- Taiwan

- /

- Auto Components

- /

- TWSE:6605

Depo Auto Parts Industrial (TPE:6605) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Depo Auto Parts Industrial Co., Ltd. (TPE:6605) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Depo Auto Parts Industrial

What Is Depo Auto Parts Industrial's Net Debt?

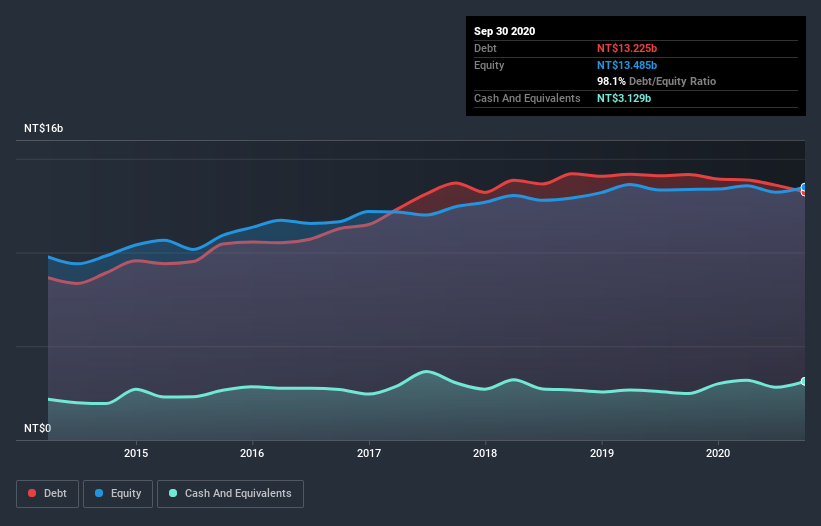

As you can see below, Depo Auto Parts Industrial had NT$13.2b of debt at September 2020, down from NT$14.2b a year prior. However, it also had NT$3.13b in cash, and so its net debt is NT$10.1b.

How Healthy Is Depo Auto Parts Industrial's Balance Sheet?

We can see from the most recent balance sheet that Depo Auto Parts Industrial had liabilities of NT$10.9b falling due within a year, and liabilities of NT$7.30b due beyond that. On the other hand, it had cash of NT$3.13b and NT$2.57b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$12.5b.

When you consider that this deficiency exceeds the company's NT$10.00b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Depo Auto Parts Industrial's debt is 2.9 times its EBITDA, and its EBIT cover its interest expense 2.6 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, Depo Auto Parts Industrial's EBIT was down 36% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Depo Auto Parts Industrial will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Depo Auto Parts Industrial recorded free cash flow of 48% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Mulling over Depo Auto Parts Industrial's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. We're quite clear that we consider Depo Auto Parts Industrial to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Depo Auto Parts Industrial you should be aware of, and 2 of them are potentially serious.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Depo Auto Parts Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6605

Depo Auto Parts Industrial

Manufactures and sells automotive and other related lighting products in Taiwan, Asia, and Americas.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026