- United Arab Emirates

- /

- Capital Markets

- /

- ADX:WAHA

Discovering Undiscovered Gems in December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators, with U.S. stocks experiencing moderate gains amid a holiday-shortened week. While large-cap growth stocks have recently led the charge, small-cap indices like the Russell 2000 have shown more modest performance, highlighting the potential for undiscovered opportunities within this segment. In such an environment, identifying promising small-cap stocks often involves seeking companies with strong fundamentals that can weather economic uncertainties and capitalize on niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across various sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate, and capital markets with a market capitalization of AED3.25 billion.

Operations: Revenue from private investments, excluding Waha Land, amounts to AED149.88 million.

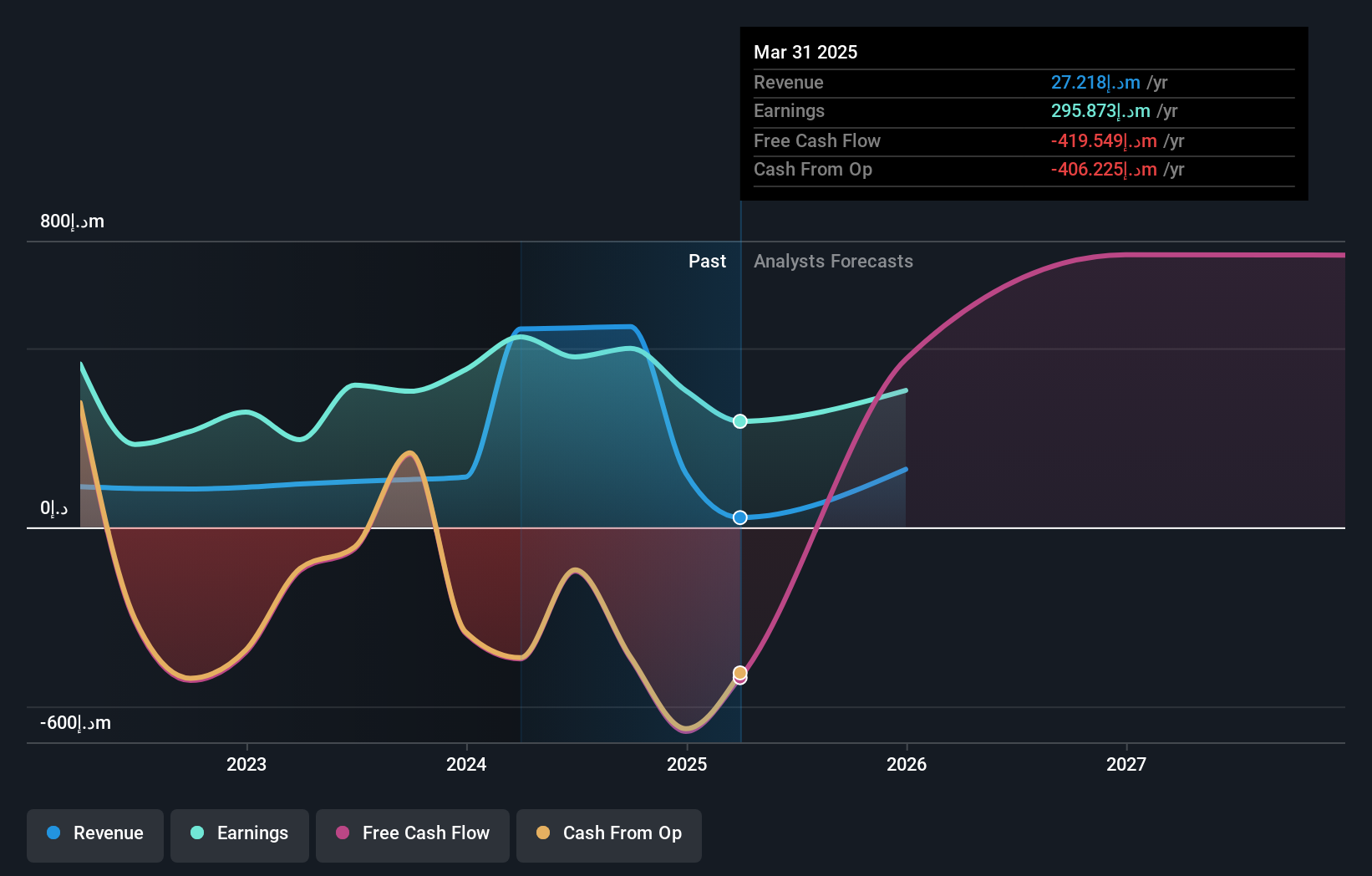

Al Waha Capital, a notable player in the capital markets, has shown impressive growth with earnings increasing by 31.6% over the past year, outpacing the industry average of 26%. The company reported a net income of AED 77.56 million for Q3 2024, up from AED 53.63 million in the previous year. Its price-to-earnings ratio stands at an attractive 6.5x compared to the AE market's average of 13.2x, suggesting potential undervaluation. Additionally, Al Waha's debt-to-equity ratio has improved significantly from 140% to just under 68% over five years, indicating better financial health and management efficiency.

- Click here and access our complete health analysis report to understand the dynamics of Al Waha Capital PJSC.

Gain insights into Al Waha Capital PJSC's past trends and performance with our Past report.

Société Fermière du Casino Municipal de Cannes (ENXTPA:FCMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Société Fermière du Casino Municipal de Cannes operates casinos and hotels in France with a market capitalization of €271.18 million.

Operations: The company generates revenue primarily from its hotel business (€127.84 million) and casinos (€17.25 million). The hotel segment is the major contributor to its revenue stream.

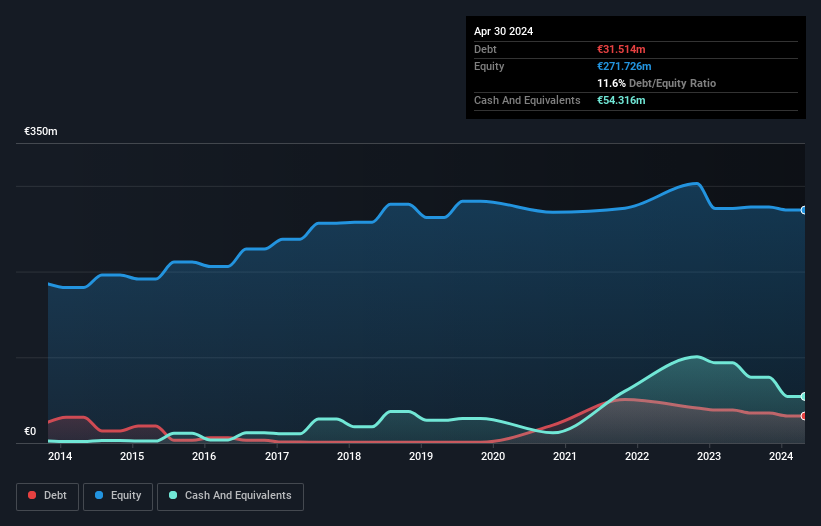

Société Fermière du Casino Municipal de Cannes, a smaller player in the hospitality sector, has shown impressive growth with earnings surging by 58% over the past year, outpacing the industry average of 11.1%. The company's debt-to-equity ratio has increased from 0.3 to 11.6 over five years, yet it holds more cash than total debt, suggesting financial stability. Trading at 16.2% below its estimated fair value adds to its appeal as an investment opportunity. Despite these positives, careful consideration of its rising leverage is advised for potential investors looking into this intriguing stock in the hospitality space.

Aygaz (IBSE:AYGAZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Aygaz A.S. is engaged in purchasing liquid petroleum gas (LPG) for distribution to retailers across Turkey, with a market capitalization of TRY36.27 billion.

Operations: Aygaz generates revenue primarily from LPG and natural gas sales, amounting to TRY55.46 billion, with additional income from cargo transportation and distribution contributing TRY882.96 million.

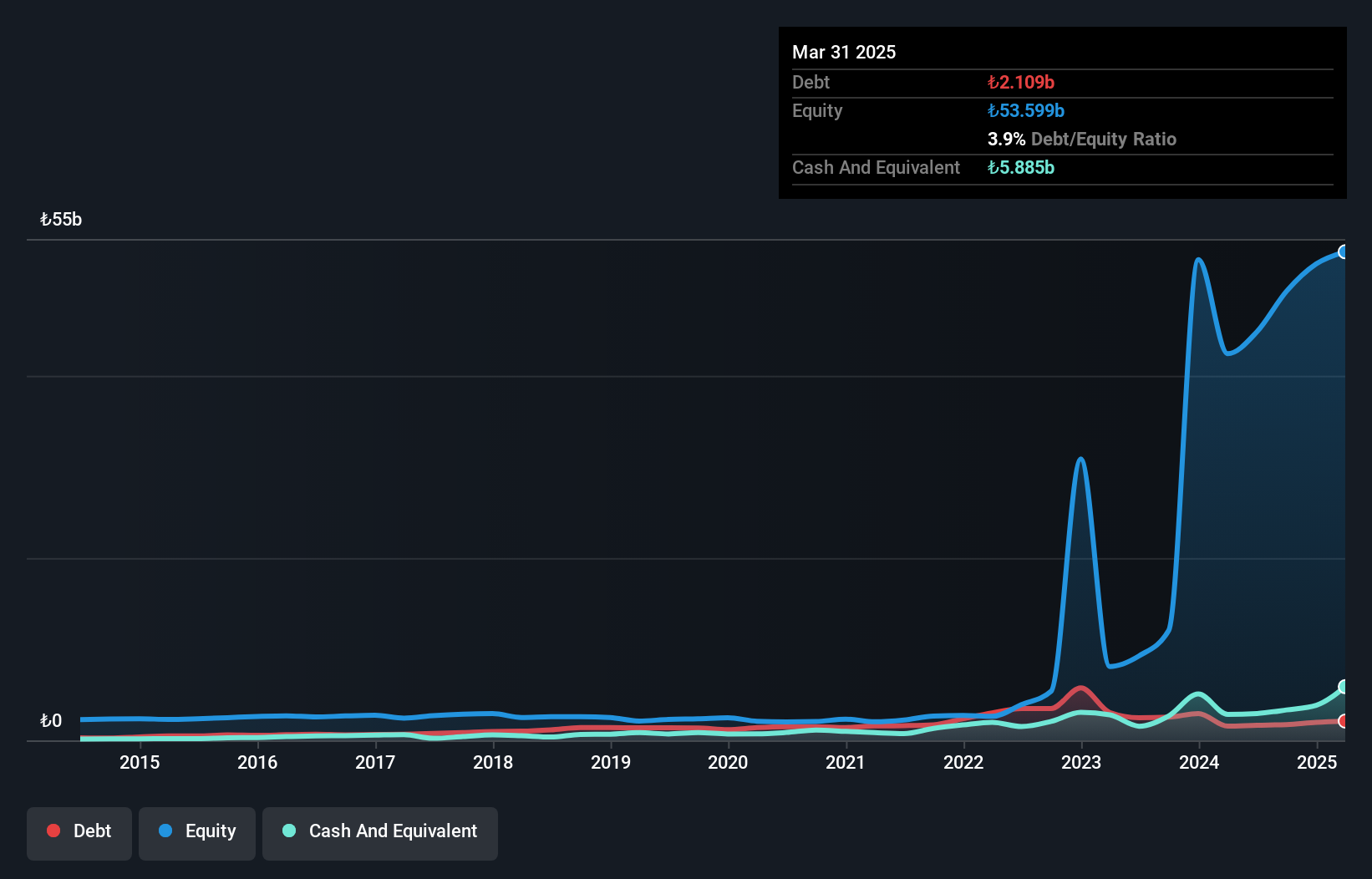

Aygaz, a notable player in the gas utilities sector, has seen its debt to equity ratio significantly drop from 56.9% to 3.5% over five years, indicating strong financial management. Despite this positive trend, recent earnings have shown a decrease with net income for the third quarter at TRY 1,046 million compared to TRY 1,225 million last year. The company trades at an attractive value of 26.4% below estimated fair value and maintains high-quality earnings even as revenue is expected to grow by over 27% annually. However, projected average annual earnings decline of 11.6% remains a concern for future prospects.

- Delve into the full analysis health report here for a deeper understanding of Aygaz.

Review our historical performance report to gain insights into Aygaz's's past performance.

Where To Now?

- Click this link to deep-dive into the 4629 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:WAHA

Al Waha Capital PJSC

A private equity firm which manages assets across several sectors, including financial services and fintech, healthcare, energy, infrastructure, industrial real estate and capital markets.

Proven track record with adequate balance sheet.