Global markets have been buoyant, with U.S. stocks reaching record highs following a "red sweep" in the elections, sparking optimism around growth and tax reforms. In this context of shifting economic policies and market enthusiasm, investors may find opportunities in penny stocks—a term that might seem outdated but still holds relevance for those seeking growth potential in smaller or newer companies. These stocks can offer significant returns when they are backed by strong financial health, making them an intriguing option for uncovering hidden value.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.29B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.06 | THB1.67B | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £864.67M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.02B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.75 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,752 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market cap of TRY3.65 billion.

Operations: The company's revenue is primarily derived from its operations in Turkey, with segments including Banking at TRY739.15 million, Holding at TRY6.35 million, Factoring at TRY1.03 billion, and Marine activities both domestically and internationally generating TRY960.79 million.

Market Cap: TRY3.65B

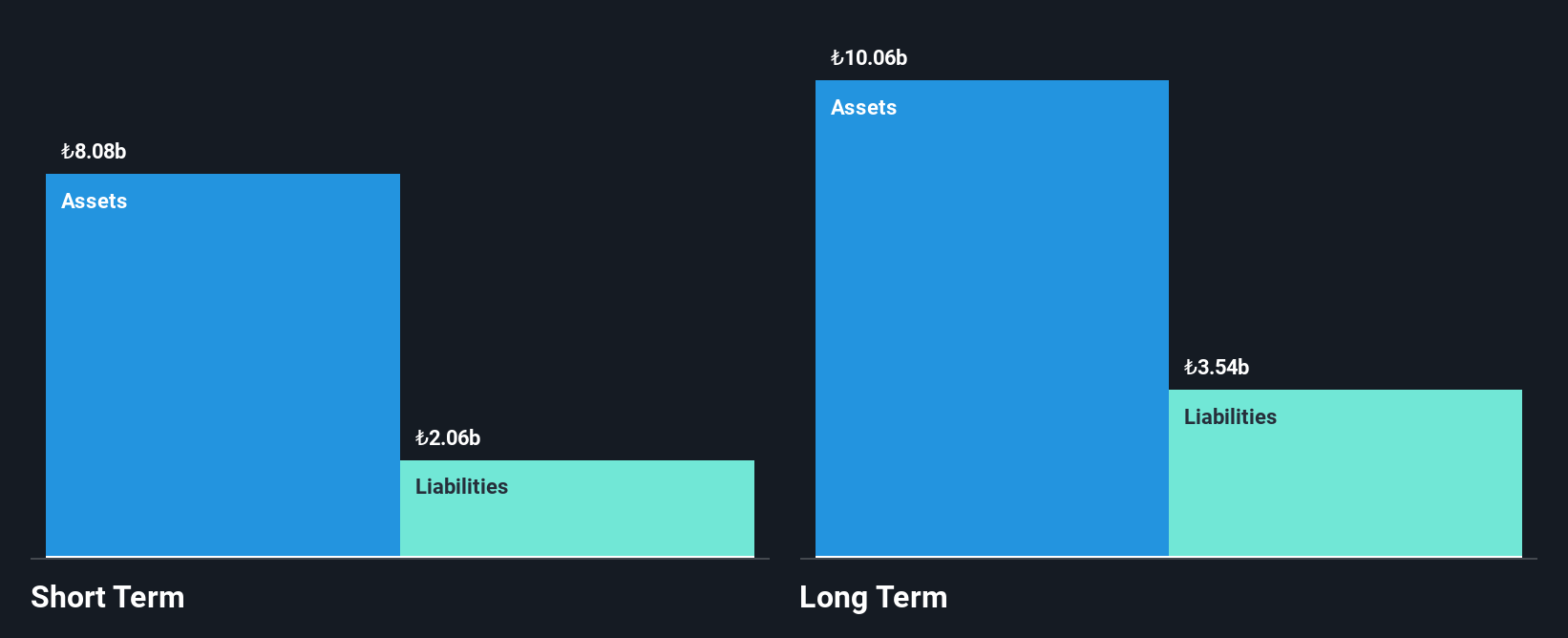

GSD Holding A.S. operates across diverse sectors, with a significant focus on financial activities in Turkey, generating TRY2.73 billion in revenue across banking, factoring, and marine operations. Despite being unprofitable with a negative return on equity of -23.65%, the company has shown improvement by reporting net income of TRY82.84 million for Q3 2024 compared to a substantial loss the previous year. The firm maintains more cash than debt and has sufficient short-term assets to cover liabilities, offering some financial stability despite its recent removal from the S&P Global BMI Index due to performance issues.

- Unlock comprehensive insights into our analysis of GSD Holding stock in this financial health report.

- Learn about GSD Holding's historical performance here.

i-Control Holdings (SEHK:1402)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: i-Control Holdings Limited is an investment holding company offering video conferencing and multimedia audiovisual solutions in Hong Kong, the People's Republic of China, Macau, and Singapore, with a market cap of HK$341.41 million.

Operations: The company generates revenue primarily from the Provision of VCMA Solution and Maintenance Services, amounting to HK$121.88 million, and the Provision of Cloud-Based IT+OT Managed Services, contributing HK$8.31 million.

Market Cap: HK$341.41M

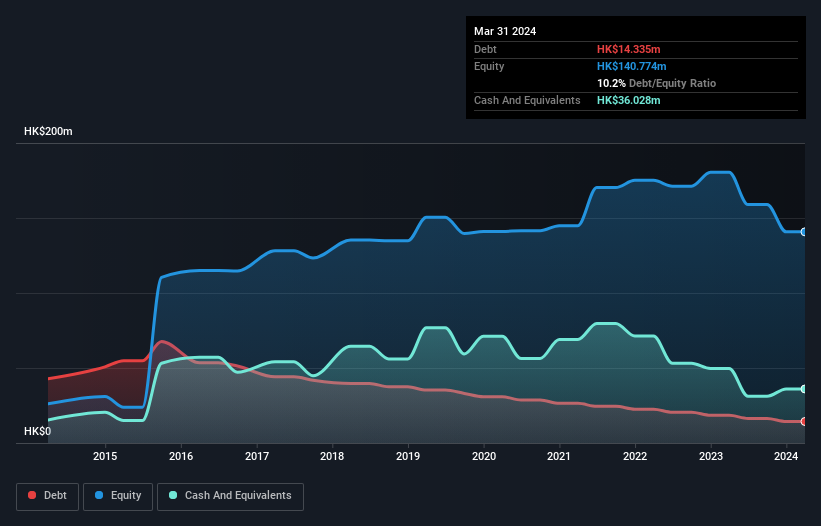

i-Control Holdings Limited, with a market cap of HK$341.41 million, operates in the audiovisual solutions sector across several Asian markets. Despite its unprofitability and an expected net loss between HK$14.0 million and HK$18.0 million for the period ending September 2024, the company maintains financial resilience with short-term assets exceeding both short- and long-term liabilities. The board's experience is notable with an average tenure of 9.5 years, complemented by recent strategic leadership changes including Ms. Ho Wing Shan's appointment as a non-executive director, bringing extensive banking industry expertise to the table.

- Dive into the specifics of i-Control Holdings here with our thorough balance sheet health report.

- Explore historical data to track i-Control Holdings' performance over time in our past results report.

Linekong Interactive Group (SEHK:8267)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linekong Interactive Group Co., Ltd. is an investment holding company that develops and publishes online games in China and internationally, with a market cap of HK$176.61 million.

Operations: The company's revenue is derived from two main segments: the Film Business, contributing CN¥49.34 million, and the Game Business, generating CN¥46.42 million.

Market Cap: HK$176.61M

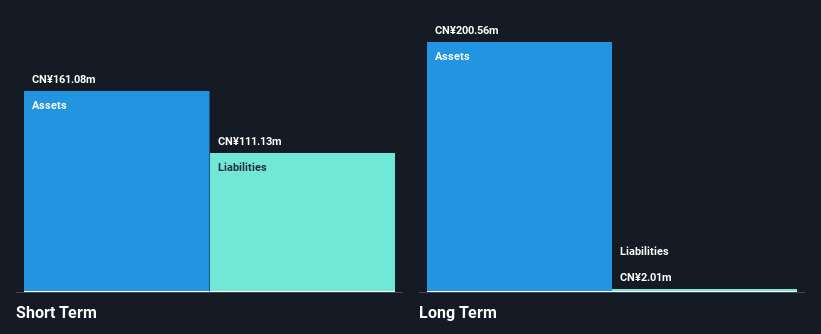

Linekong Interactive Group, with a market cap of HK$176.61 million, operates primarily in the Film and Game Business segments, generating CN¥49.34 million and CN¥46.42 million respectively. Despite being unprofitable, the company has reduced losses over five years by 23.8% annually and maintains a strong financial position with short-term assets of CN¥161.1M surpassing both short- and long-term liabilities. The company is debt-free, offering a stable cash runway exceeding three years if free cash flow continues to grow at historical rates. Recent leadership changes include the resignation of executive director Chen Hao for personal development reasons.

- Click here to discover the nuances of Linekong Interactive Group with our detailed analytical financial health report.

- Examine Linekong Interactive Group's past performance report to understand how it has performed in prior years.

Taking Advantage

- Discover the full array of 5,752 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if i-Control Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1402

i-Control Holdings

An investment holding company, provides video conferencing and multimedia audiovisual (VCMA) solutions in Hong Kong, the People’s Republic of China, Macau, and Singapore.

Excellent balance sheet low.

Market Insights

Community Narratives