- Turkey

- /

- Diversified Financial

- /

- IBSE:BRYAT

Undiscovered Gems in Middle East Stocks to Watch This July 2025

Reviewed by Simply Wall St

As Gulf stocks remain steady amid investor anticipation for clarity on U.S. trade policies, the Middle East market continues to demonstrate resilience with mixed performances across key indices. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can navigate the current geopolitical and economic landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★★

Overview: Borusan Yatirim ve Pazarlama A.S. is an investment company that, along with its subsidiaries, focuses on investing in the industrial, commercial, and service sectors with a market capitalization of TRY53.07 billion.

Operations: BRYAT generates revenue through its investments in industrial, commercial, and service sectors. The company has a market capitalization of TRY53.07 billion.

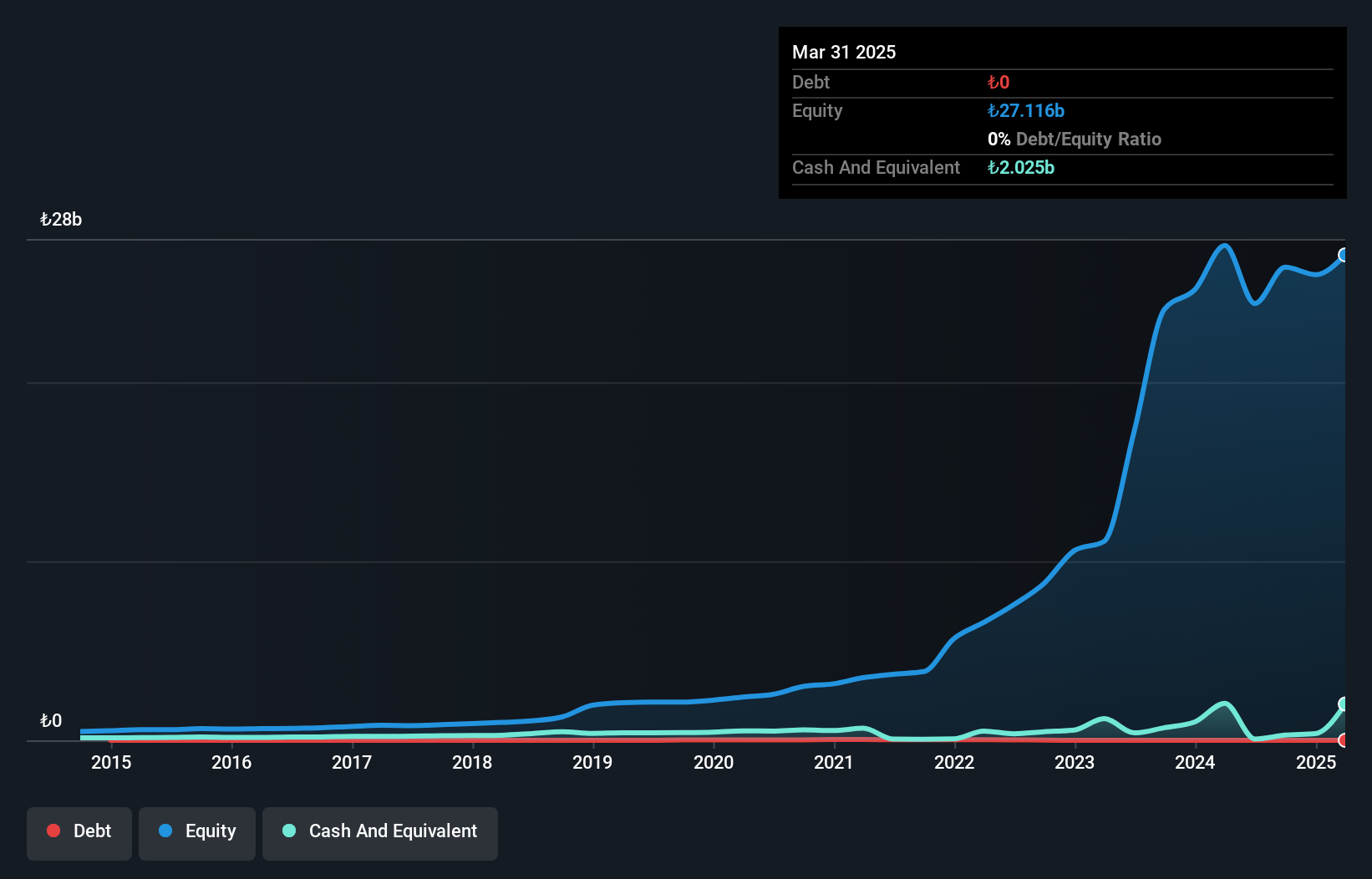

Borusan Yatirim ve Pazarlama, a nimble player in the financial sector, showcases impressive earnings growth of 48.4% annually over the past five years. With no debt and high-quality earnings, it navigates its market with confidence. The company reported TRY 355 million net income for Q1 2025, up from TRY 263.77 million last year, reflecting robust profitability despite its modest revenue size of TRY 90 million. However, its recent annual growth rate of 9.7% lags behind the industry average of 26.1%, suggesting room for improvement in competitive positioning within the diversified financial landscape.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★★☆

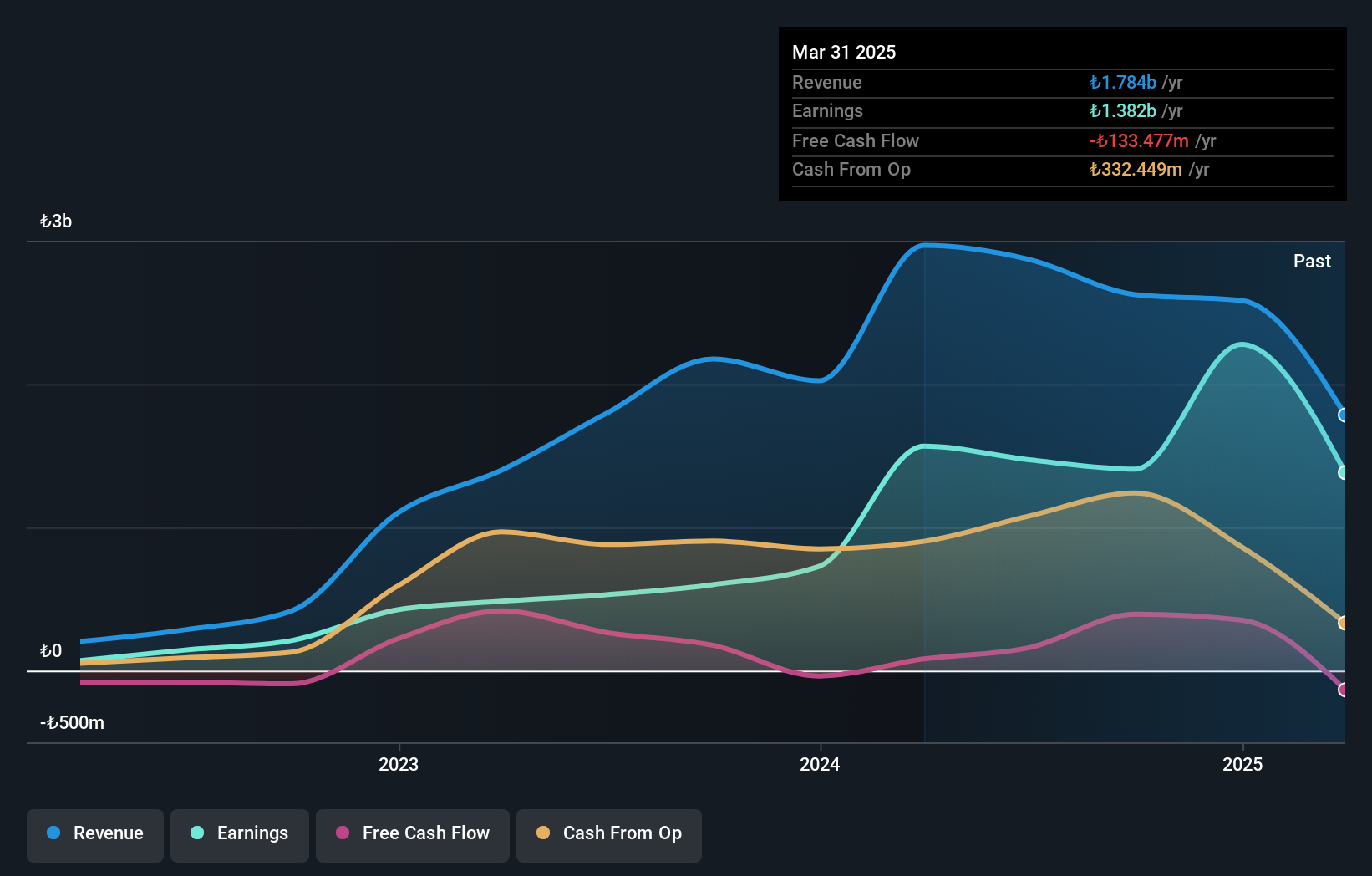

Overview: MIA Teknoloji Anonim Sirketi offers software development services to both public and private organizations in Turkey, with a market capitalization of TRY15.65 billion.

Operations: The primary revenue stream for MIA Teknoloji Anonim Sirketi is from its software and programming segment, generating TRY1.78 billion. The company's net profit margin is 12.5%, reflecting its profitability in the software development sector in Turkey.

MIA Teknoloji stands out with its satisfactory net debt to equity ratio of 2.4%, showcasing a solid financial footing. Despite a negative earnings growth of 11.8% last year, the company seems to maintain profitability, alleviating concerns about cash runway issues. Its price-to-earnings ratio at 11.3x is notably lower than the TR market average of 18.3x, suggesting potential undervaluation in the market context. High levels of non-cash earnings further highlight its operational efficiency, even as it navigates challenges within the software industry where average growth is pegged at 22%.

Kerur Holdings (TASE:KRUR)

Simply Wall St Value Rating: ★★★★★☆

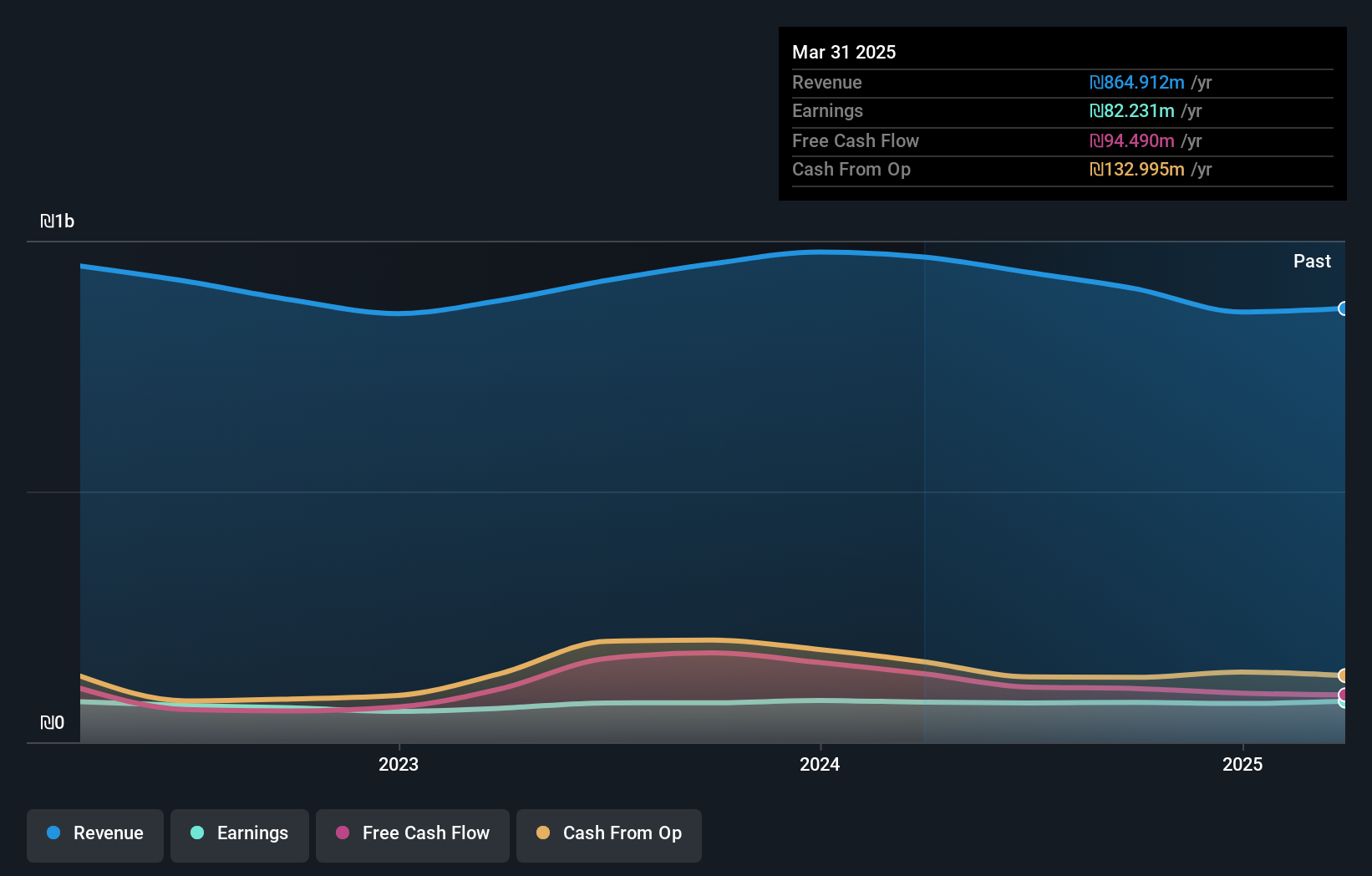

Overview: Kerur Holdings Ltd., with a market cap of ₪1.05 billion, operates in the food sector in Israel through its subsidiaries.

Operations: Kerur Holdings generates revenue primarily from its Beverage Production and Marketing Sector, contributing ₪830.80 million, followed by the Food Production and Marketing Sector at ₪334.16 million. The Recycling Sector adds a smaller portion of revenue at ₪34.11 million, while adjustments account for a deduction of -₪334.16 million in the financial statements.

Kerur Holdings, a promising player in the Middle Eastern market, has seen its earnings dip by 2.1% annually over the last five years. Despite this, it remains profitable with a debt-to-equity ratio rising modestly to 1.1%. The company boasts high-quality earnings and trades at a significant discount of 43.8% below estimated fair value. Recent results for Q1 2025 show sales climbing to ILS 188 million from ILS 181 million year-on-year, while net income jumped to ILS 13.82 million from ILS 8.9 million previously, indicating solid financial health and potential for growth in the future.

- Unlock comprehensive insights into our analysis of Kerur Holdings stock in this health report.

Evaluate Kerur Holdings' historical performance by accessing our past performance report.

Make It Happen

- Click this link to deep-dive into the 220 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borusan Yatirim ve Pazarlama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BRYAT

Borusan Yatirim ve Pazarlama

Invests in companies in the industrial, commercial and service sectors.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives