- Israel

- /

- Semiconductors

- /

- TASE:QLTU

Undiscovered Gems in the Middle East to Explore This May 2025

Reviewed by Simply Wall St

As Gulf markets experience gains driven by a rebound in oil prices and investor anticipation of the Federal Reserve's policy meeting, the Middle East presents intriguing opportunities for those looking to explore lesser-known stocks. In this dynamic environment, identifying promising companies involves assessing their resilience to economic shifts and their potential to capitalize on regional growth trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 17.77% | -1.63% | -0.93% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Bati Ege Gayrimenkul Yatirim Ortakligi (IBSE:BEGYO)

Simply Wall St Value Rating: ★★★★★★

Overview: Bati Ege Gayrimenkul Yatirim Ortakligi A.S. is an investment company focused on the real estate sector in Denizli and the Aegean Region, with a market cap of TRY15.93 billion.

Operations: BEGYO generates revenue primarily through its investments in the real estate sector within Denizli and the Aegean Region. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses.

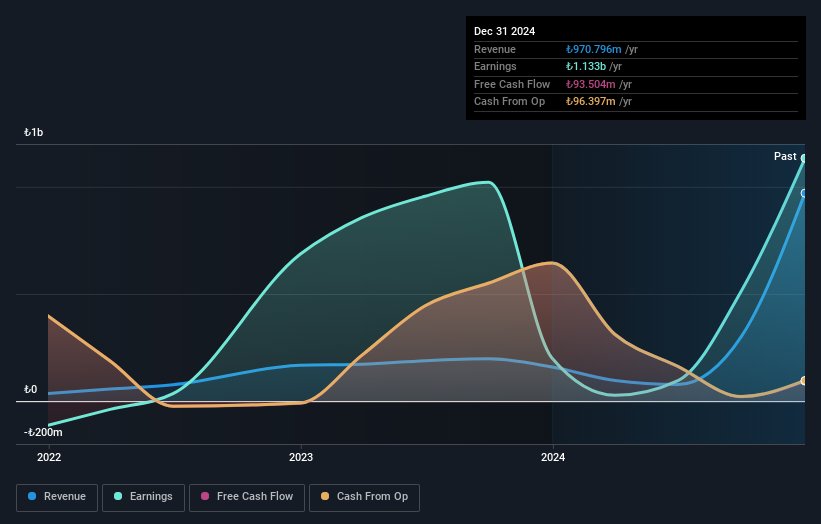

Bati Ege Gayrimenkul Yatirim Ortakligi, a promising player in the real estate investment trust sector, has shown remarkable earnings growth of 3600.6% over the past year, outpacing the broader REIT industry. With no debt on its books for five years and a price-to-earnings ratio of 15.9x below the Turkish market average of 17x, it presents an attractive valuation. The company reported sales of TRY 970.8 million for 2024 compared to TRY 159.31 million in the previous year, while net income soared to TRY 1,133.3 million from TRY 199.89 million, reflecting strong financial performance and strategic positioning within its industry context.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi (IBSE:KLKIM)

Simply Wall St Value Rating: ★★★★★★

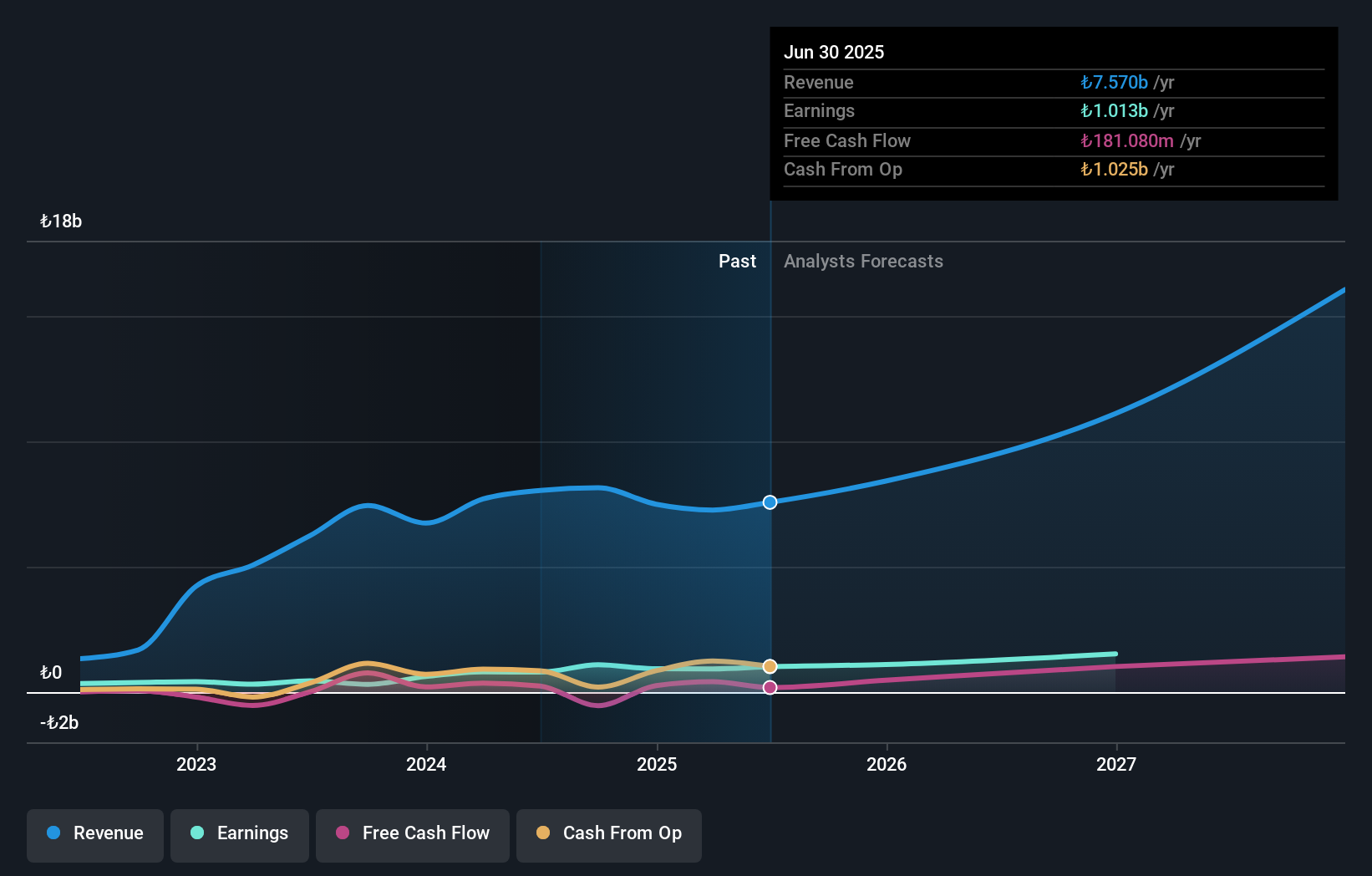

Overview: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi operates in the building materials and chemicals industry, serving both domestic and international markets, with a market capitalization of TRY15.28 billion.

Operations: Kalekim generates revenue primarily from Ceramic Applications, contributing TRY4.54 billion, followed by Concrete Chemicals at TRY1.78 billion. The Paint-Plaster and Water Isolation segments add TRY534.68 million and TRY471.31 million respectively to the company's revenue streams.

Kalekim Kimyevi Maddeler, a notable player in the chemicals industry, demonstrates robust financial health with its earnings surging 49.5% last year, outpacing the industry's -5%. The company boasts a solid price-to-earnings ratio of 16.4x, undercutting the TR market's 17x. Its debt-to-equity ratio has impressively shrunk from 35.7% to just 7.2% over five years, indicating prudent financial management and reduced leverage risks. Recent announcements include an annual dividend of TRY 0.43 per share payable on May 8, reflecting confidence in sustained profitability and shareholder returns amidst strong net income growth from TRY 621 million to TRY 929 million year-on-year.

Qualitau (TASE:QLTU)

Simply Wall St Value Rating: ★★★★★★

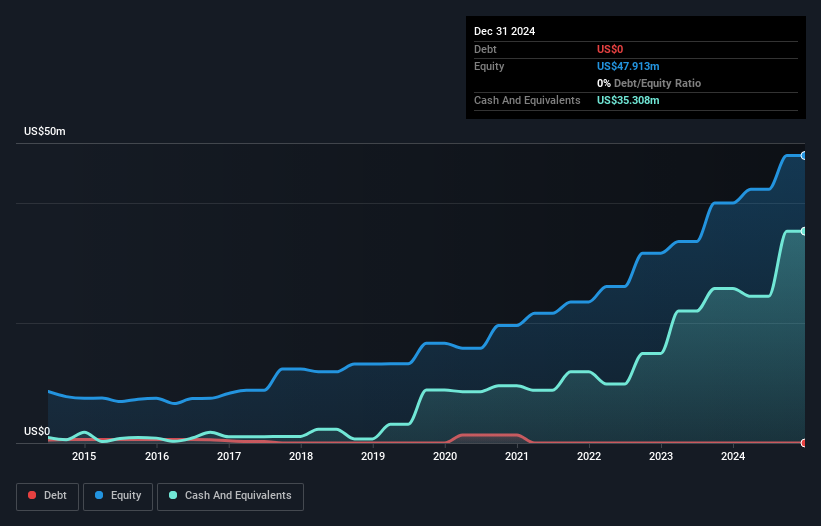

Overview: Qualitau Ltd develops, manufactures, and sells test equipment and services for the semiconductor industry, targeting European and Far-Eastern markets, with a market cap of ₪978.96 million.

Operations: Qualitau Ltd generates revenue from its electronic components and parts segment, amounting to $46.25 million.

Qualitau, a small player in the semiconductor space, sports a price-to-earnings ratio of 19.6x, which is lower than the industry average of 26x, indicating potential value. Despite its earnings growth of 13.1% last year not surpassing the industry's 14.1%, it has achieved an impressive annual earnings growth rate of 31.2% over five years. The company remains debt-free and boasts high-quality earnings with positive free cash flow at US$15 million as of December 2024. Recent initiatives include a share repurchase program worth ILS 7.37 million and a cash dividend distribution, reflecting confidence in its financial stability and future prospects.

- Navigate through the intricacies of Qualitau with our comprehensive health report here.

Gain insights into Qualitau's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 247 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Qualitau, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qualitau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:QLTU

Qualitau

Engages in the development, manufacture, and sale of test equipment and services for use in the semiconductor industry for European and Far-Eastern markets.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives