- China

- /

- Interactive Media and Services

- /

- SZSE:002315

Focus Technology Leads Our 3 Must-Know Dividend Stocks

Reviewed by Simply Wall St

In a week marked by economic uncertainty and fluctuating indices, global markets have shown mixed results, with technology stocks facing pressure amid cautious earnings reports. As investors navigate these turbulent waters, dividend stocks remain an attractive option due to their potential for steady income and resilience during volatile market conditions. Understanding what makes a strong dividend stock—such as consistent earnings growth and robust cash flow—can be crucial in these times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

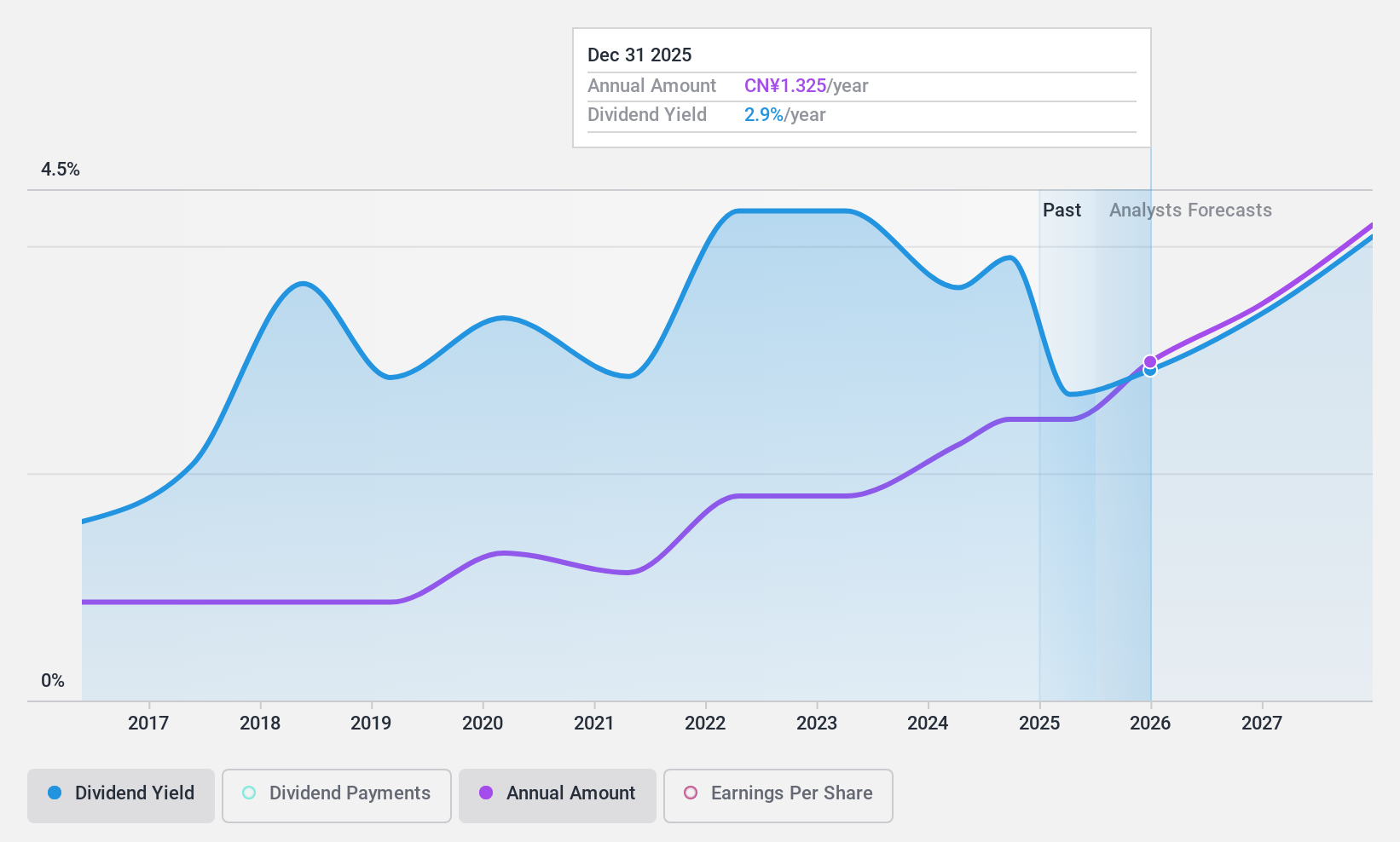

Focus Technology (SZSE:002315)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Focus Technology Co., Ltd. operates e-commerce platforms both in China and internationally, with a market cap of CN¥10.08 billion.

Operations: Focus Technology Co., Ltd.'s revenue is primarily derived from its e-commerce platforms operating within China and internationally.

Dividend Yield: 3.5%

Focus Technology's dividend payments are covered by earnings and cash flows, with a payout ratio of 72% and a cash payout ratio of 51.5%. The company offers a competitive dividend yield, ranking in the top 25% of CN market payers. Despite this, its dividend history is unstable and volatile over the past decade. Recent earnings growth supports dividend sustainability, with net income reaching CNY 357.71 million for the nine months ended September 2024.

- Take a closer look at Focus Technology's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Focus Technology is priced lower than what may be justified by its financials.

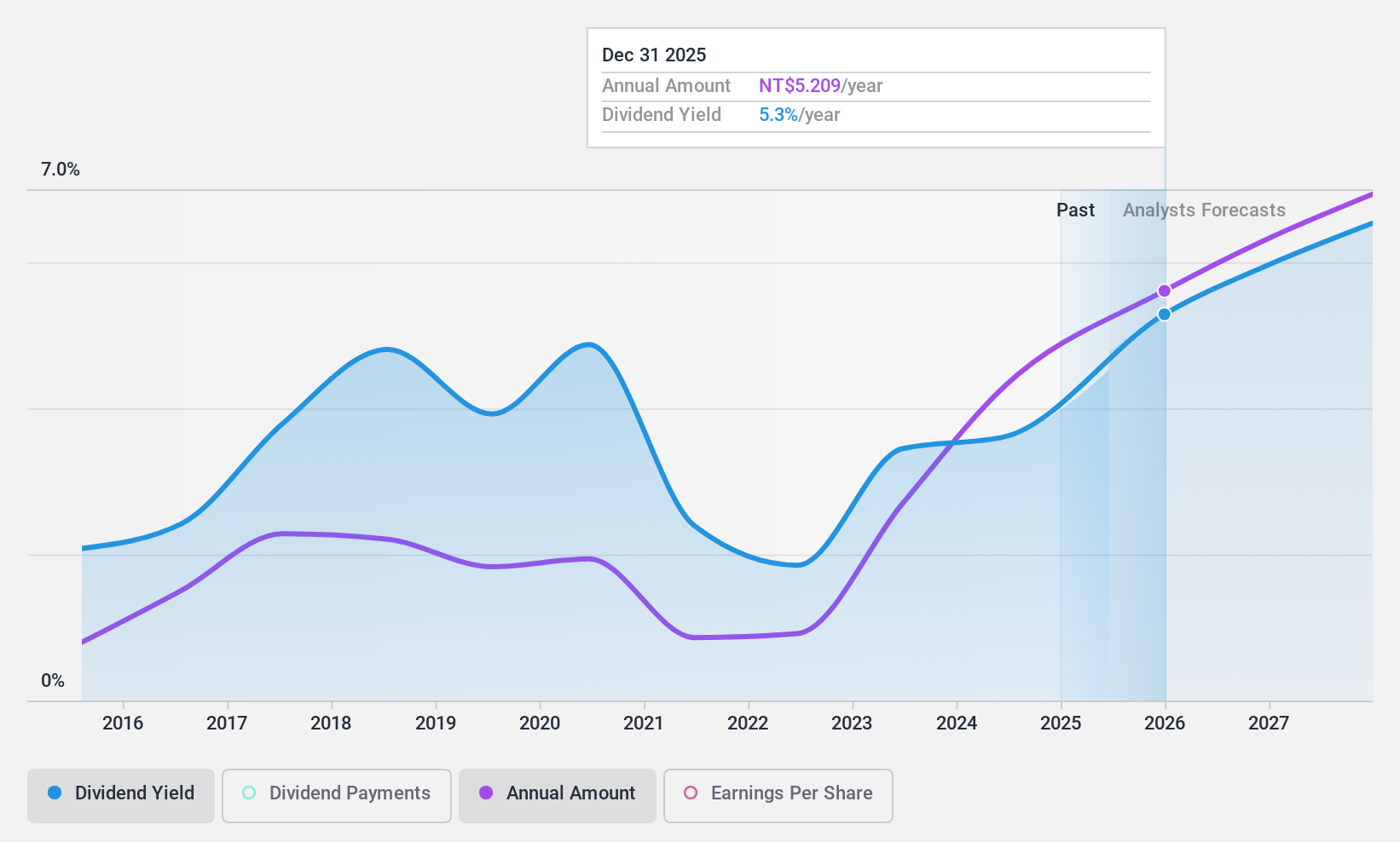

Tong Yang Industry (TWSE:1319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Industry Co., Ltd. manufactures and sells automotive and motorcycle parts, components, and models in Taiwan, China, the United States, and internationally with a market cap of NT$64.47 billion.

Operations: Tong Yang Industry Co., Ltd.'s revenue segments include the manufacture and sale of automotive and motorcycle parts, components, and models in Taiwan, China, the United States, and other international markets.

Dividend Yield: 3.7%

Tong Yang Industry's dividends are supported by earnings and cash flows, with payout ratios of 59.4% and 56.1%, respectively. Despite a volatile dividend history over the past decade, recent earnings growth of TWD 1.04 billion for Q2 2024 suggests improved sustainability. However, its dividend yield of 3.67% is below the top quartile in Taiwan's market, highlighting potential limitations for income-focused investors seeking high yields from stable payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Tong Yang Industry.

- In light of our recent valuation report, it seems possible that Tong Yang Industry is trading behind its estimated value.

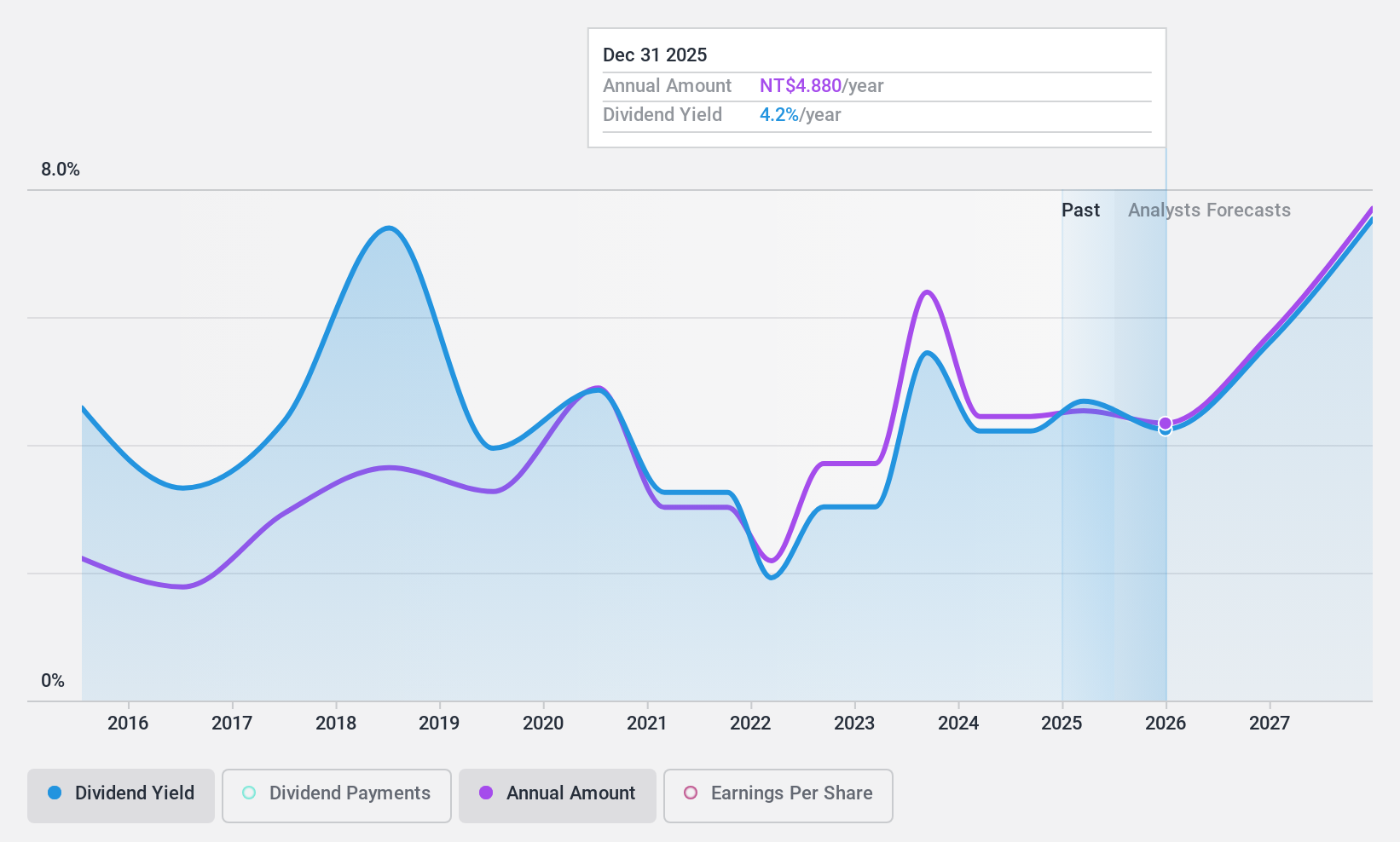

Fulgent Sun International (Holding) (TWSE:9802)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fulgent Sun International (Holding) Co., Ltd., along with its subsidiaries, is engaged in the production and sale of sports and leisure outdoor footwear in Taiwan, with a market cap of NT$21.51 billion.

Operations: Fulgent Sun International (Holding) Co., Ltd. generates revenue primarily from its production and sales of sports and leisure outdoor footwear, amounting to NT$13.90 billion.

Dividend Yield: 4.4%

Fulgent Sun International's dividends are covered by earnings and cash flows, with payout ratios of 66.8% and 39.8%, respectively, despite a volatile history over the past decade. The dividend yield of 4.42% ranks in Taiwan's top quartile, though recent earnings declines—net income dropped to TWD 102.29 million for Q3 2024 from TWD 338.47 million a year ago—may impact future payouts amid ongoing equity offerings and private placements totaling over TWD 1 billion.

- Click here to discover the nuances of Fulgent Sun International (Holding) with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Fulgent Sun International (Holding) is priced higher than what may be justified by its financials.

Next Steps

- Get an in-depth perspective on all 2033 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002315

Focus Technology

Operates e-commerce platforms in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives