- Taiwan

- /

- Auto Components

- /

- TPEX:2235

Are I Yuan Precision Industrial's (GTSM:2235) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding I Yuan Precision Industrial (GTSM:2235).

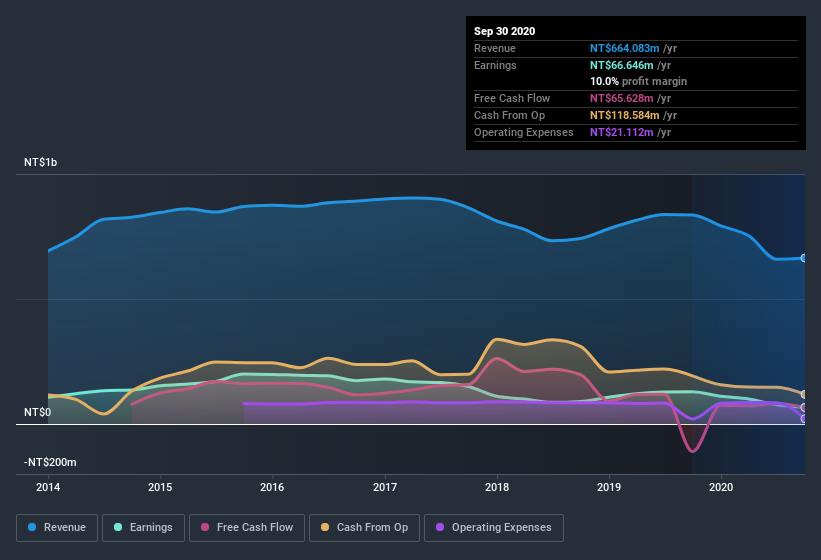

We like the fact that I Yuan Precision Industrial made a profit of NT$66.6m on its revenue of NT$664.1m, in the last year. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

View our latest analysis for I Yuan Precision Industrial

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted I Yuan Precision Industrial's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of I Yuan Precision Industrial.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that I Yuan Precision Industrial's profit was reduced by NT$13m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect I Yuan Precision Industrial to produce a higher profit next year, all else being equal.

Our Take On I Yuan Precision Industrial's Profit Performance

Unusual items (expenses) detracted from I Yuan Precision Industrial's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that I Yuan Precision Industrial's statutory profit actually understates its earnings potential! On the other hand, its EPS actually shrunk in the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 4 warning signs for I Yuan Precision Industrial you should be mindful of and 1 of these is potentially serious.

Today we've zoomed in on a single data point to better understand the nature of I Yuan Precision Industrial's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade I Yuan Precision Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:2235

I Yuan Precision Industrial

Manufactures, processes, trades in, imports, and exports auto parts and components in Taiwan, Asia, America, and Europe.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion