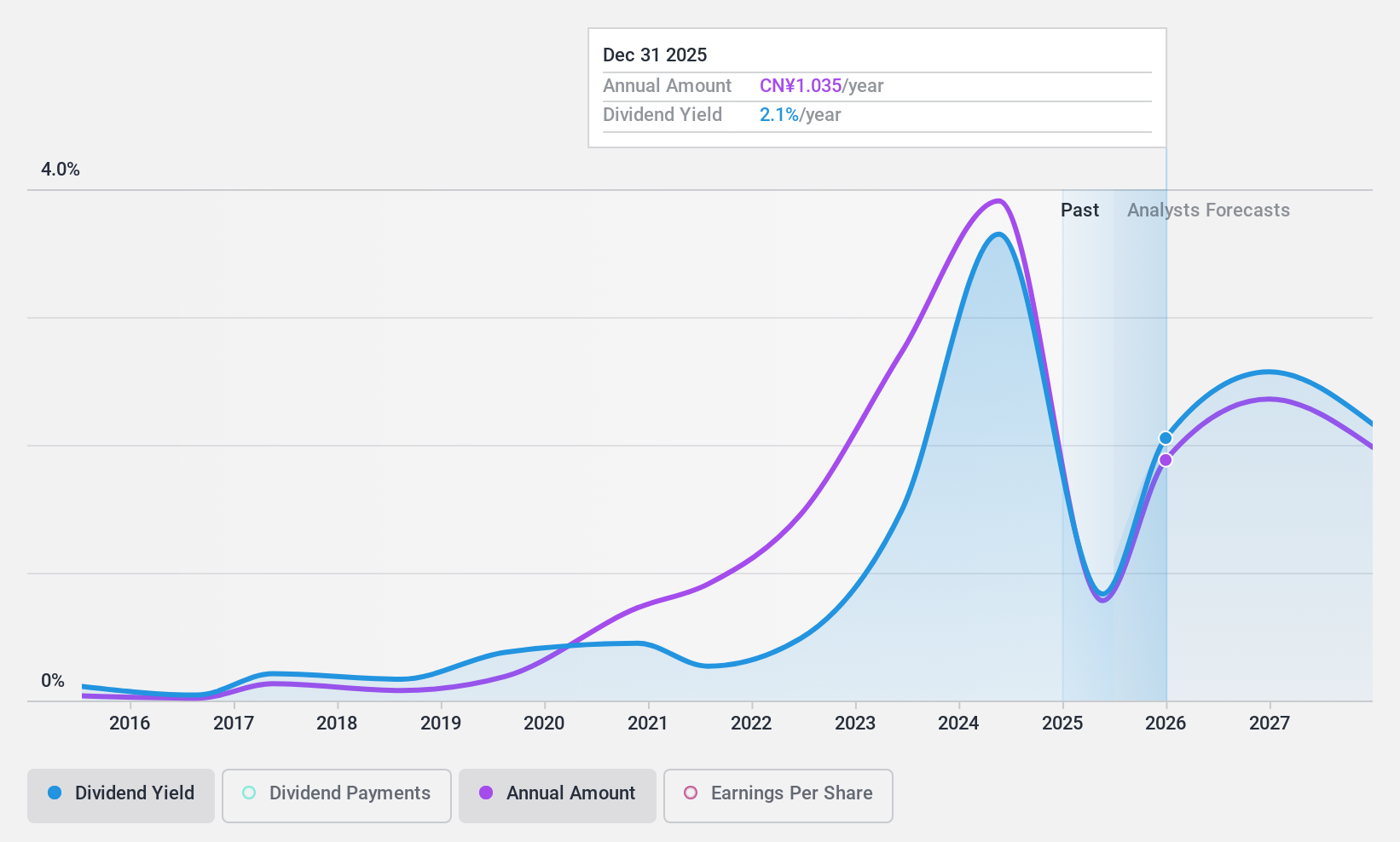

Shede Spirits (SHSE:600702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shede Spirits Co., Ltd., with a market cap of CN¥18.44 billion, designs, produces, and sells liquor products in China through its subsidiaries.

Operations: Shede Spirits Co., Ltd. generates its revenue primarily from the design, production, and sale of liquor products within China.

Dividend Yield: 3.9%

Shede Spirits' dividend yield of 3.86% is among the top 25% in the Chinese market, yet its reliability is questionable due to past volatility and lack of free cash flow coverage. While trading at a significant discount to fair value, the company's dividends are not fully supported by earnings or cash flows, despite a reasonable payout ratio of 62.9%. Recent share buybacks might signal management's confidence but do not directly enhance dividend stability.

- Click here to discover the nuances of Shede Spirits with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shede Spirits shares in the market.

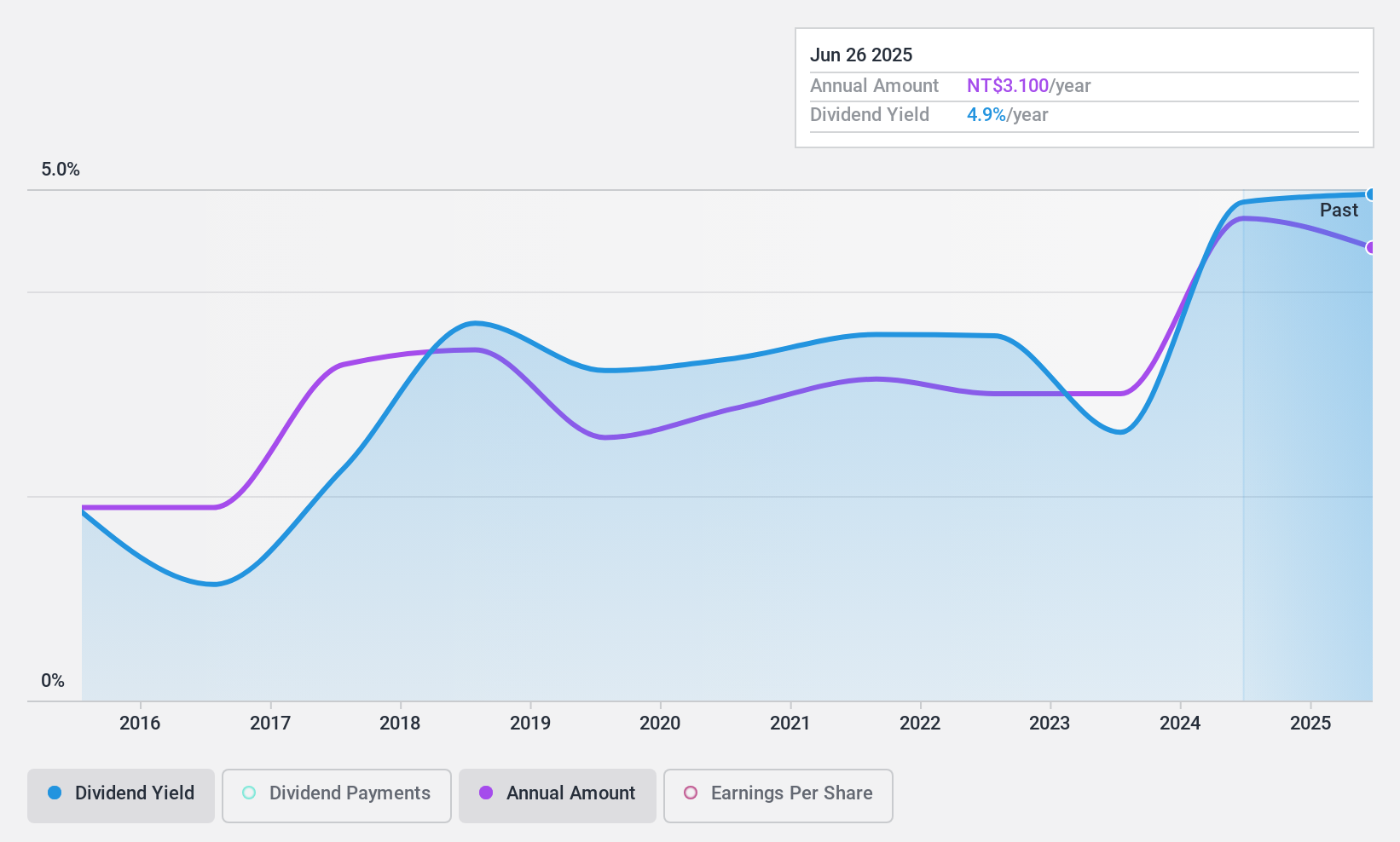

Kian Shen (TWSE:1525)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kian Shen Corporation manufactures and sells automobile body frames, stamping dies, and woodworking products in Taiwan, with a market cap of NT$4.32 billion.

Operations: Kian Shen Corporation's revenue is primarily derived from its Manufacturing Segment, which generated NT$1.45 billion.

Dividend Yield: 5.6%

Kian Shen offers a dividend yield of 5.61%, placing it in the top 25% of payers in Taiwan, though its reliability is undermined by past volatility and lack of free cash flow coverage. Despite an attractive price-to-earnings ratio of 15.9x compared to the market's 21.1x, dividends are not fully backed by earnings or cash flows, with a high payout ratio of 89.5%. Recent executive changes may impact future strategy but have no immediate effect on dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Kian Shen.

- Upon reviewing our latest valuation report, Kian Shen's share price might be too optimistic.

Where To Now?

- Navigate through the entire inventory of 1961 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600702

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives