- Portugal

- /

- Wireless Telecom

- /

- ENXTLS:SNC

Unveiling Undiscovered Gems with Strong Potential December 2024

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence dipping and manufacturing orders declining, while major stock indexes like the S&P 500 and Nasdaq Composite posted moderate gains. In this climate of uncertainty and opportunity, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to navigate these complex conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi | 56.22% | 44.24% | 26.23% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Sonaecom SGPS (ENXTLS:SNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Sonaecom SGPS, S.A. operates globally through its subsidiaries in the technology, media, and telecommunications sectors with a market capitalization of €678.81 million.

Operations: Sonaecom SGPS generates revenue primarily from its media segment, contributing €16.38 million, followed by the technology segment at €3.02 million. The company also incurs costs related to holding activities amounting to €0.74 million.

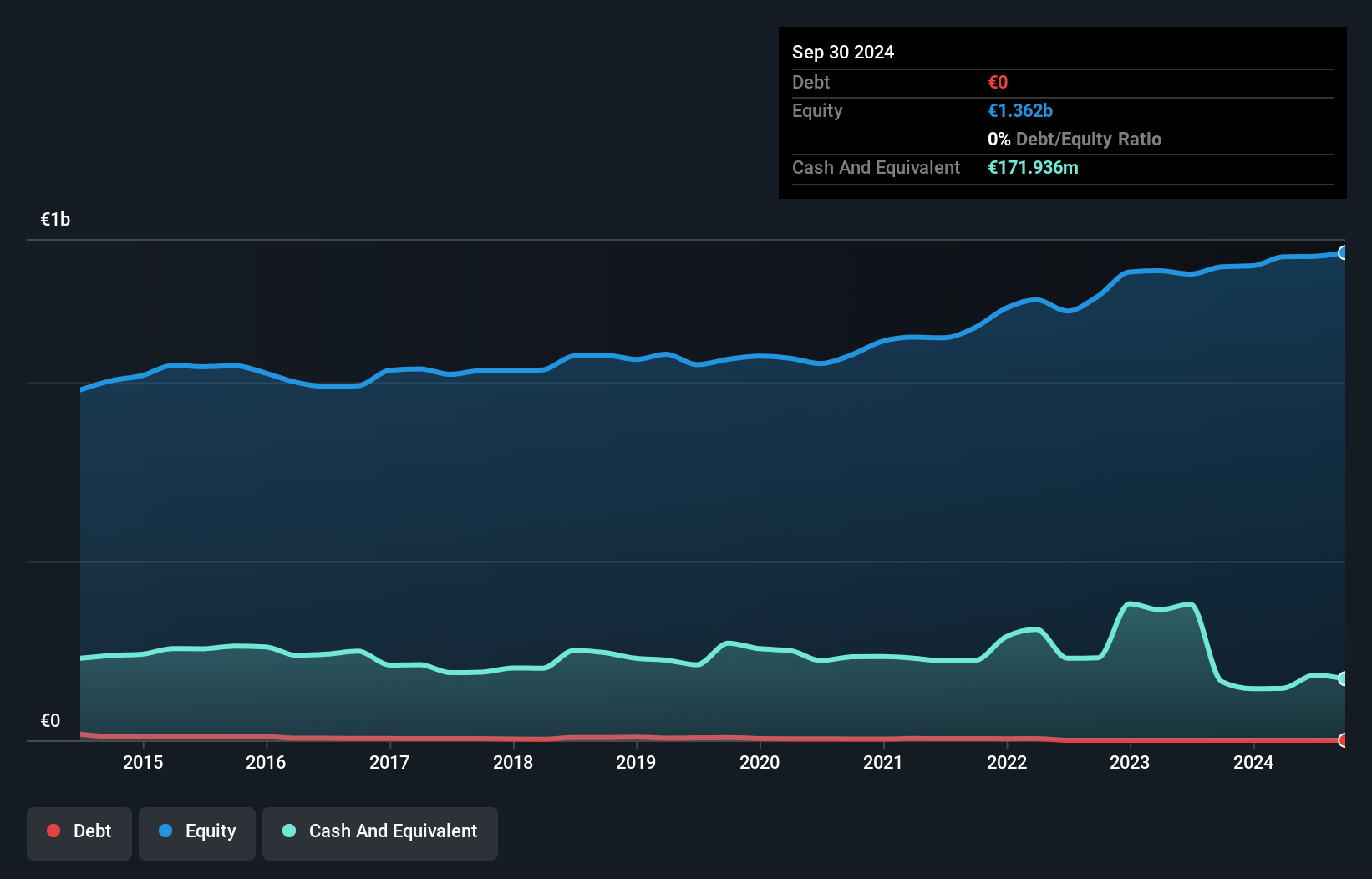

Sonaecom SGPS, a smaller player in the telecom sector, showcases intriguing dynamics with its recent financials. Despite a significant one-off loss of €19 million impacting results, earnings surged by 150% over the past year, outpacing industry growth. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 0.7%. With sales at €4.75 million for nine months ending September 2024 and net income jumping to €61.67 million from €33.63 million last year, Sonaecom's price-to-earnings ratio of 9.4x remains attractive against the broader Portuguese market average of 12x.

- Click to explore a detailed breakdown of our findings in Sonaecom SGPS' health report.

Evaluate Sonaecom SGPS' historical performance by accessing our past performance report.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust focusing on commercial properties, with a market capitalization of TRY32.40 billion.

Operations: Reysas Gayrimenkul Yatirim Ortakligi generates revenue primarily from its commercial real estate investments, reporting TRY3.53 billion in this segment. The company's financial performance is characterized by its gross profit margin trends over recent periods.

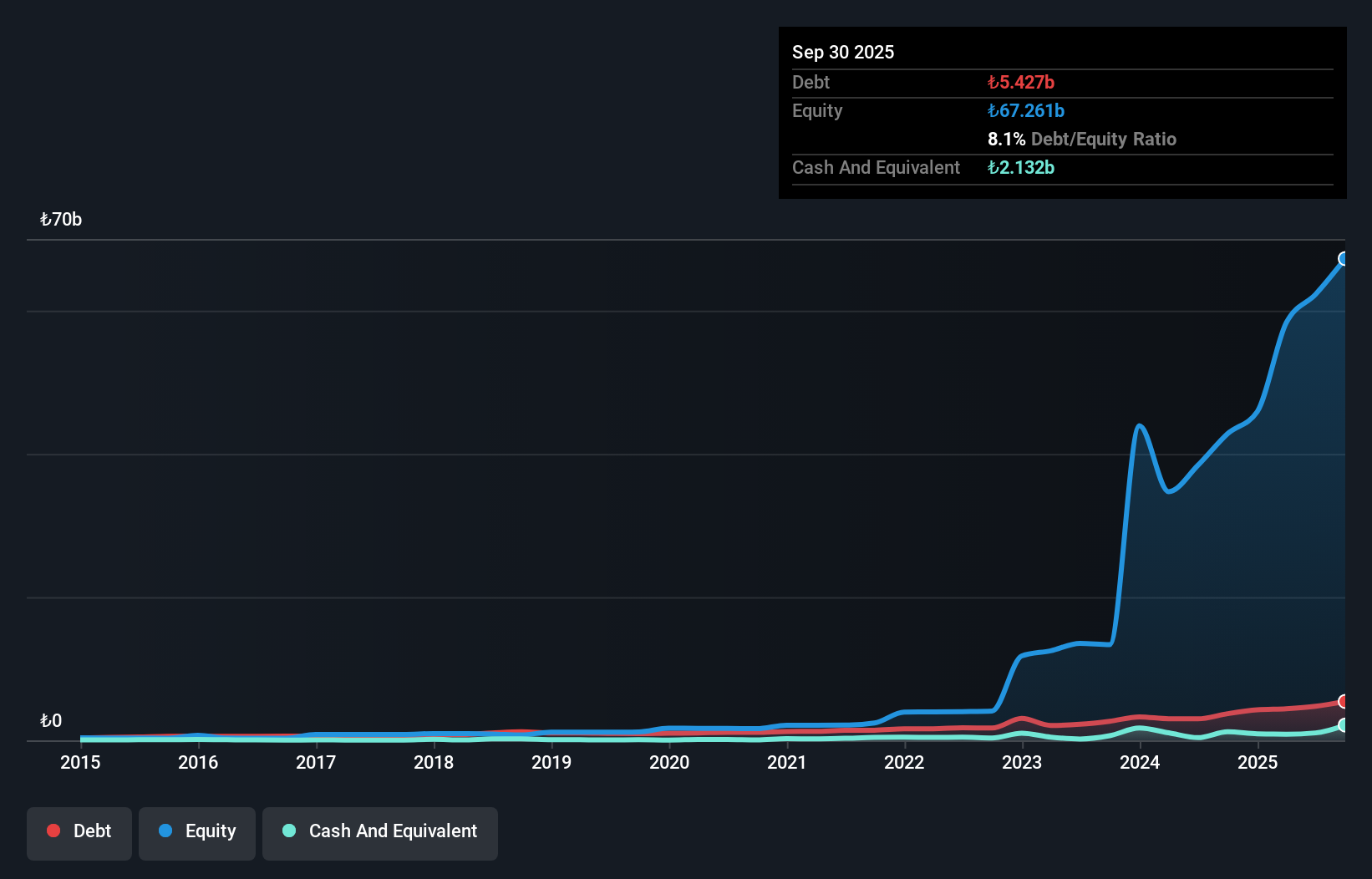

Reysas Gayrimenkul Yatirim Ortakligi showcases impressive financial health, with its debt to equity ratio plummeting from 79.8% to 8.7% over five years, indicating robust management of liabilities. The company enjoys a satisfactory net debt to equity ratio of 5.9%, reflecting sound fiscal discipline. Its earnings surged by 115.7% last year, outpacing the Industrial REITs sector's growth of 5.8%. Recent reports highlight significant sales growth for the third quarter at TRY 1,037 million compared to TRY 474 million previously and net income climbing from TRY 106 million to TRY 803 million, underscoring strong operational performance and potential value for investors seeking promising opportunities in emerging markets like Turkey's real estate sector.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both in Turkey and internationally, with a market capitalization of TRY46.80 billion.

Operations: Türk Tuborg generates revenue primarily from the sale of alcoholic beverages, amounting to TRY20.78 billion. The company's market capitalization is approximately TRY46.80 billion.

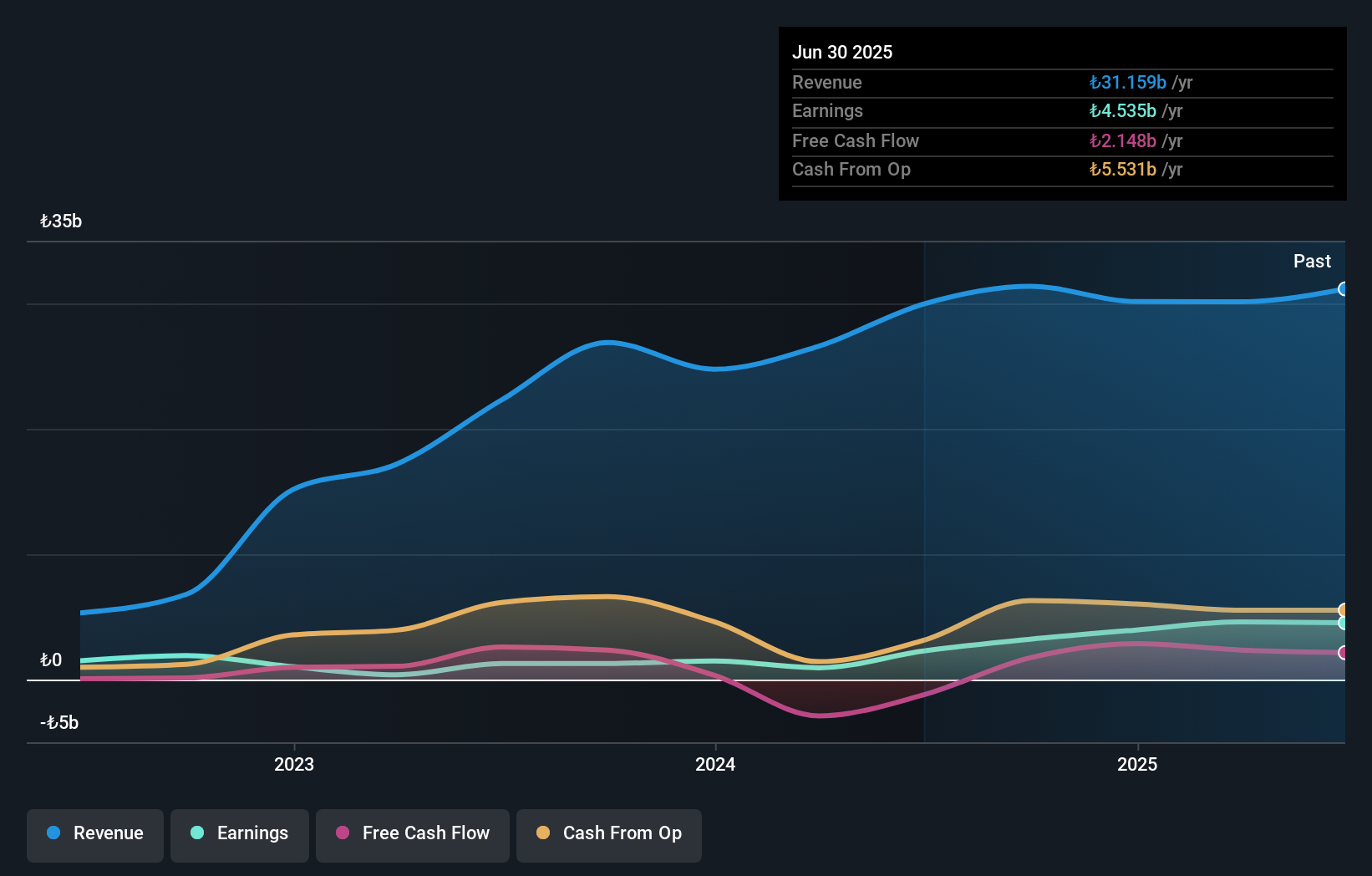

Türk Tuborg, a notable player in the beverage sector, has shown impressive growth with earnings surging 90.5% over the past year, outpacing industry averages. The company reported third-quarter sales of TRY 8.65 billion compared to TRY 7.25 billion last year, and net income jumped to TRY 1.69 billion from TRY 752 million. Its debt-to-equity ratio improved significantly from 30.8% to just 0.8% over five years, reflecting a robust financial structure with more cash than total debt and high-quality earnings contributing to its stability and potential for continued success in the market.

- Click here to discover the nuances of Türk Tuborg Bira ve Malt Sanayii with our detailed analytical health report.

Understand Türk Tuborg Bira ve Malt Sanayii's track record by examining our Past report.

Where To Now?

- Access the full spectrum of 4630 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:SNC

Sonaecom SGPS

Sonaecom, S.G.P.S., S.A., together with its subsidiaries, operates in technology, media, and telecommunications areas worldwide.

Flawless balance sheet with proven track record.