- Taiwan

- /

- Capital Markets

- /

- TPEX:6023

Uncovering November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and smaller-cap indexes outperforming their large-cap counterparts, investors are navigating a landscape marked by positive economic indicators such as falling jobless claims and rising home sales. In this environment of broad-based gains, identifying undiscovered gems requires a focus on stocks that demonstrate strong fundamentals and potential for growth despite the prevailing market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS)

Simply Wall St Value Rating: ★★★★★★

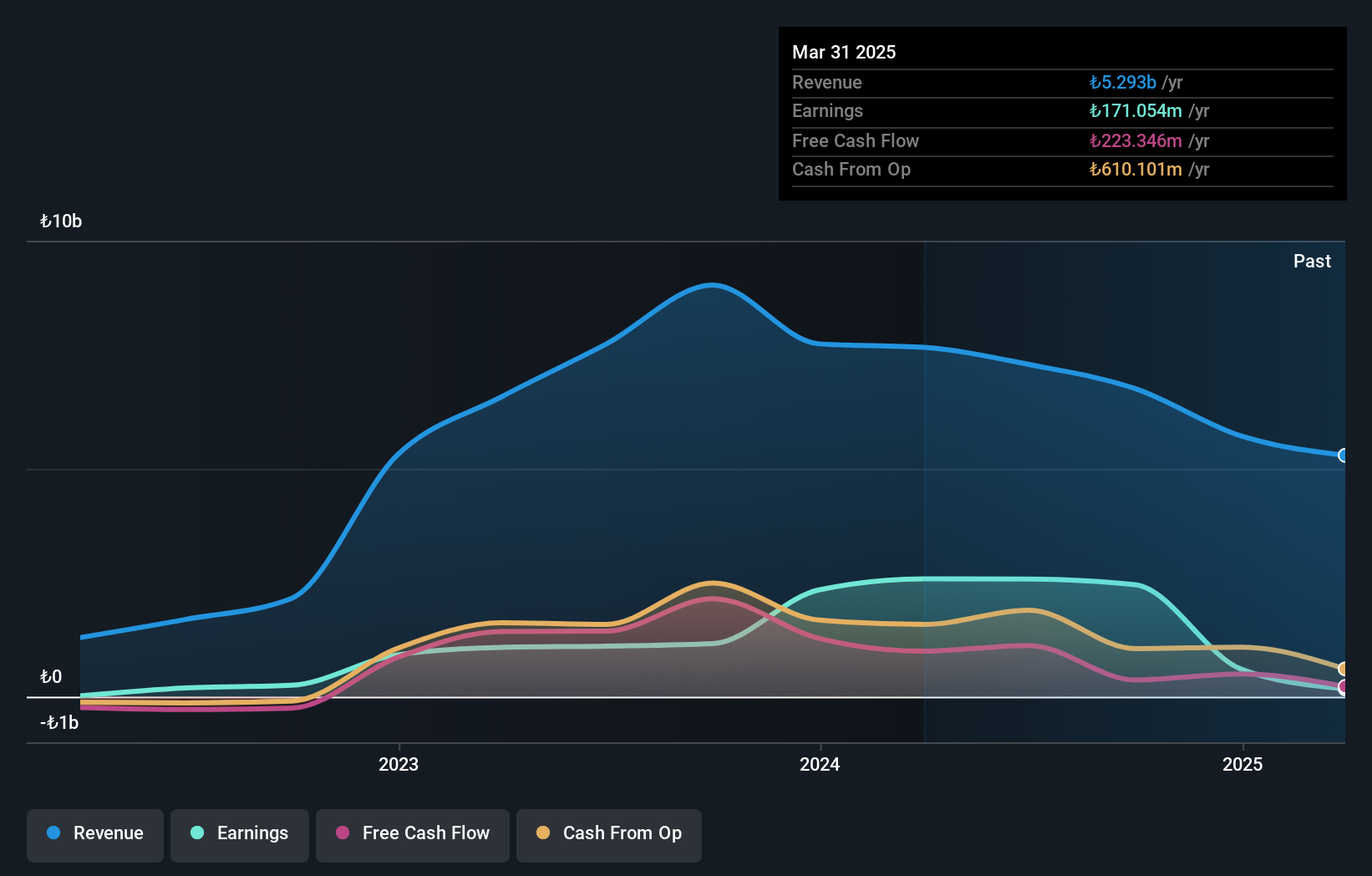

Overview: Göltas Göller Bölgesi Çimento Sanayi ve Ticaret A.S. is a company engaged in the production and sale of cement, with a market capitalization of TRY8.71 billion.

Operations: Göltas generates revenue primarily through the production and sale of cement. The company's net profit margin is 12%, reflecting its efficiency in managing costs relative to its revenue.

Göltas, a notable player in the cement industry, showcases a compelling financial profile despite recent challenges. Its price-to-earnings ratio of 5.3x is attractively below the Turkish market average of 15.6x, indicating potential undervaluation. Over the past year, earnings have surged by 34.8%, outpacing the Basic Materials industry growth of 24.5%. The company's net debt to equity ratio has impressively decreased from 125% to a satisfactory 18% over five years, reflecting improved financial health. However, recent quarterly results showed sales at TRY1,487 million with a net loss of TRY1 million compared to last year's profit figures.

- Delve into the full analysis health report here for a deeper understanding of Göltas Göller Bölgesi Cimento Sanayi ve Ticaret.

Learn about Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's historical performance.

Yuanta Futures (TPEX:6023)

Simply Wall St Value Rating: ★★★★☆☆

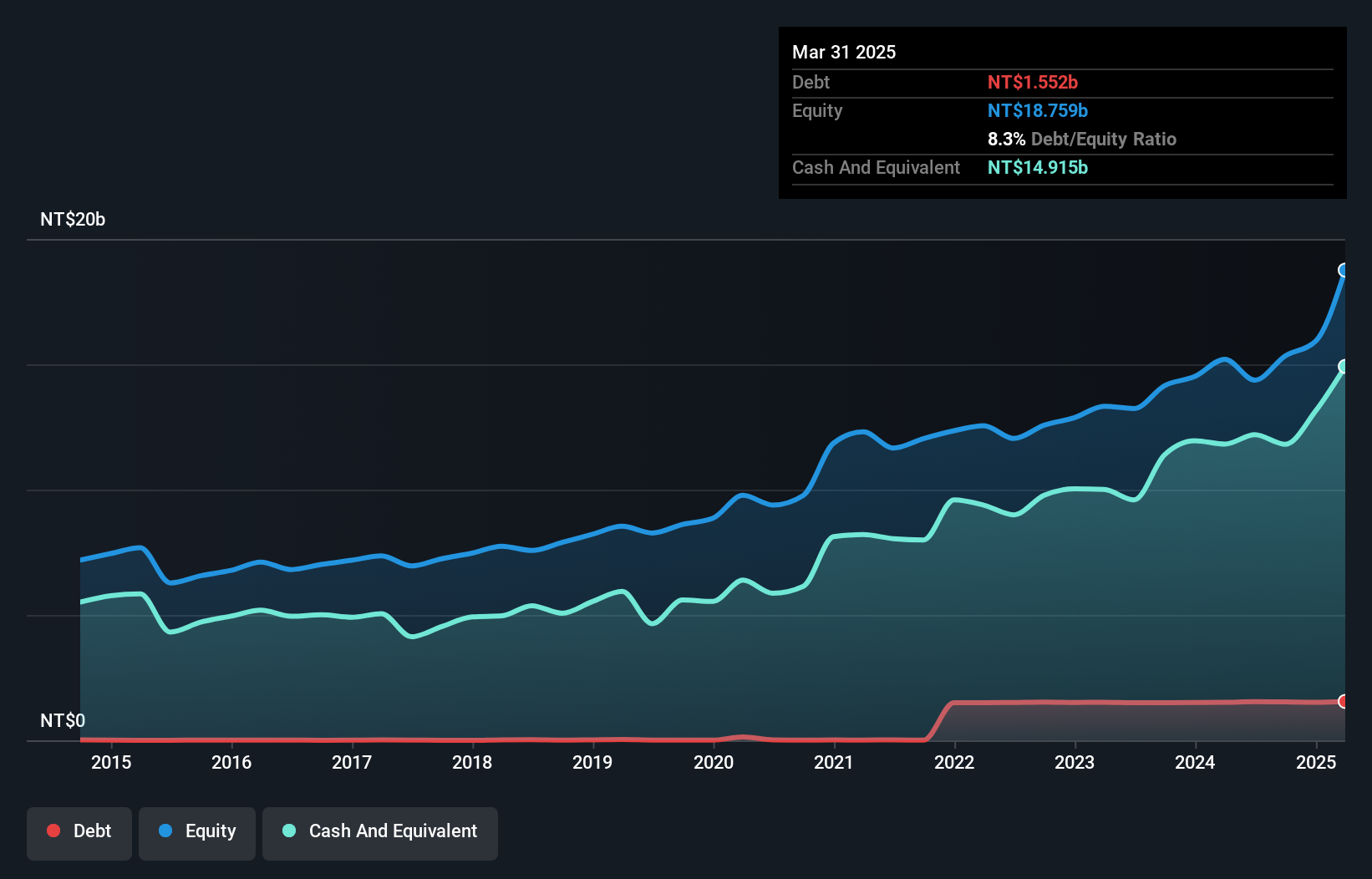

Overview: Yuanta Futures Co., Ltd. operates in the onshore and offshore futures brokerage business, futures dealing, consulting, securities dealing, and leverage transaction merchant services across Taiwan and internationally with a market cap of NT$26.30 billion.

Operations: Yuanta Futures generates revenue primarily through its futures brokerage and dealing services, with significant operations in Taiwan and international markets. The company has a market capitalization of NT$26.30 billion.

Yuanta Futures has been making waves with its recent financial performance, showcasing a revenue increase to NT$1.14 billion in Q3 2024 from NT$945.83 million the previous year, and net income rising to NT$624.3 million from NT$488.2 million. The company’s earnings per share improved to NT$2.15 compared to last year's NT$1.68, reflecting solid growth momentum over the past five years at 14.5% annually, although it trails behind the industry average of 22.4%. With a price-to-earnings ratio of 12.9x below the Taiwan market's average of 21.3x and high-quality earnings reported, Yuanta seems well-positioned financially despite an increased debt-to-equity ratio now at 9.8%.

- Get an in-depth perspective on Yuanta Futures' performance by reading our health report here.

Explore historical data to track Yuanta Futures' performance over time in our Past section.

Grape King Bio (TWSE:1707)

Simply Wall St Value Rating: ★★★★★★

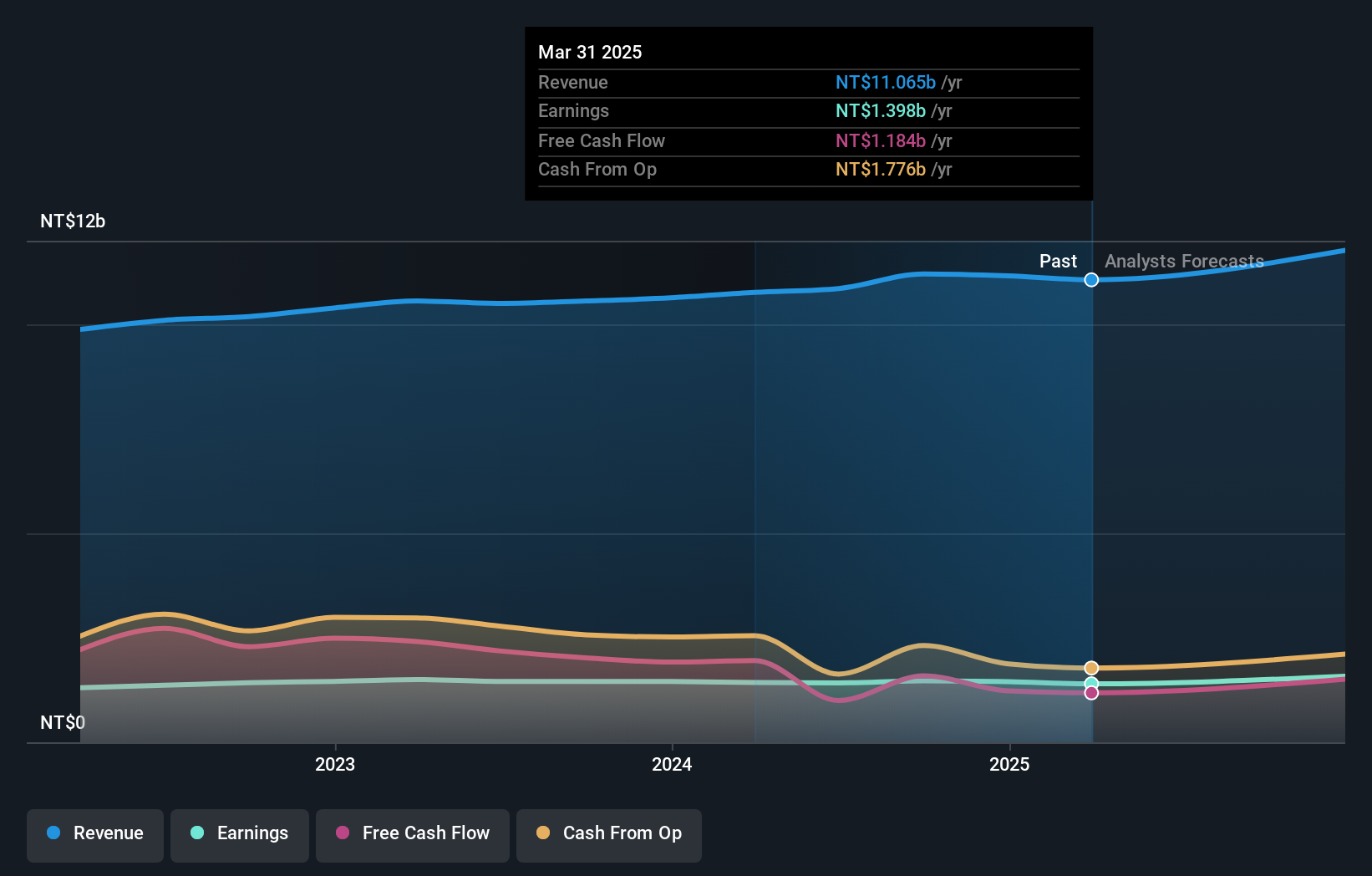

Overview: Grape King Bio Ltd, along with its subsidiaries, engages in the production and sale of pharmaceutical preparations, patent medicines, liquid tonics, drinks, and healthy food across Taiwan, China, and international markets with a market cap of NT$23.26 billion.

Operations: Grape King Bio generates revenue primarily through the sale of pharmaceutical preparations, patent medicines, liquid tonics, drinks, and healthy food. The company's gross profit margin has shown variation over recent periods.

Grape King Bio stands out with its robust financial health, being debt-free and showing a notable improvement from a debt to equity ratio of 19.7% five years ago. The company reported a solid net income of TWD 415.89 million for Q3 2024, up from TWD 366.74 million the previous year, reflecting strong earnings quality that surpasses industry growth rates. Trading at an attractive valuation, it is currently priced at 18.5% below its estimated fair value, offering potential upside for investors seeking undervalued opportunities in the personal products sector without interest payment concerns due to its debt-free status.

- Take a closer look at Grape King Bio's potential here in our health report.

Assess Grape King Bio's past performance with our detailed historical performance reports.

Seize The Opportunity

- Explore the 4638 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6023

Yuanta Futures

Engages in the futures brokerage business in Taiwan, the rest of Asia, Europe, America, and internationally.

6 star dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives