- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3080

Discovering Hidden Opportunities In Middle Eastern Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced positive momentum, driven by investor optimism regarding potential U.S. interest rate cuts and geopolitical developments in the region. As Gulf bourses gain traction, investors are increasingly on the lookout for undiscovered opportunities that align with these shifting dynamics, particularly those stocks that demonstrate resilience and growth potential amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Is Yatirim Menkul Degerler Anonim Sirketi (IBSE:ISMEN)

Simply Wall St Value Rating: ★★★★★☆

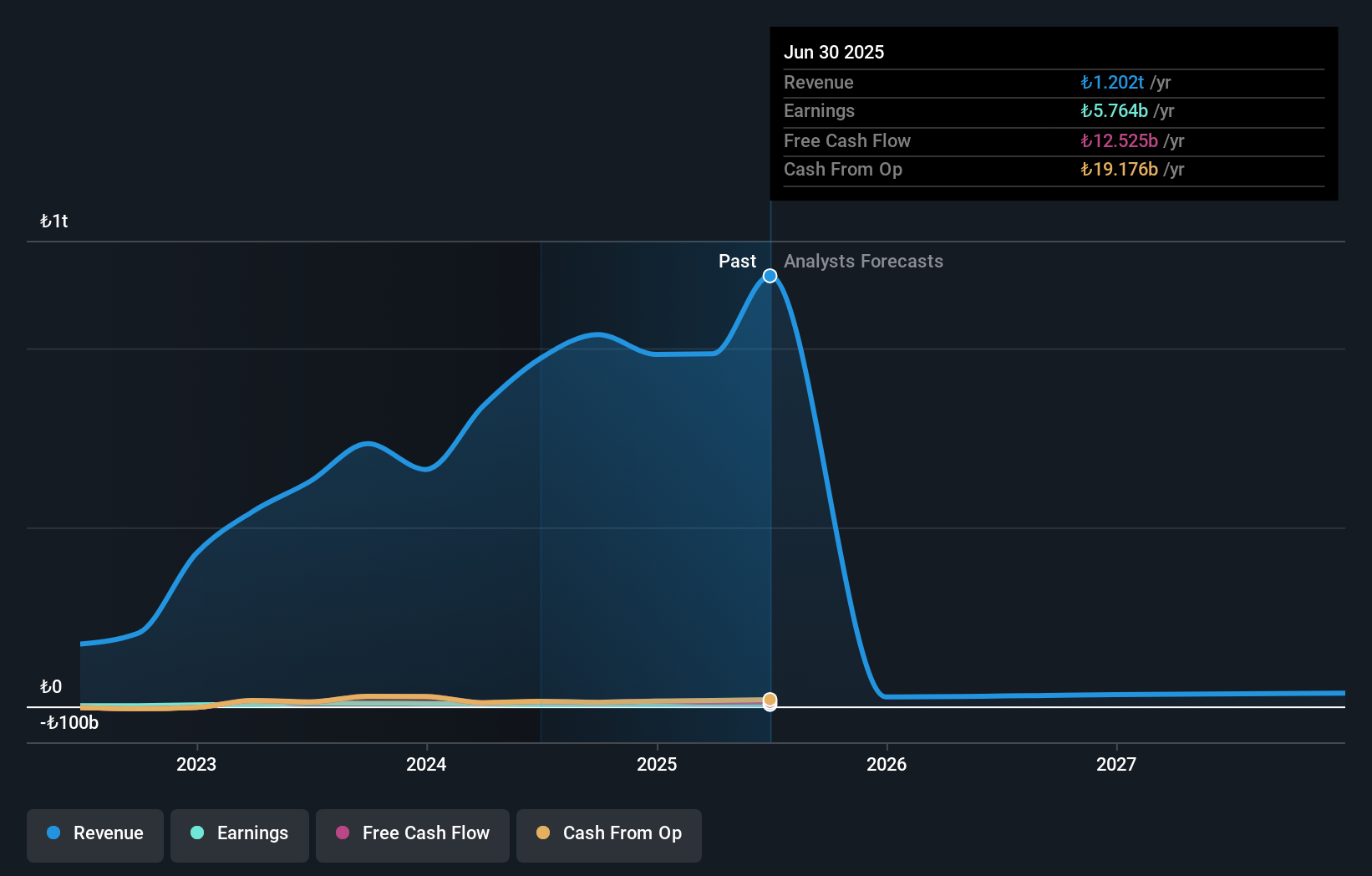

Overview: Is Yatirim Menkul Degerler Anonim Sirketi offers capital market services to both individual and corporate investors in Turkey and abroad, with a market capitalization of TRY66 billion.

Operations: Is Yatirim Menkul Degerler Anonim Sirketi generates revenue primarily through its Asset Management/Asset Leasing segment, which accounts for TRY975.03 billion. The Venture Capital segment also contributes significantly with TRY7.63 billion in revenue. Net profit margin trends and other financial specifics are not detailed in the provided information.

Is Yatirim Menkul Degerler Anonim Sirketi, a financial entity with high-quality earnings, has shown robust performance in the past year, with earnings growth of 11.5%, outpacing the industry average. The company boasts a healthy balance sheet, having reduced its debt-to-equity ratio from 58.4% to 23% over five years and holding more cash than total debt. Despite a dip in quarterly net income to TRY 1,848.9 million from TRY 2,409.74 million last year, six-month figures show an increase to TRY 3,056.38 million from TRY 2,798.26 million previously reported.

Ozak Gayrimenkul Yatirim Ortakligi (IBSE:OZKGY)

Simply Wall St Value Rating: ★★★★★☆

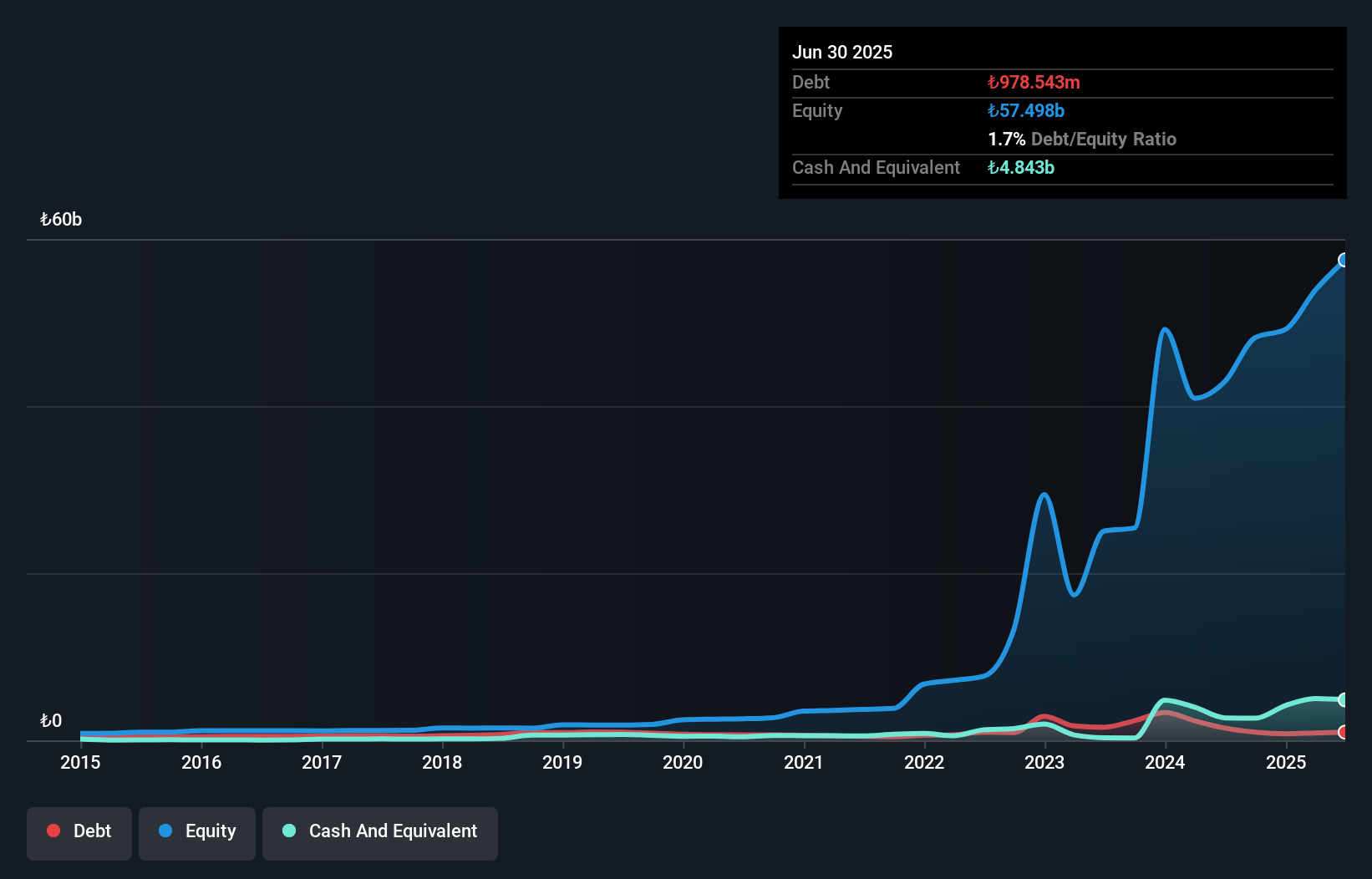

Overview: Ozak Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust with a market capitalization of TRY19.54 billion.

Operations: The company generates revenue primarily from its Real Estate Investment Trust segment, contributing TRY3.79 billion, and its Tourism Hotel Business, which adds TRY2.15 billion. The net profit margin for the period is not specified in the provided data.

Ozak Gayrimenkul Yatirim Ortakligi, a notable player in the Turkish real estate sector, has demonstrated impressive financial resilience with its earnings growth of 76.6% over the past year, significantly outpacing the -11.2% industry average. The company's debt-to-equity ratio has improved dramatically from 25.1% to just 1.7% in five years, highlighting effective financial management. Despite a large one-off gain of TRY315.6 million impacting recent results, its price-to-earnings ratio of 16.2x remains attractive compared to the broader Turkish market at 22.2x, suggesting potential undervaluation for investors seeking opportunities in emerging markets like Turkey's real estate sector.

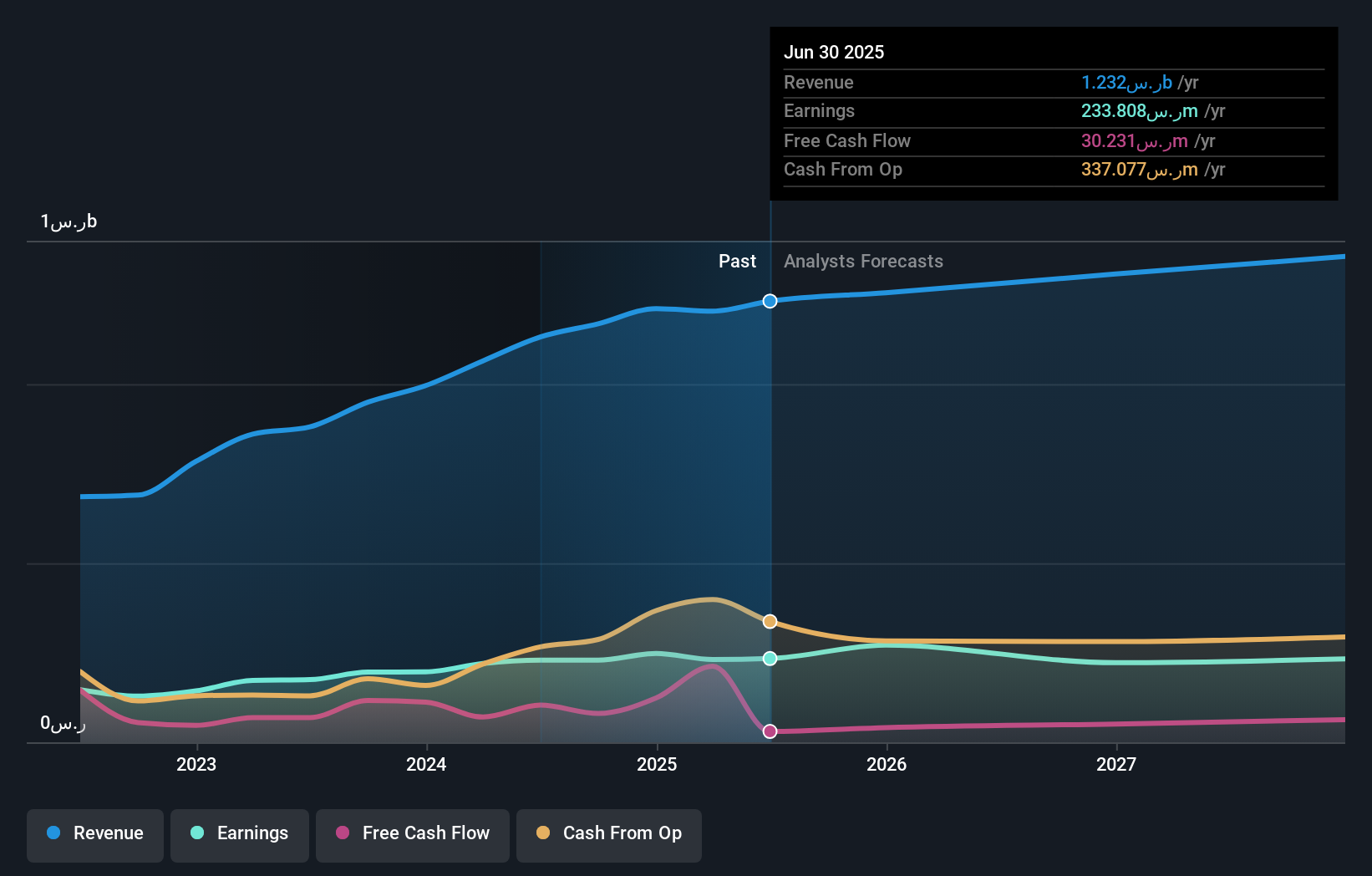

Eastern Province Cement (SASE:3080)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Province Cement Company engages in the production and sale of clinker and cement both domestically within Saudi Arabia and internationally, with a market capitalization of SAR2.33 billion.

Operations: The company's primary revenue streams are from the sale of cement, generating SAR897.84 million, and precast concrete, contributing SAR352.29 million.

Eastern Province Cement, a notable player in the cement industry, has demonstrated consistent financial health with earnings growing at 2.5% annually over the past five years. Despite a recent dip in net income to SAR 125 million for the first half of 2025 from SAR 134 million last year, sales rose to SAR 609 million from SAR 574 million. The company boasts a favorable price-to-earnings ratio of 9.9x compared to the SA market's average of 21.3x, indicating good value relative to peers. With no debt on its books and positive free cash flow, it remains financially robust amidst industry challenges.

- Click here to discover the nuances of Eastern Province Cement with our detailed analytical health report.

Evaluate Eastern Province Cement's historical performance by accessing our past performance report.

Key Takeaways

- Gain an insight into the universe of 206 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Province Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3080

Eastern Province Cement

Produces and sells clinker and cement in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives