As global markets navigate the uncertainties surrounding the incoming Trump administration, key indices such as the S&P 500 and Russell 2000 have experienced notable fluctuations, reflecting investor concerns over potential policy changes and their impact on corporate earnings. Despite these challenges, inflation data remains largely in line with expectations, while long-term interest rates are on the rise, influencing market sentiment across various sectors. In this environment of heightened volatility and shifting economic landscapes, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Deva Holding (IBSE:DEVA)

Simply Wall St Value Rating: ★★★★★☆

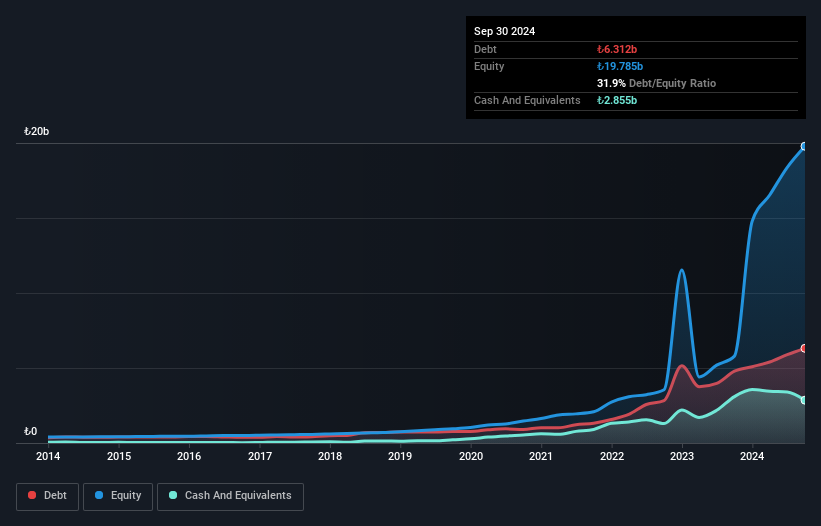

Overview: Deva Holding A.S. is a Turkish company that manufactures, markets, and sells pharmaceutical products with a market capitalization of TRY13.84 billion.

Operations: Deva Holding generates revenue primarily from its Human Pharma segment, which accounts for TRY10.50 billion, and also earns from Veterinary Products at TRY429.85 million.

Deva Holding, a notable player in the pharmaceutical sector, has shown impressive earnings growth of 860.2% over the past year, significantly outpacing its industry peers at 7.1%. The company's price-to-earnings ratio stands attractively at 4.5x compared to the market's 14.7x, suggesting it might be undervalued. Despite a satisfactory net debt to equity ratio of 17.5%, interest payments remain poorly covered with EBIT only covering them by 1.1 times—far below the desired threshold of three times coverage. Recent financials indicate a net loss reduction from TRY 575 million to TRY 267 million year-over-year for Q3, reflecting some operational improvements amidst challenges.

- Click to explore a detailed breakdown of our findings in Deva Holding's health report.

Gain insights into Deva Holding's historical performance by reviewing our past performance report.

Everest Kanto Cylinder (NSEI:EKC)

Simply Wall St Value Rating: ★★★★★★

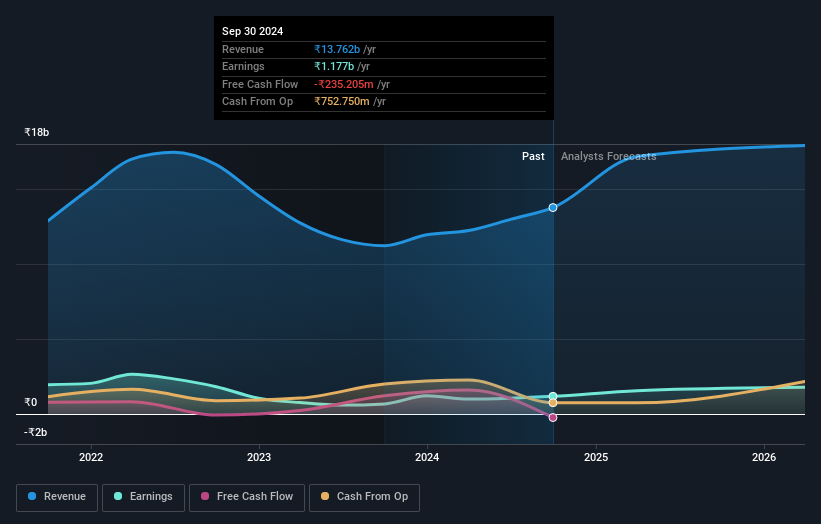

Overview: Everest Kanto Cylinder Limited, along with its subsidiaries, is engaged in the manufacturing and sale of gas cylinders in India with a market capitalization of ₹21.63 billion.

Operations: EKC generates revenue primarily from the sale of gas cylinders. The company's net profit margin is 8.5%, reflecting its ability to convert sales into profit after accounting for all expenses.

Everest Kanto Cylinder, a player in the industrial gas cylinder space, has shown robust earnings growth of 75.6% over the past year, surpassing the Packaging industry's 13.2%. Trading at a price-to-earnings ratio of 18.4x, it offers good value compared to the Indian market's 31.1x average. Despite its high volatility recently, EKC's net debt to equity ratio stands at a satisfactory 0.8%, with interest payments well covered by EBIT at 28.9x coverage. Recent results highlight sales and revenue increases to INR 3,672 million and INR 3,775 million respectively for Q2 ending September 2024 from last year’s figures.

- Navigate through the intricacies of Everest Kanto Cylinder with our comprehensive health report here.

Understand Everest Kanto Cylinder's track record by examining our Past report.

Compucase Enterprise (TWSE:3032)

Simply Wall St Value Rating: ★★★★★★

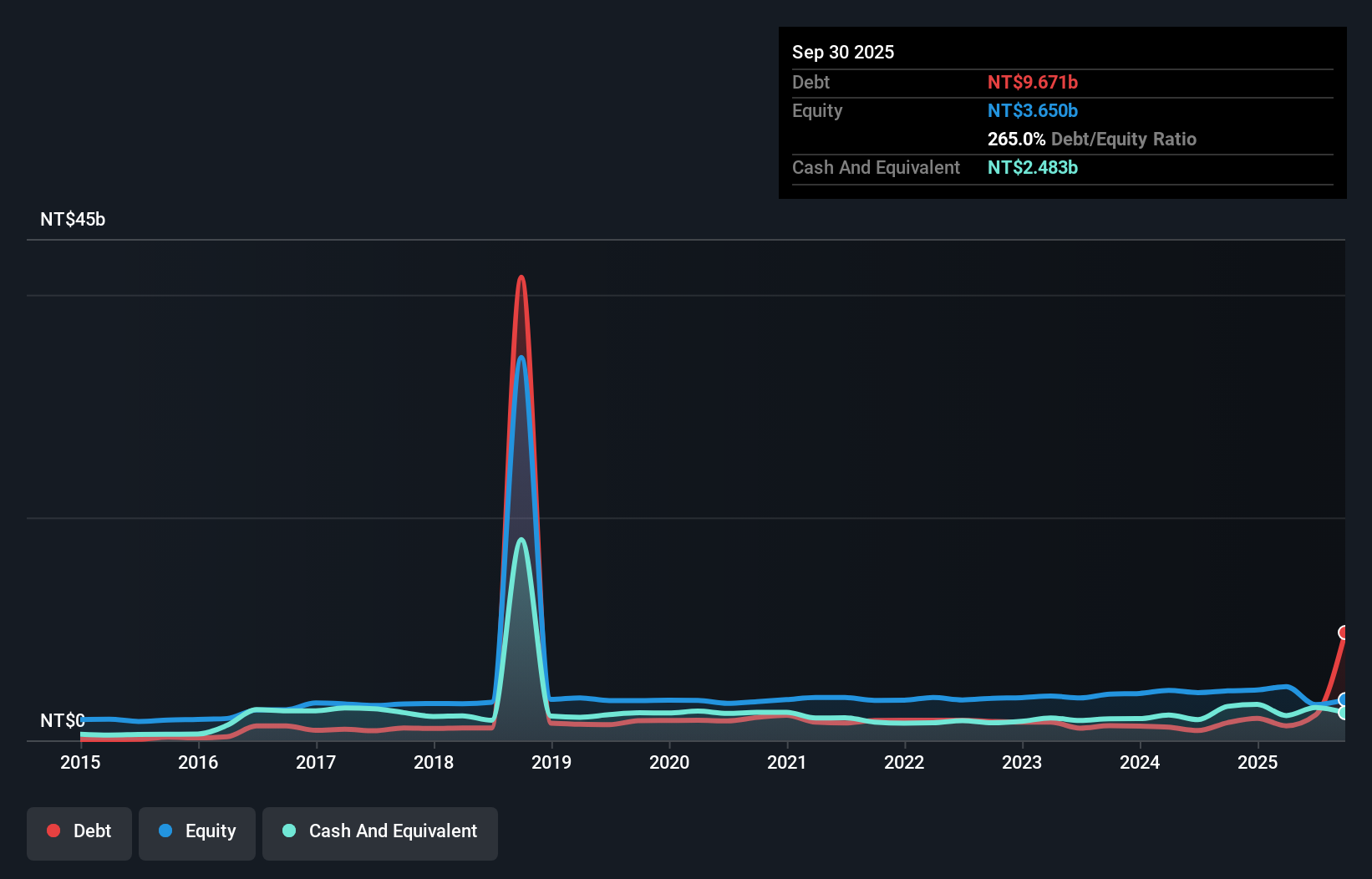

Overview: Compucase Enterprise Co., Ltd. is a global company that designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets, with a market cap of NT$8.16 billion.

Operations: Compucase Enterprise generates revenue primarily through the sale of PC cases, power supplies, rackmount chassis, and cabinets. The company's net profit margin has shown variability over the observed periods.

Compucase Enterprise, a smaller player in the tech space, showcases a mixed bag of financials. Over the past five years, its debt to equity ratio has improved from 49.5% to 35.8%, indicating better financial health. Despite this, recent earnings growth of 2.7% fell short compared to the tech industry's average of 10.4%. The company reported third-quarter sales at TWD 1,632 million and net income at TWD 69.93 million—both lower than last year’s figures of TWD 2,068 million and TWD 181 million respectively—highlighting challenges in maintaining momentum amidst broader industry trends.

- Delve into the full analysis health report here for a deeper understanding of Compucase Enterprise.

Evaluate Compucase Enterprise's historical performance by accessing our past performance report.

Make It Happen

- Click this link to deep-dive into the 4646 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Kanto Cylinder might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:EKC

Flawless balance sheet with solid track record.