- United Arab Emirates

- /

- Hospitality

- /

- ADX:NCTH

Undiscovered Gems in Middle East to Watch April 2025

Reviewed by Simply Wall St

As most Gulf bourses experience gains driven by upbeat earnings and easing tariff concerns, the Middle East market is capturing attention with its resilience and growth potential. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate strong financial performance and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

National Corporation for Tourism and Hotels (ADX:NCTH)

Simply Wall St Value Rating: ★★★★★★

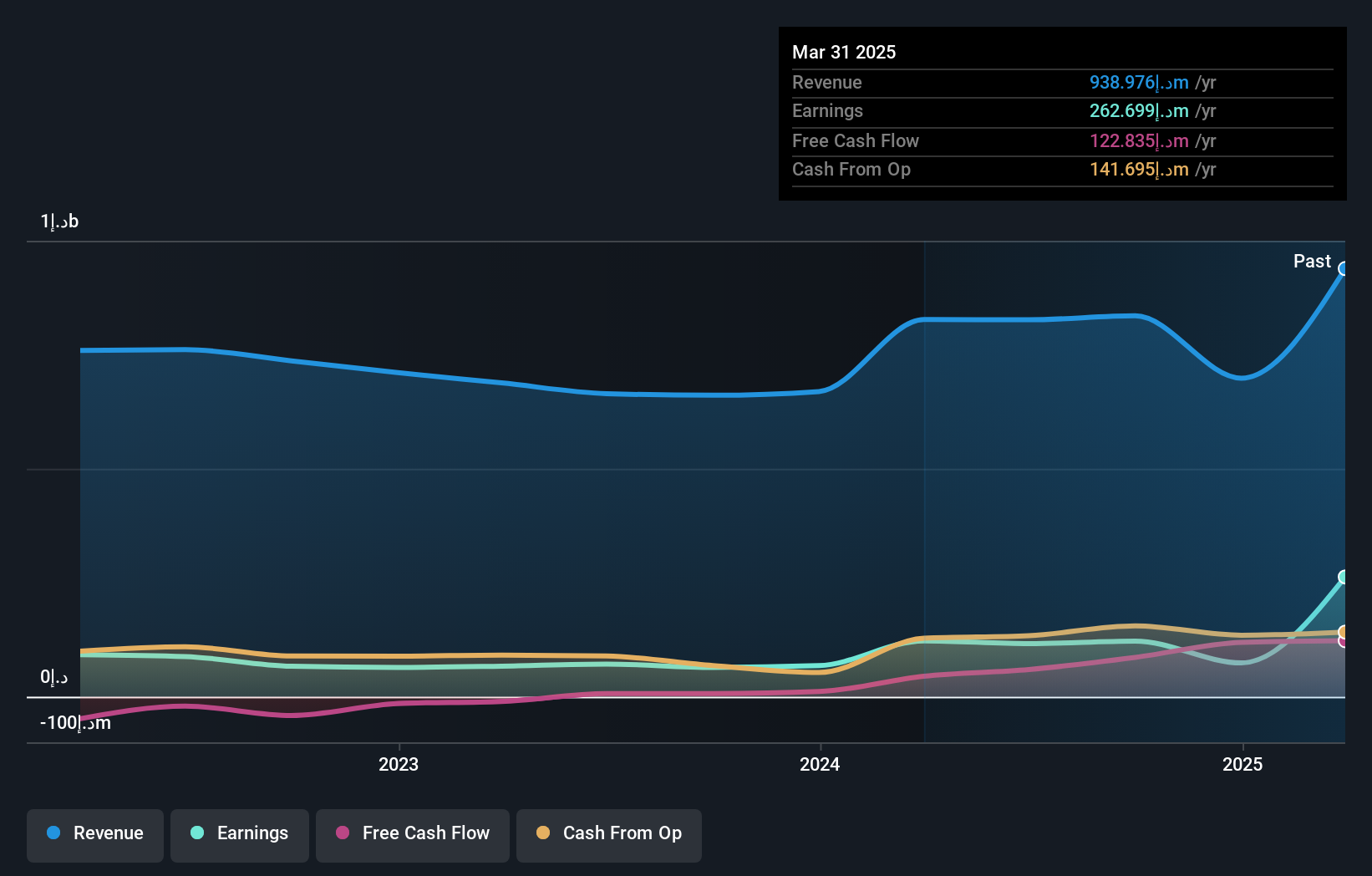

Overview: National Corporation for Tourism and Hotels focuses on investing in, owning, and managing hotels and leisure complexes in the United Arab Emirates, with a market capitalization of AED2.19 billion.

Operations: NCTH generates revenue primarily from its hotels, retail services, and catering services, with the latter contributing AED429.15 million. The company incurs eliminations of AED7.96 million in its financials.

National Corporation for Tourism and Hotels, a modest player in the hospitality sector, has shown resilience despite earnings declining by 13% annually over the past five years. The company reported sales of AED 698.56 million for 2024, up from AED 669.2 million in the previous year, with net income rising to AED 74.03 million from AED 68.08 million. Its interest payments are well covered by EBIT at a ratio of 6.3 times, indicating robust financial management. Additionally, trading at a discount of about one-third below its estimated fair value suggests potential investment appeal amidst board changes and steady performance metrics.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★★☆

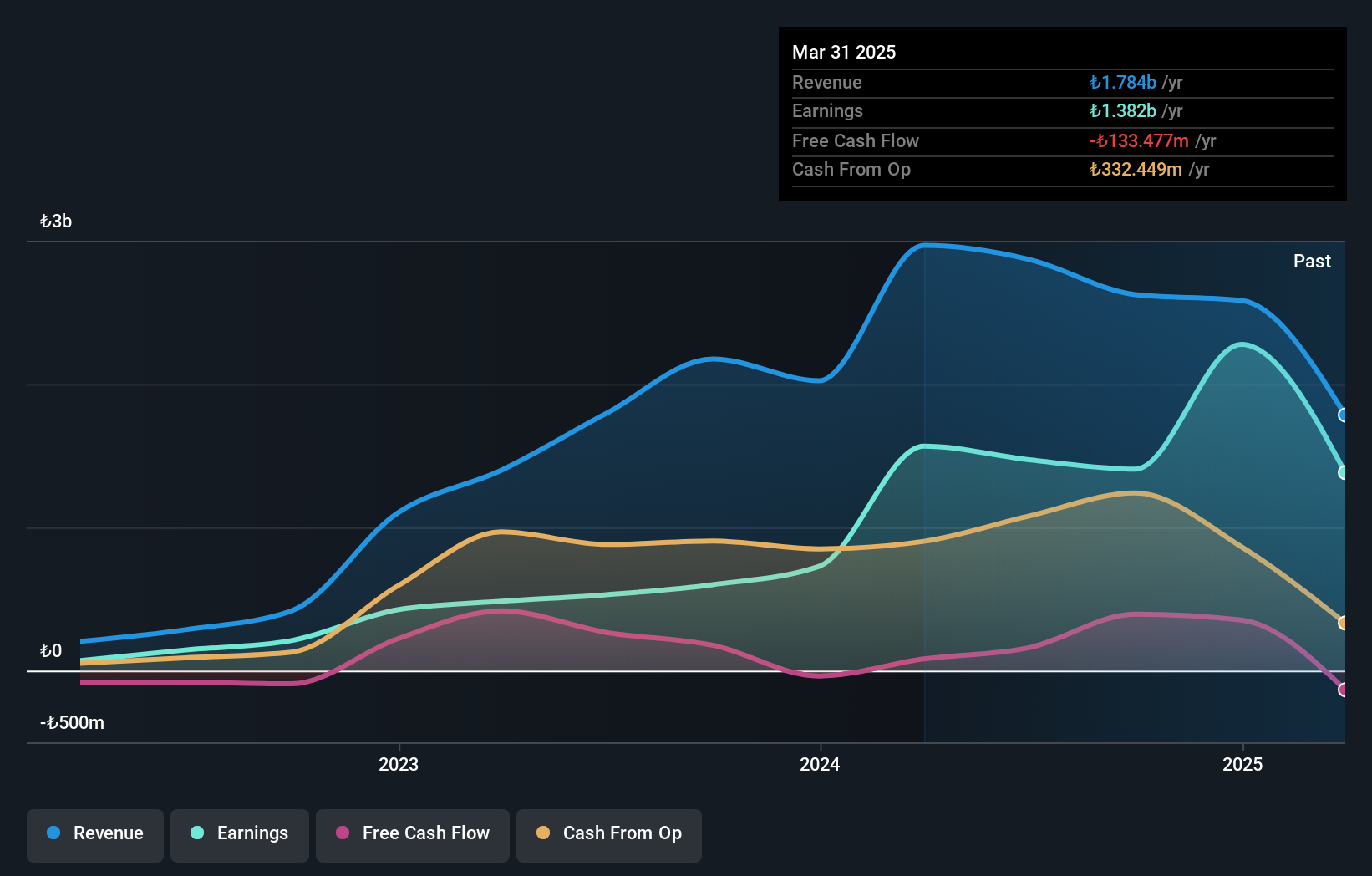

Overview: MIA Teknoloji Anonim Sirketi offers software development services to public and private organizations in Turkey, with a market capitalization of TRY18.08 billion.

Operations: MIA Teknoloji generates revenue primarily from its software and programming segment, amounting to TRY2.58 billion. The company's financial performance is highlighted by its ability to derive substantial income from this core segment within Turkey.

MIA Teknoloji Anonim Sirketi, a smaller player in the software sector, has shown impressive financial performance with earnings growth of 212.9% over the past year, outpacing its industry peers. The company boasts a favorable price-to-earnings ratio of 7.9x compared to the TR market's 17.9x, indicating potential undervaluation. Despite recent share price volatility, MIATK remains financially sound with more cash than total debt and strong interest coverage capabilities. Recent results highlight significant sales growth from TRY 2,022 million to TRY 2,583 million and net income surging from TRY 727 million to TRY 2,276 million, showcasing robust profitability improvements.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★☆☆

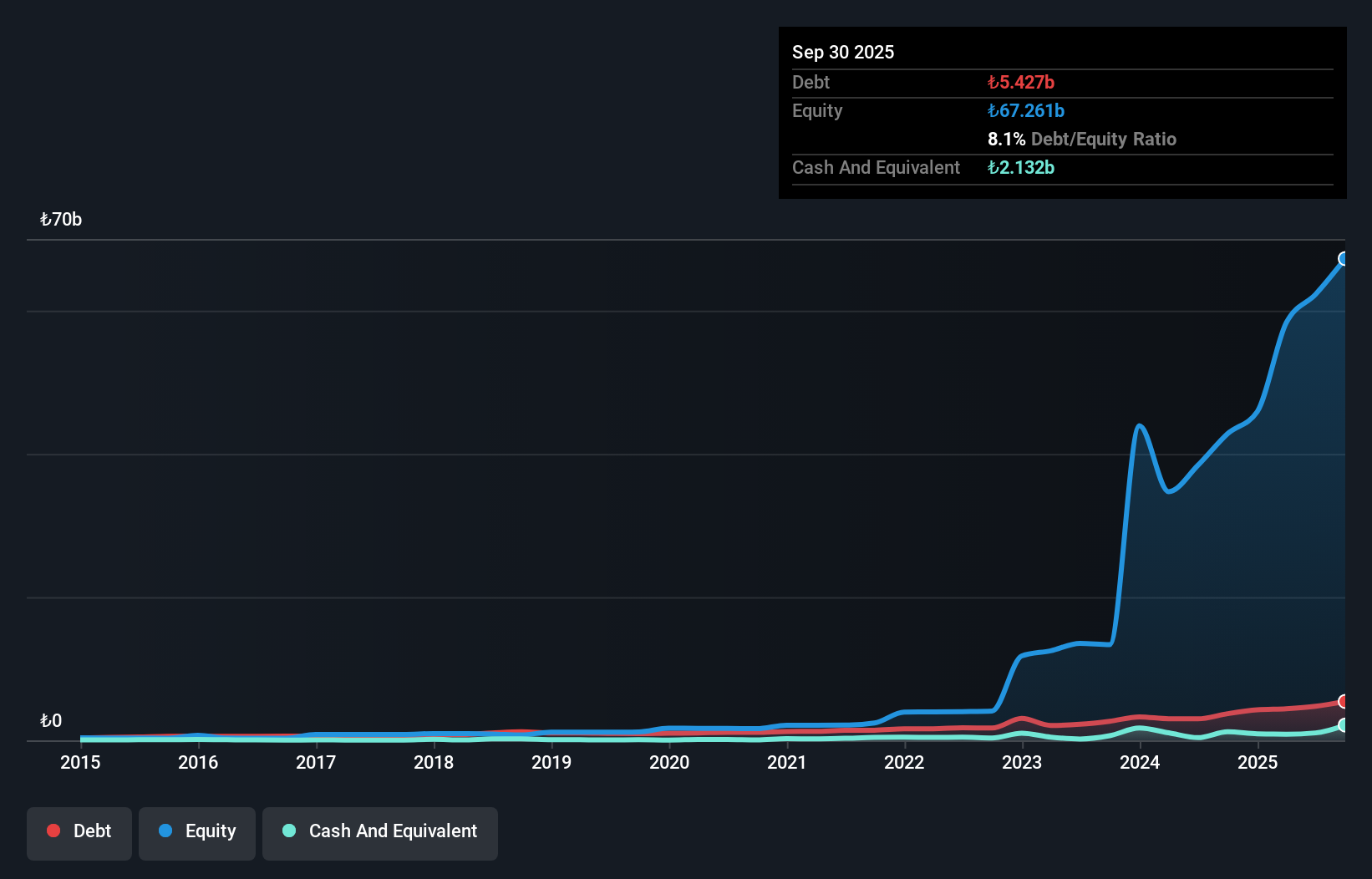

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust focused on commercial properties and has a market capitalization of TRY27.58 billion.

Operations: Reysas Gayrimenkul Yatirim Ortakligi generates revenue primarily from its commercial real estate investments, with a reported income of TRY3.61 billion. The company's net profit margin is not provided in the available data, but the focus on commercial properties suggests a structured revenue model centered around leasing and property management.

Reysas Gayrimenkul Yatirim Ortakligi, a smaller player in the Turkish real estate sector, presents an intriguing profile with its price-to-earnings ratio at 3x, significantly below the TR market average of 17.9x. Despite a challenging year marked by negative earnings growth of -26.5%, the company's net debt to equity ratio stands at a satisfactory 7.3%. Over five years, it has impressively reduced this from 58.3% to 9.3%. Recent financials show sales increasing to TRY 3.58 billion from TRY 2.55 billion last year, though net income dipped to TRY 9.23 billion from TRY 12.56 billion previously.

Summing It All Up

- Click this link to deep-dive into the 245 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Corporation for Tourism and Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NCTH

National Corporation for Tourism and Hotels

Invests in, owns, and manages hotels and leisure complexes in the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives