- Turkey

- /

- Wireless Telecom

- /

- IBSE:TCELL

Middle Eastern Dividend Stocks To Watch In October 2025

Reviewed by Simply Wall St

As most Gulf markets see gains with investors closely monitoring earnings, the Saudi bourse experiences a decline due to banking sector challenges, reflecting a mixed sentiment across the Middle Eastern financial landscape. In this environment, dividend stocks can offer stability and potential income streams for investors looking to navigate the current market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.49% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.48% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.68% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.43% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.22% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.09% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.29% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.15% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.99% | ★★★★★☆ |

Click here to see the full list of 70 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

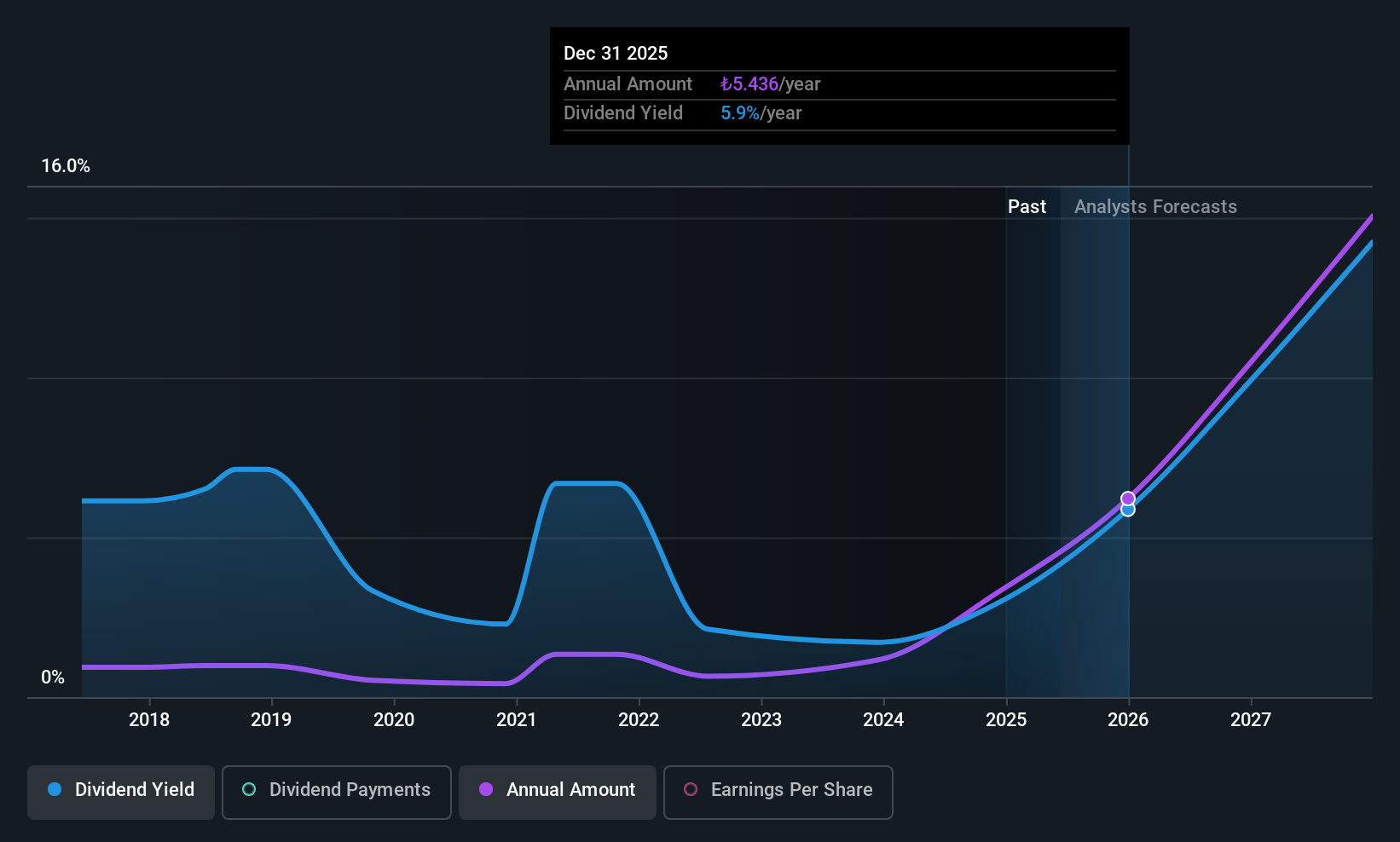

Turkiye Garanti Bankasi (IBSE:GARAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey and has a market cap of TRY521.64 billion.

Operations: Turkiye Garanti Bankasi A.S. generates revenue through its Retail Banking segment with TRY177.10 billion and Corporate Banking segment with TRY167.70 billion.

Dividend Yield: 3.5%

Turkiye Garanti Bankasi's dividend payments are well-covered by earnings, with a low payout ratio of 18.4%, suggesting sustainability despite an unstable track record over the past decade. Its dividends rank in the top 25% of payers in Turkey, though they have been volatile historically. Recent financial results show strong growth in net interest income and net income, indicating robust underlying profitability. The bank also completed a $700 million subordinated note issuance, enhancing its capital structure.

- Click here to discover the nuances of Turkiye Garanti Bankasi with our detailed analytical dividend report.

- Our valuation report unveils the possibility Turkiye Garanti Bankasi's shares may be trading at a discount.

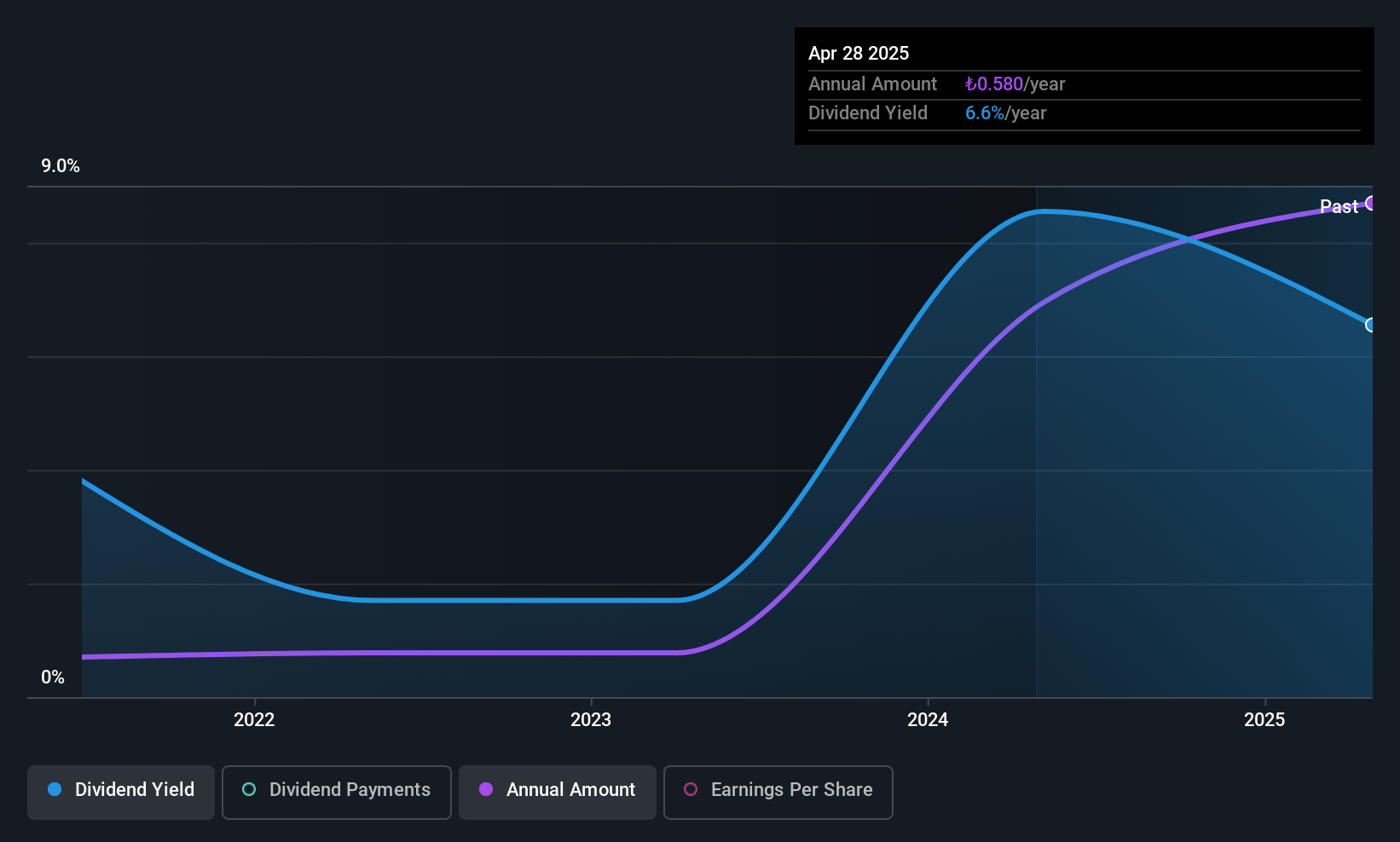

Naturelgaz Sanayi ve Ticaret (IBSE:NTGAZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Naturelgaz Sanayi ve Ticaret A.S. operates in Turkey, focusing on the purchase, compression, transportation, and delivery of natural gas, with a market cap of TRY6.70 billion.

Operations: Naturelgaz Sanayi ve Ticaret A.S. generates revenue primarily from its Non-Regulated Utility segment, amounting to TRY6.24 billion.

Dividend Yield: 6%

Naturelgaz Sanayi ve Ticaret offers a compelling dividend yield of 5.97%, placing it in the top quartile of Turkish dividend payers. Despite only four years of consistent payments, dividends have grown steadily and are well-covered by both earnings and cash flows, with payout ratios at 58% and 57%, respectively. Recent financial performance is strong, with net income for the first half of 2025 reaching TRY 428.88 million, up significantly from the previous year.

- Get an in-depth perspective on Naturelgaz Sanayi ve Ticaret's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Naturelgaz Sanayi ve Ticaret's share price might be too pessimistic.

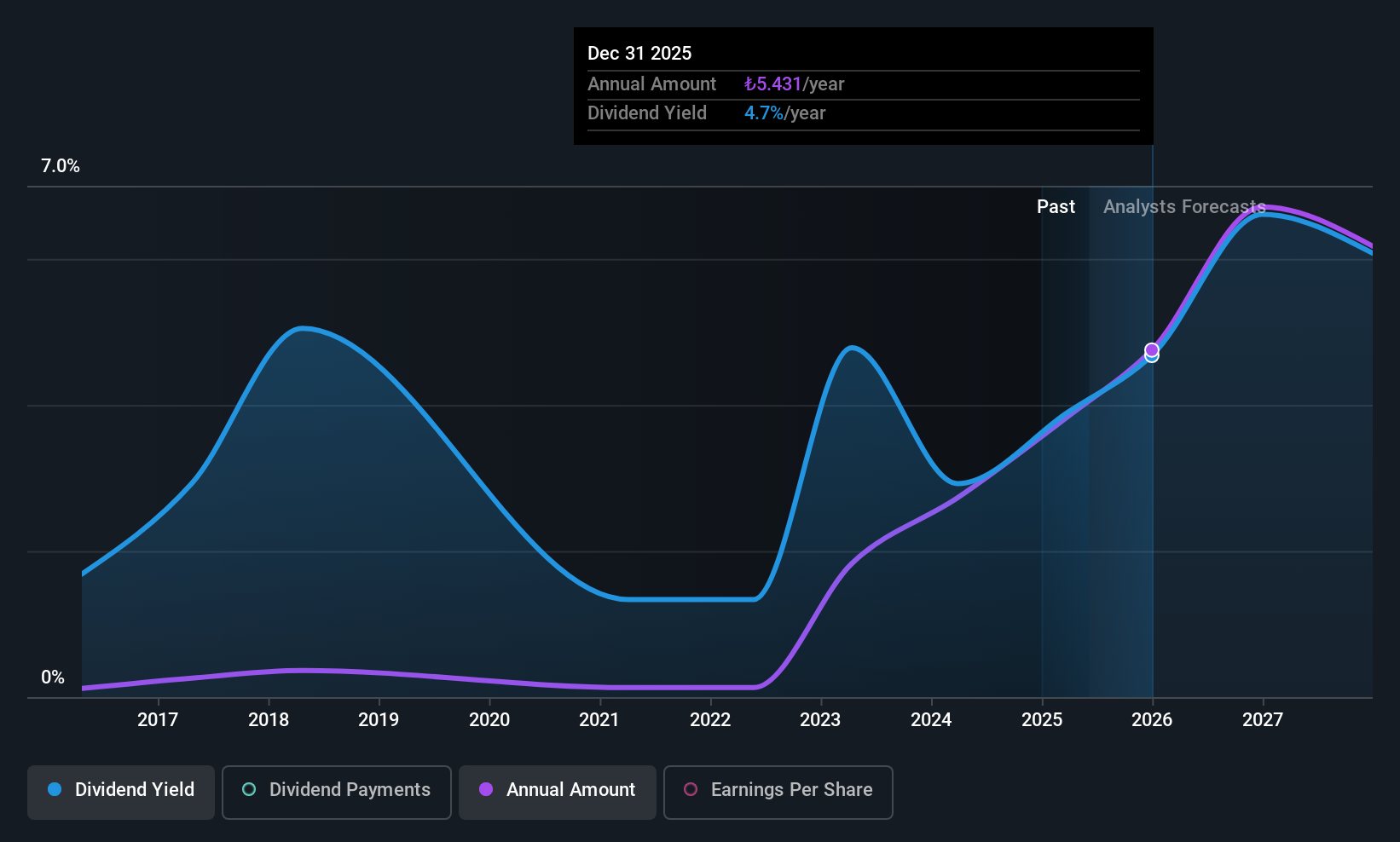

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S., along with its subsidiaries, offers converged telecommunication and technology services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY210.88 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily through its Turkcell Turkey segment, which accounts for TRY153.66 billion, and its Techfin segment, contributing TRY9.88 billion.

Dividend Yield: 3.8%

Turkcell Iletisim Hizmetleri's dividend yield of 3.75% ranks within the top 25% in Turkey, supported by a low cash payout ratio of 20.8%. However, dividends have been volatile over the past decade. Recent earnings show robust sales growth, though profit margins have declined from last year. The company's recent acquisition of a significant portion of Turkey's 5G spectrum for US$1.22 billion could bolster its technological leadership and long-term revenue potential despite requiring substantial investment.

- Click here and access our complete dividend analysis report to understand the dynamics of Turkcell Iletisim Hizmetleri.

- Insights from our recent valuation report point to the potential undervaluation of Turkcell Iletisim Hizmetleri shares in the market.

Turning Ideas Into Actions

- Click here to access our complete index of 70 Top Middle Eastern Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turkcell Iletisim Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TCELL

Turkcell Iletisim Hizmetleri

Provides converged telecommunication and technology services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives