- Taiwan

- /

- Auto Components

- /

- TWSE:4566

Is GLOBAL TEK FABRICATION CO., Ltd. (TPE:4566) At Risk Of Cutting Its Dividend?

Dividend paying stocks like GLOBAL TEK FABRICATION CO., Ltd. (TPE:4566) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

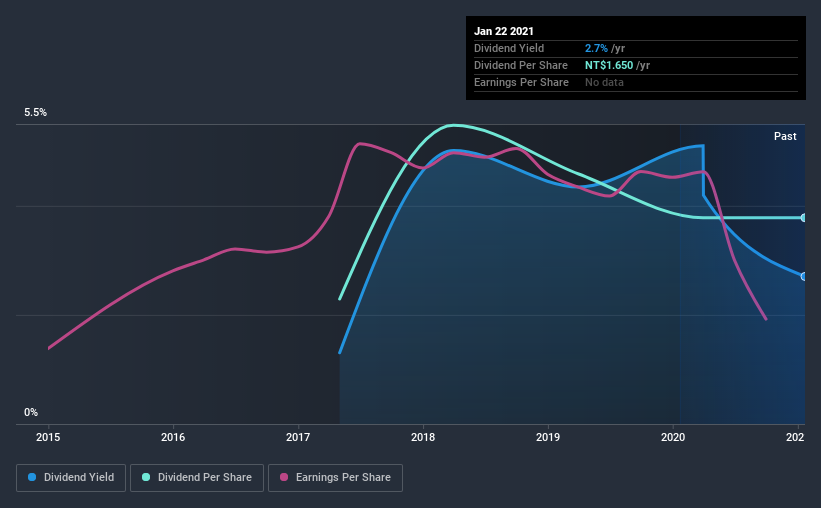

Investors might not know much about GLOBAL TEK FABRICATION's dividend prospects, even though it has been paying dividends for the last four years and offers a 2.7% yield. While the yield may not look too great, the relatively long payment history is interesting. That said, the recent jump in the share price will make GLOBAL TEK FABRICATION's dividend yield look smaller, even though the company prospects could be improving. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on GLOBAL TEK FABRICATION!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, GLOBAL TEK FABRICATION paid out 118% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. GLOBAL TEK FABRICATION paid out 99% of its free cash flow last year, which we think is concerning if cash flows do not improve. As GLOBAL TEK FABRICATION's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

While the above analysis focuses on dividends relative to a company's earnings, we do note GLOBAL TEK FABRICATION's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on GLOBAL TEK FABRICATION every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that GLOBAL TEK FABRICATION has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past four-year period, the first annual payment was NT$1.0 in 2017, compared to NT$1.7 last year. Dividends per share have grown at approximately 13% per year over this time.

GLOBAL TEK FABRICATION has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. In the last five years, GLOBAL TEK FABRICATION's earnings per share have shrunk at approximately 7.3% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's a concern to see that the company paid out such a high percentage of its earnings and cashflow as dividends. Earnings per share are down, and to our mind GLOBAL TEK FABRICATION has not been paying a dividend long enough to demonstrate its resilience across economic cycles. There are a few too many issues for us to get comfortable with GLOBAL TEK FABRICATION from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 4 warning signs for GLOBAL TEK FABRICATION that investors should know about before committing capital to this stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading GLOBAL TEK FABRICATION or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:4566

GLOBAL TEK FABRICATION

Manufactures and sells precision parts and subassemblies in China and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion